4 Types of Audit Report

Overview

Audit report is the report that auditors express an opinion on financial statements whether they faithfully present the company’s financial position, financial performance, and cash flows in accordance with the applicable financial reporting framework, such as US GAAP, IFRS or local GAAP.

The objective of the auditor is to express an appropriate opinion on financial statements whether they are free from material misstatement. Likewise, there are four types of audit reports which are based on this perspective.

These four types of audit reports include:

- Unqualified audit report

- Qualified audit report

- Adverse audit report

- Disclaimer of opinion audit report

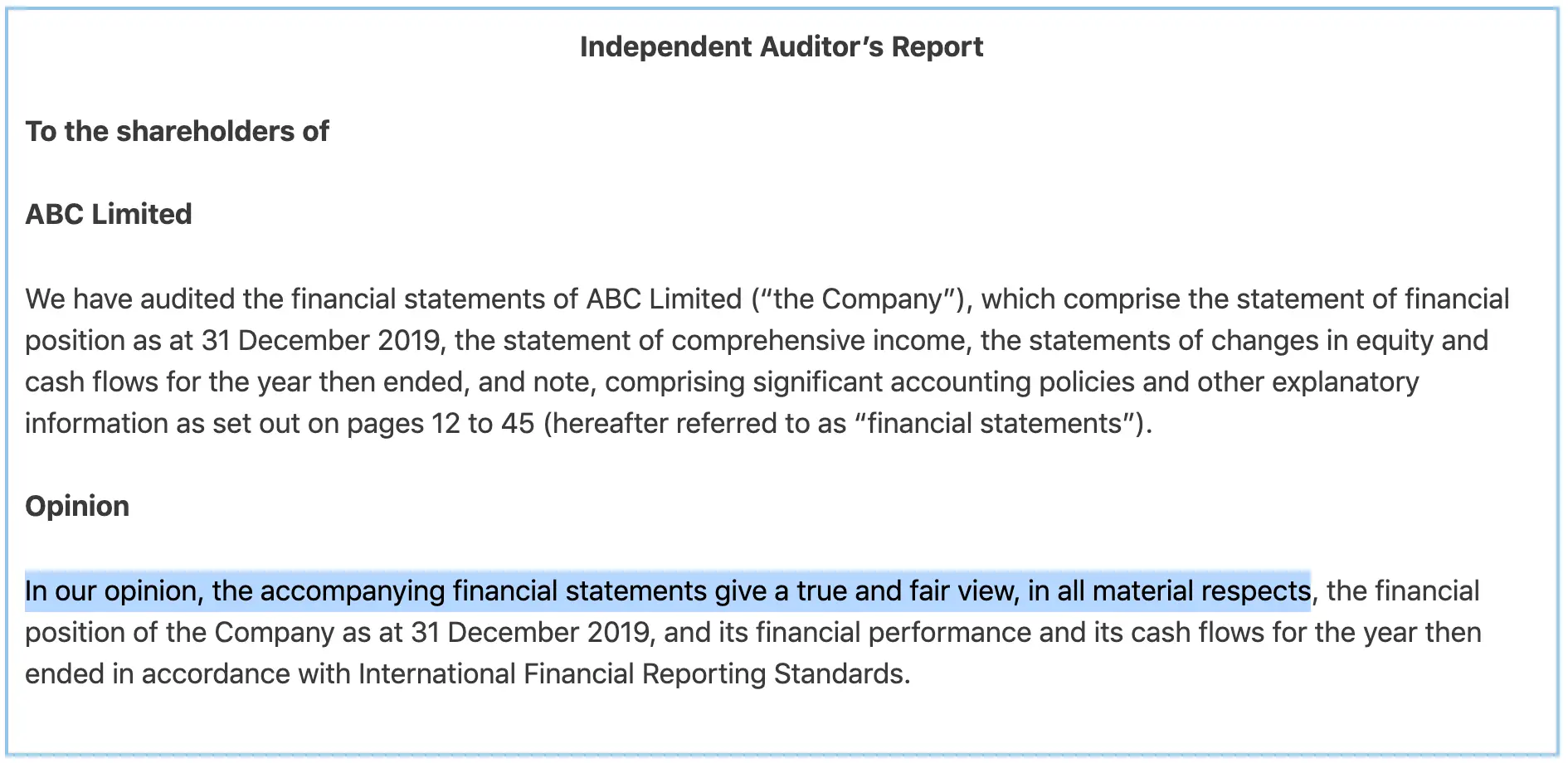

Unqualified audit report

Unqualified audit report is the report auditors express their opinion that there is no material misstatement on financial statements. In this case, the financial statements are prepared in accordance with the applicable accounting standards.

Among the four types of audit report, unqualified audit report is the report that auditors usually issue most of the time. This is due to unqualified audit report is only the report that expresses there is no problem with financial statements (no material misstatement).

Likewise, if there is any material misstatement, auditors usually propose the adjustment to the client’s management for correction. And most of the time, the adjustment is made and auditors issue the unqualified audit report as a result.

In this type of audit report, auditors usually state: “In our opinion, the financial statements give a true and fair view, in all material respects…” or “In our opinion, the financial statements present fairly, in all material respects…”

For example, auditors issue an unqualified audit report of the company ABC Limited that follows IFRS. In the case, the extracted unqualified audit report* usually looks like below:

*It is an extracted report as there are several other sections in the audit report besides the opinion, such as management’s responsibilities and auditor’s responsibilities sections.

