Determine Materiality in Audit

Introduction

Auditors usually focus only on the matters that have a significant impact on financial statements. This is due to it is not practical for them to examine all transactions and balances of the client. Hence, auditors need to determine the materiality level in audit so that they can perform their work in an efficient and effective manner.

Materiality is the term that expresses the importance of the matter. In this case, a misstatement is considered material if it is significant which can influence the decision making of the users of financial statements. In the audit, auditors usually determine two types of materiality, overall materiality and performance materiality.

Determine Overall Materiality

Auditors need to determine overall materiality which is the materiality for the financial statements as a whole in the planning stage of the audit when forming the audit strategy. Throughout the whole process of the audit, auditors also need to review the materiality and may need to revise it if necessary.

Auditors need to determine overall materiality which is the materiality for the financial statements as a whole in the planning stage of the audit when forming the audit strategy. Throughout the whole process of the audit, auditors also need to review the materiality and may need to revise it if necessary.

There is no specific rule on how to determine materiality. So, the process may be different from one accounting firm to another based on the auditors’ experiences and professional judgment.

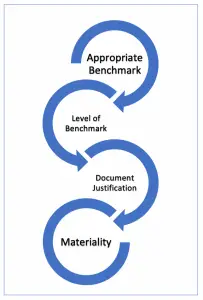

However, auditors usually follow three steps in determining the overall materiality level including:

- Choosing appropriate benchmark

- Determining level of the chosen benchmark

- Document justification of the choice

Choosing Appropriate Benchmark

The first step to determine materiality is to choose what benchmark to use. Usually, auditors use different benchmarks for the different types and nature of the business that the clients have, such as a profit-making organization and a not-for-profit organization.

The benchmark that auditors usually use in determining materiality include:

- Total revenues

- Total assets

- Gross profit

- Net profit before tax

- Total expenses

Auditors usually use the profit as the benchmark for the profit-making client unless the client makes a loss or its profit is too small. If so, they may use the revenues or assets for the benchmark instead.

For a not-for-profit organization such as a charity, auditors usually use total expenses as their benchmark since this type of client usually does not have profit. For the revenues, the organization mainly receives from the donation which they usually fluctuate a lot from one period to another. That’s why auditors usually use total expenses, as a benchmark for a not-for-profit organization, instead of revenues.

However, it should be noted that there is no set rule or standard to determine which type of client should use which benchmark. And there is no such thing as one size fits all here.

So, auditors need to rely on their experiences and professional judgment in order to determine which benchmark to use in determining the overall materiality.

Multiple benchmarks

Also, there is no rule stating that only one benchmark can be used to determine materiality. So, sometimes auditors may use more than one benchmark, e.g. an average of two or three, based on circumstances.

However, professional judgment should always be maintained when determining which benchmark to use, either one or more than one benchmark.

Determining the Level of Chosen Benchmark

After choosing which benchmark to use, the next step auditors usually do is deciding what percentage of such benchmark to use as materiality. Then again, there is no specific rule or standard that states how many percent to use on which benchmark to determine materiality.

However, there is a rule of thumb that applies as below:

- 0.5% to 1% of total revenues or expenses

- 1% to 2% of total assets

- 5% to 10% of net profit before tax

Auditors still need to apply their professional judgment when determining what percentage to use in the benchmark. Also, they may decide to use higher or lower than the above percentage based on their experiences and professional judgment.

Document Justification of the Choice

The last step of determining materiality in audit is documenting the choice that they use with proper justification. Auditors need to document the thought process with their experiences in determining the materiality here into a file.

It is important to have proper documentation of the process in determining the materiality as the regulators may review such process in the documentation and evaluate whether the materiality have been appropriately determined by auditors with sufficient experiences.

Though it doesn’t involve calculating the actual figure of the materiality level, this step is always required when auditors determine materiality in the audit. Usually, accounting firms have their own policies and procedures in the documentation of such matters. This is so that they can avoid the criticisms from regulators.

Determine Performance Materiality

Auditors also need to determine performance materiality at the planning stage of the audit and review through the course of audit as well. After determining overall materiality, auditors need to determine the performance materiality. This type of materiality is always less than the overall materiality.

In this case, auditors know that performance materiality which needs to be determined has to be lower than overall materiality. So, they need to decide how much lower it should be. Auditors usually determine the performance materiality based on the level of risks that are involved in the audit.

While overall materiality is for financial statements as a whole, performance materiality is the materiality for particular classes of transactions, account balances, or disclosures. It is sometimes called working materiality as it is usually considered as a guide for audit team members to perform their work.

In this case, audit team members will need to use this materiality throughout the audit work to tests various transactions and account balances of the client. So, setting how much amount should be used as performance materiality is one of the factors that can determine the efficiency and effectiveness of the audit work.

If the materiality level is too high, auditors may not perform sufficient audit procedures to detect material misstatement. On the other hand, if it is too low, auditors may perform more work than necessary.

In short, the level of performance materiality that auditors determine will need to reflect the identified and assessed risks of material misstatement for particular classes of transactions, account balances, or disclosures.

For example, auditors have determined the similar level of overall materiality of client A and client B due to their similarity in several factors such as level of revenues, assets, profit, size, industry, etc.

However, in the audit planning, auditors have found that client A has a strong internal control while client B has a weak internal control. In this case, auditors have assessed the risk of control in client A as low and client B as high.

As a result, performance materiality for client B is set lower than that of client A regardless of their similar level of overall materiality. So, auditors have to perform more audit work in client B to obtain sufficient appropriate audit evidence.