Accumulated Depreciation

Overview

Accumulate depreciation represents the total amount of the fixed asset’s cost that the company has charged to the income statement so far. Likewise, the company needs to calculate and make the journal entry for accumulated depreciation to account for the depreciation expense that has occurred during the period as well as to record the accumulated depreciation on the balance sheet.

As the accumulated depreciation represents the total allocated cost to the income statement, total accumulated depreciation will equal the total cost plus salvage value (if any) of the fixed asset at the end of the fixed asset’s useful life. That is the time when the net book value of the asset becomes zero.

For example, if equipment costs $5,000 with the zero salvage value at the end of the useful life of 5 years, the accumulated depreciation at the end of 5 years will be $5,000 where the net book value is zero as the result of cost minus accumulated depreciation ($5,000 of cost – $5,000 of accumulated depreciation).

Calculate accumulated depreciation

The company can calculate the accumulated depreciation with the formula of depreciation expense plus the depreciated amount of fixed asset that the company have made so far.

Accumulated depreciation formula:

Depreciation expense in this formula is the expense that the company have made in the period. On the other hand, the depreciated amount here is the total amount of depreciation expense that the company has charged to the income statement so far on the particular fixed asset including those in the prior accounting periods.

In other words, the depreciated amount in the formula above is the beginning balance of the accumulated depreciation on the balance sheet of the company. Likewise, the accumulated depreciation in the formula represents the accumulated depreciation at the end of the accounting period which is the cutoff period that the company prepares the financial statements.

Accumulated depreciation at the end of the period = Depreciation expense during the period+ Accumulated depreciation at the beginning of the period.

Accumulated depreciation journal entry

The company can make the accumulated depreciation journal entry by debiting the depreciation expense account and crediting the accumulated depreciation account.

| Account | Debit | Credit |

|---|---|---|

| Depreciation expense | 000 | |

| Accumulated depreciation | 000 |

Depreciation expense account is an expense on the income statement in which its normal balance is on the debit side. On the other hand, the accumulated depreciation is an item on the balance sheet.

However, the accumulated depreciation is not a liability but a contra account to the fixed assets on the balance sheet. Likewise, the accumulated depreciation journal entry will reduce the total assets on the balance sheet while increasing the total expenses on the income statement.

Accumulated depreciation example

For example, on Jan 1, the company ABC buys a piece of equipment that costs $5,000 to use in the business operation. The company estimates that the equipment has a useful life of 5 years with zero salvage value. The company’s policy in fixed asset management is to depreciate the equipment using the straight-line depreciation method.

What is the journal entry for accumulated depreciation in the first, second, and third years?

Calculate the accumulated depreciation and net book value of the equipment at the end of the third year.

Solution:

Journal entry for accumulated depreciation

As the company uses the straight-line depreciation method, we can calculate the depreciation of the equipment as below:

Depreciation = $5,000 / 5 years = $1,000 per year

In this case, the company can make the accumulated depreciation journal entry with the $1,000 for each year of the three years as below:

Year 1:

| Account | Debit | Credit |

|---|---|---|

| Depreciation expense | 1,000 | |

| Accumulated depreciation | 1,000 |

Year 2:

| Account | Debit | Credit |

|---|---|---|

| Depreciation expense | 1,000 | |

| Accumulated depreciation | 1,000 |

Year 3:

| Account | Debit | Credit |

|---|---|---|

| Depreciation expense | 1,000 | |

| Accumulated depreciation | 1,000 |

Accumulated depreciation and net book value at the end of the third year

Accumulated depreciation = Depreciation expense + Depreciated amount

Depreciation expense in the second year is $1,000 while the depreciated amount is $2,000 (depreciation in the first and second year).

In this case, we can calculate the accumulated depreciation of the equipment at the end of the third year as below:

Accumulated depreciation = $1,000 + $2,000 = $3,000

Likewise, the net book value of the equipment at the end of the third year can be calculated as below:

Net book value of equipment = $5,000 – $3,000 = $2,000

Hence, the amount of accumulated depreciation at the end of the third year is $3,000 which will be included in the balance sheet as the contra account for the cost of equipment. Likewise, the net book value of the equipment is $2,000 at the end of the third year.

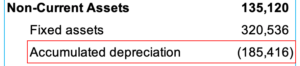

Accumulated depreciation on balance sheet

As mentioned, the accumulated depreciation is not an expense nor a liability, but it is a contra account to the fixed assets on the balance sheet. Likewise, if the company’s balance sheet shows the gross amount of fixed assets which is the total cost, the accumulated depreciation will show as a reduction to the balance of fixed assets.

In other words, the accumulated depreciation will usually show up as negative figures below the fixed assets on the balance sheet like in the sample picture below. Likewise, the normal balance of the accumulated depreciation is on the credit side.

When the fixed assets are sold or disposed of, the accumulated depreciation of the fixed assets that are sold or disposed of will need to be removed as well from the balance sheet together with the fixed assets themselves. Of course, this also applies when the company makes an exchange of fixed assets to replace the old fixed assets with the new ones.

Likewise, when the company removes the fixed assets from balance sheet as a result of the disposal, the company can remove the accumulated depreciation by debiting the accumulated depreciation account instead as the reverse of crediting like the above journal entry.