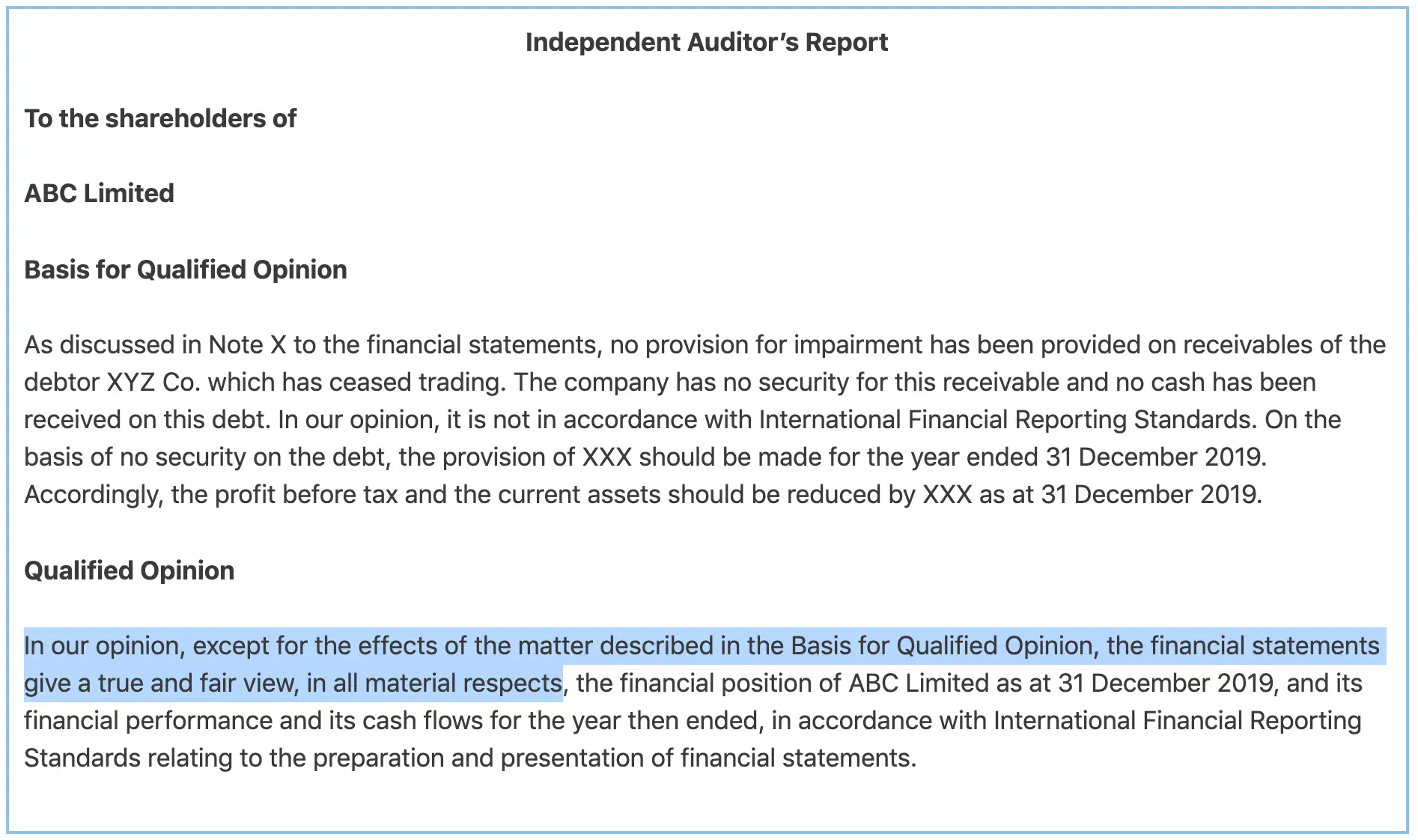

Qualified audit report

Qualified audit report is the report that auditors give a qualified opinion on financial statements. In this case, financial statements contain material misstatement which can be isolated to one part of financial statements.

In other words, the misstatement is material but not pervasive. It does not affect the financial statements as a whole.

In this type of audit report, auditors express that there is a problem in financial statements but the problem is not too serious.

The problem, in this case, can be either:

- Auditors find that there is a material misstatement in accounts or balances of financial statements, or

- Auditors cannot obtain sufficient appropriate evidence to ensure certain account or balance is free from material misstatement.

In the qualified audit report, auditors usually state: “In our opinion, except for the matter described in the Basis for Qualified Opinion, the financial statements give a true and fair present fairly, in all material respects…”

For example, an extracted qualified audit report that auditors issue on financial statements of the company ABC Limited that follows IFRS looks like below:

Auditors use the phrase “except for” in the opinion paragraph to point to the issue leading to the qualification. Likewise, a Basis for Qualified Opinion which is a separate paragraph is required to describe the matter concerning the qualification of opinion.

