Declining Balance Depreciation

Overview

Declining balance depreciation is the type of accelerated method of depreciation of fixed assets that results in a bigger amount of depreciation expense in the early year of fixed asset usage. In this case, the company can calculate decline balance depreciation after it determines the yearly depreciation rate and the net book value of the fixed asset.

As the declining balance depreciation accelerates the depreciation expense in the early year of the fixed assets, such depreciation method will fit well with the fixed assets that provide greater benefits when they are new and in the early year comparing to the later years. The company uses declining balance depreciation on this type of fixed asset to comply with the matching principle of accounting as it requires the expense occurred to match with the benefits that the company receives from the use of the fixed asset.

In general, the company should allocate the cost of fixed assets based on the benefits that the company receives from them. Hence, the declining balance depreciation is suitable for the fixed assets that provide bigger benefits in the early year. On the other hand, if the fixed asset provides the same or similar benefits each year to the company through its useful life, such as building, the straight-line depreciation will be more suitable in this case.

Calculate declining balance depreciation

The company can calculate declining balance depreciation for fixed assets with the formula of the net book value of fixed assets multiplying with the depreciation rate.

Declining balance depreciation formula

Net book value is the carrying value of fixed assets after deducting the depreciated amount (or accumulated depreciation). It is the remaining book value of the fixed asset after it is used for a period of time. The net book value is calculated by deducting the accumulated depreciation from the cost of the fixed asset.

Depreciation rate in the formula of declining balance depreciation above is the rate that the management of the company decides on each type of fixed asset based on their past experiences and how the assets are being used. Also, this yearly rate of depreciation is usually in line with the industry average.

Example of declining balance depreciation

For example, on Jan 01, the company ABC buys a machine that costs $20,000. The company ABC has the policy to depreciate the machine type of fixed asset using the declining balance depreciation with the rate of 40% per year. The machine is expected to have a $1,000 salvage value at the end of its useful life.

Calculate declining balance depreciation of the machine above.

Solution:

With the information in the example, the company ABC can calculate the declining balance depreciation of the machine that costs $20,000 as below:

Year 1 depreciation

In the first year, the net book value equals the cost of the machine. Likewise, the depreciation expense of machine using the declining balance can be calculated as below:

Year 1 depreciation = $20,000 x 40% = $8,000

Year 2 depreciation

The net book value of the machine in year 2 = $20,000 – $8,000 = $12,000

Year 2 depreciation = $12,000 x 40% = $4,800

Year 3 depreciation

The net book value of the machine in year 3 = $12,000 – $4,800 = $7,200

Year 3 depreciation = $7,200 x 40% = $2,880

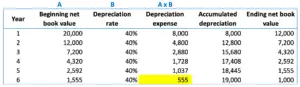

And the rest of the depreciation of the machine in the declining balance method is as in the table below:

***The depreciation expense in the sixth year is adjusted from $622 ($1,555 x 40%) to $555 in order to make the ending net book value equals the salvage value of the machine.

Determine depreciation rate

As seen in the formula of declining balance depreciation above, the company needs the deprecation rate in order to calculate the depreciation. Hence, it is important for the management of the company to determine the depreciation rate that can allow the company to properly allocate the cost of the fixed asset over its useful life.

In this case, the management usually determines the depreciation rate in the declining balance method based on past experience as well as the type of business or industry and the manner that the fixed asset is used. The depreciation rate can vary based on the different types of fixed assets. It can range from 20% per year to 50% per year or more.

Although any rate can be used, the straight-line rate is commonly used as a base to determine the depreciation rate for the declining balance method. This is due to the straight-line rate can be easily determined through the estimated useful life of the fixed asset.

In this case, the depreciation rate in the declining balance method can be determined by multiplying the straight-line rate by 2. For example, if the fixed asset’s useful life is 5 years, then the straight-line rate will be 20% per year. Likewise, the depreciation rate in declining balance depreciation will be 40% (20% x 2).

However, when the depreciation rate is determined this way, the method is usually called the double-declining balance depreciation method. Though, the double-declining balance depreciation is still the declining balance depreciation method. It is something like a subclass of declining balance depreciation.

Salvage value in declining balance depreciation

As the declining balance depreciation uses the net book value in the calculation, the company doesn’t need to determine the depreciable cost like other depreciation methods. In other words, unlike other depreciation methods, the salvage value is ignored completely when the company calculates the declining balance depreciation.

However, the company needs to use the salvage value in order to limit the total depreciation the company charges to the income statements. In other words, the depreciation in the declining balance method will stop when the net book value of the fixed asset equals the salvage value.

If the fixed asset doesn’t have the salvage value or its salvage value is zero, the company usually charges the remaining balance of the net book value as depreciation expense when its net book value is considered insignificant. This is usually when the net book value of the fixed asset is below the minimum value that asset is required to be capitalized (which should be stated in the fixed asset management policy of the company).

For example, if the fixed asset management policy sets that only long-term asset that has value more than or equal to $500 should be recorded as a fixed asset. Those that have value less than $500 should be recorded as expenses immediately. In this case, when the net book value is less than $500, the company usually charges all remaining net book balance into depreciation expense directly when it uses the declining balance depreciation.

The company usually does this to prevent charging depreciation on the fixed asset forever as the net book value in the formula of declining balance depreciation above will reduce bit by bit as time passes but it will not become zero.