Deferred Financing Costs

Deferred Financing Costs are the additional costs that a company pays to obtain the loan or issuing debt securities. These costs include lawyer fees, auditor, commission and investment bank fee, etc. When the company obtains loans or issue bonds, it is very common to incur some fees to the third parties. These costs are called deferred financing costs, debt issue costs, or bond issue costs.

These costs are not going to provide any future benefits to the company, so we cannot capitalize them as assets. They should be recognized as expenses when they are incurred, the problem is when we record them into profit and loss statements. Based on the accounting standard, these costs should be recorded in the balance sheet and amortized over the loan/bond term. We should follow the matching principle that expense and benefit should record in the same accounting period. But how do we amortize the deferred financing costs?

First, the financial institute standard board recommends using the effective interest rate which depends on the cash flow. Loan only recognized base on the cash flow into the company, so it will net off with the deferred financing cost. Thus, the effective interest rate will be higher than the normal rate in loan applications (or rates on bonds). It is the best option that will work in accordance with the effective interest rate.

The second option, we can amortize these costs over the loan terms or bonds term and record them as additional expenses. This option may create some variance if compare with the first option, but they are not significant and can be ignored if the company is unable to calculate the effective interest rate. However, this method is not recommended by the accounting standard.

Deferred Financing Costs Example

Company A borrows loan $ 2,000,000 from the bank with a 5% annual interest rate. The bank requires the company to pay $ 200,000 for the admin fee. Please calculate the deferred financing cost and record it into the financial statement.

The payment schedule is following:

| Year | Payment | Interest (5%) | Principle | Balance |

| 01 Jan 2020 | 2,000,000 | |||

| 31 Dec 2020 | 259,010 | 100,000 | 159,010 | 1,840,990 |

| 31 Dec 2021 | 259,010 | 92,050 | 166,961 | 1,674,030 |

| 31 Dec 2022 | 259,010 | 83,701 | 175,309 | 1,498,721 |

| 31 Dec 2023 | 259,010 | 74,936 | 184,074 | 1,314,647 |

| 31 Dec 2024 | 259,010 | 65,732 | 193,278 | 1,121,369 |

| 31 Dec 2025 | 259,010 | 56,068 | 202,942 | 918,428 |

| 31 Dec 2026 | 259,010 | 45,921 | 213,089 | 705,339 |

| 31 Dec 2027 | 259,010 | 35,267 | 223,743 | 481,596 |

| 31 Dec 2028 | 259,010 | 24,080 | 234,930 | 246,666 |

| 31 Dec 2029 | 259,010 | 12,333 | 246,666 | 0 |

| Total | 2,590,100 | 590,089 | 2,000,000 | 11,801,786 |

The admin fee $ 200,000 is the deferred financing cost that needs to record as the expense in the income statement. The problem is how to allocate the expense as the loan term which is 10 years.

Using Effective Interest Rate

Effective interest rate is the method which we need to recalculate the real interest rate which reflects the loan fee. This method considers the loan fee as part of the interest as it impacts the decision of the loan provider. The creditor may not provide loans at a lower rate if they cannot charge an additional fee. In this example, loan fee $ 200,000 needs to include as the interest and using the formula to recalculate the effective interest rate.

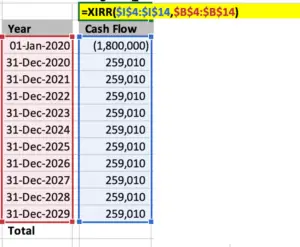

The effective rate will be calculated using the XIRR formula which usually found in Ms. Excel. It is the formula used to calculate the internal rate of return (IRR) for a series of cash flows which not periodic. The rate will depend on the amount for cash flow and each specific date.

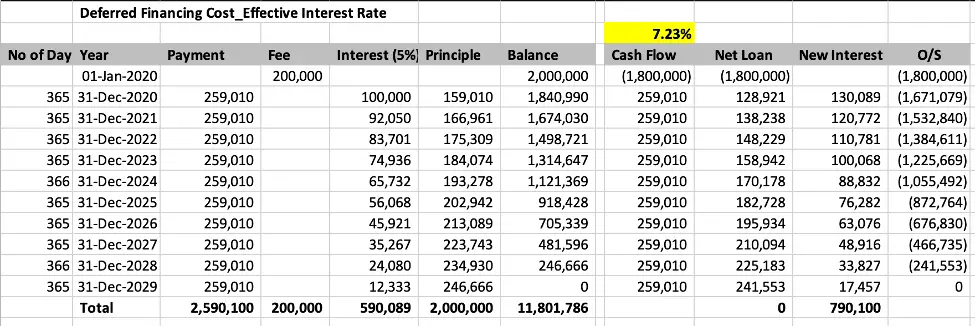

Base on the example above, the Effective Interest rate equal to 7.23%

As we can see, the rate depends on the cash flow which includes principal, fee, and annual payment. We recognized the loan amount as only $ 1.8 million as it is the cash outflow from the creditor.

Based on this interest rate, we need to recalculate the interest expense and record it into the income statement. Total new interest expense $ 790,100 equal to the total of old interest plus fee ($ 590,089 + $ 200,000). Please ignore the error rounding of $10.

We need to recalculate the interest expense base on effective interest rate (7.23%) rather than old rate. Company A need to record interest expense and loan outstanding base on the righ column, please refer to below table.

Please check the calculation in Excel.

Journal Entries

Both borrower and creditor need to record loan amount and interest base on the new interest and loan movement.

| Creditor | Borrower |

|---|---|

| Initial Recording | |

|

|

| Recognize Interest in 2020 | |

|

|

If both companies record base on the old schedule, they need to make adjustments to ensure the ending balance reflects with new loan movement.

Straight-line method

As the effective interest rate is a bit complicated and it will be a problem with creditors issue hundreds or thousands of loans to the customers. Without any help from accounting software, it almost impossible to calculate the effective interest rate of all loans.

However, the method of fee amortization is not recommended by the accounting standard. It just amortizes the loan fee equally over the loan term while the loan outstanding change over time.

Base on the above example, the loan fee $ 200,000 needs to allocate over years which is the loan term. The creditor needs to record additional interest income of $ 20,000 per year while borrowers record additional interest expense of the same amount.

The interest expense still depends on the old loan schedule.

Journal Entries

| Creditor | Borrower |

|---|---|

| Initial Recording | |

|

|

| Record of loan fee | |

|

|

| Recognize Interest in 2020 | |

|

|

| Amortize Loan Fee | |

|

|