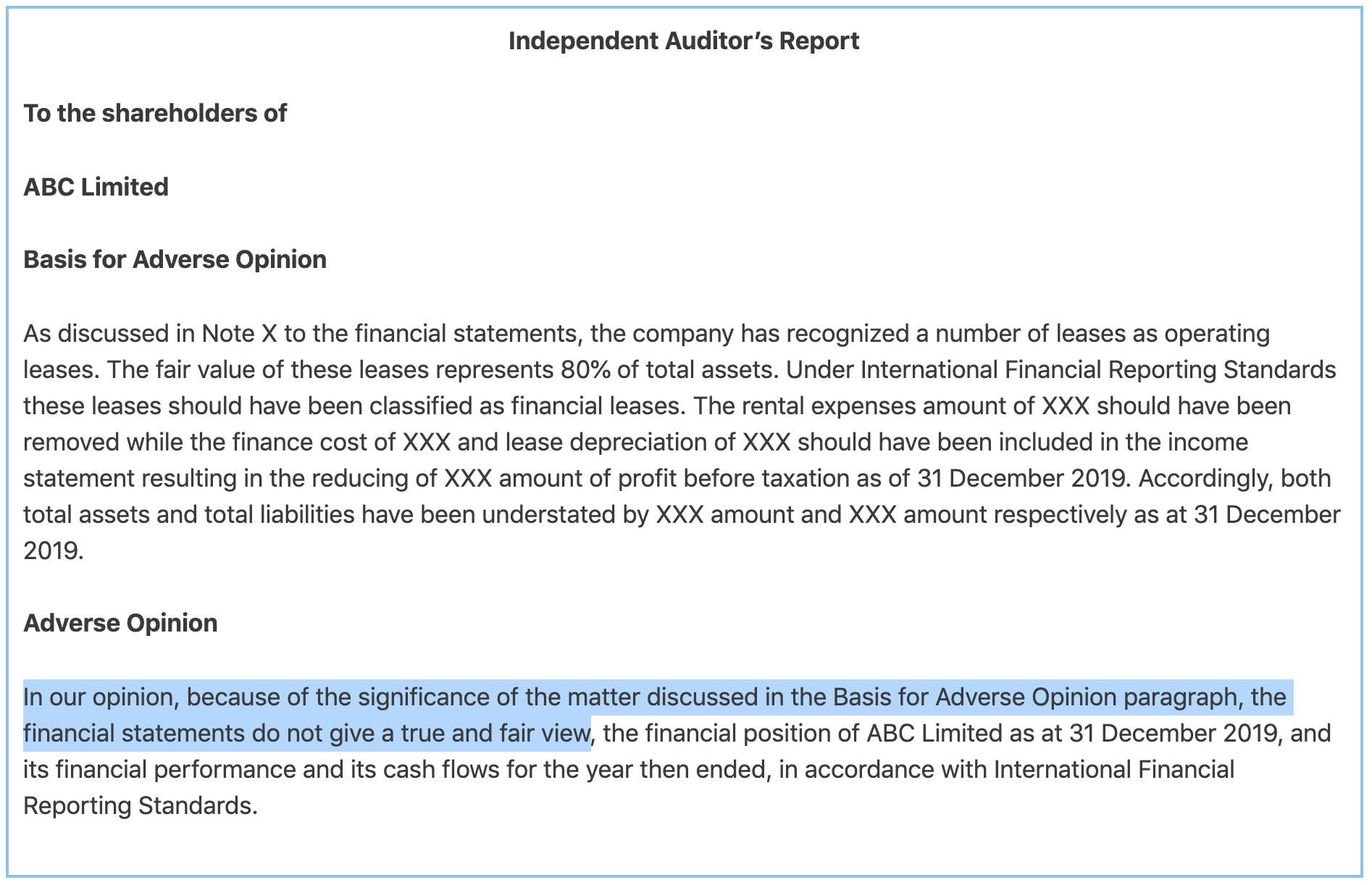

Adverse audit report

Adverse audit report is the report that auditors issue saying that there is a material misstatement and it affects financial statements as a whole. In this case, the misstatement is both material and pervasive.

In an adverse audit report, auditors express an opinion that the financial statements contain a serious problem, i.e. financial statements cannot be trusted.

Likewise, this type of audit report usually indicates that the financial statements are not reliable and the integrity of the client’s management may be questionable.

Auditors usually state that “the financial statements do not give a true and fair view” or “the financial statements do not present fairly” in an adverse audit report.

For example, if auditors issue an adverse audit report for the company ABC Limited that follows IFRS, it would look like an extracted report below:

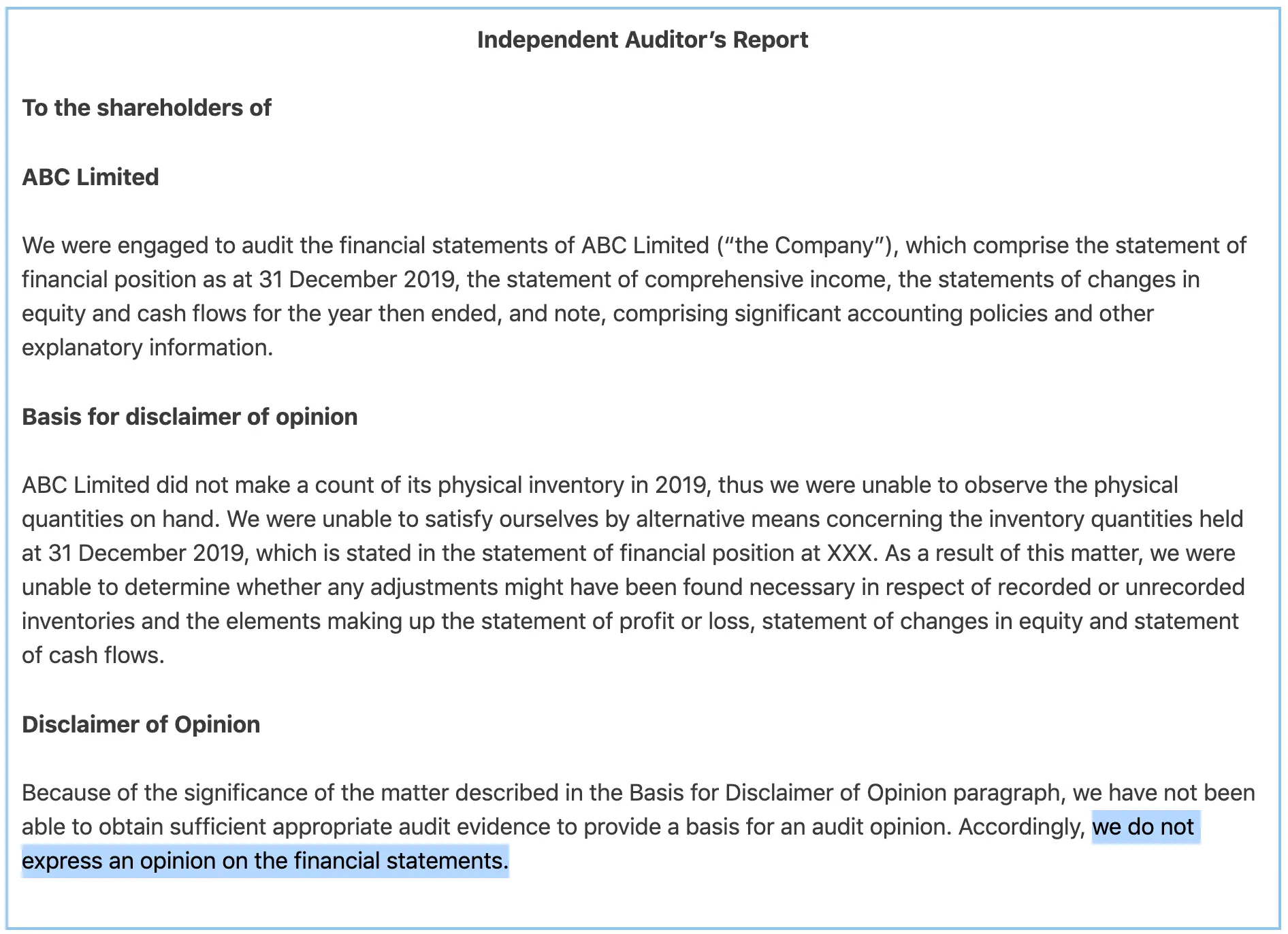

Disclaimer of opinion audit report

Disclaimer of opinion audit report is the audit report that auditors cannot express their opinion on financial statements. This is usually due to auditors could not obtain sufficient appropriate audit evidence to form an opinion on financial statements.

Also, in this type of audit report, transactions or balances that auditors could not obtain evidence on are both material and pervasive. Such matter cannot be isolated as it affects financial statements as a whole.

Similarly, auditors may also disclaim on opinion when they face situations involving significant uncertainties or situations of lacking independence. However, this usually only happens in a rare circumstance.

Auditors usually state that “we do not express an opinion on the financial statements” in the disclaimer of opinion audit report.

For example, a disclaimer of opinion audit report that auditors issue on financial statements of ABC Limited would look like below: