Financial Statements

Definition

Financial statements are the written reports which show the financial condition and performance of the company. For this reason, financial statements are used by many users, such as shareholders, investors, lenders, and suppliers, as the tools to make a business decision involving the company.

They consist of 4 types of statements including:

- Balance sheet

- Income statement

- Statement of cash flows

- Statement of changes in equity

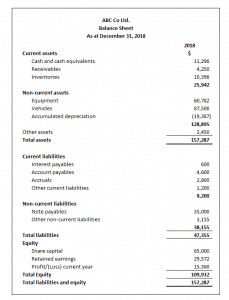

Balance Sheet

Balance sheet shows the company’s financial condition at a given point in time. It presents the balance of the company’s assets, liabilities, and equity which follow the accounting equation.

Assets are what the company owns in the business which includes cash, account receivable, inventory equipment.

Liabilities are what you owe in the business which includes account payables, interest payables, and note payables.

Equity is the owner’s investment in the business which includes the owner’s initial investment in capital and investment from accumulated profit from the previous year and current year profit etc.

Balance Sheet Example

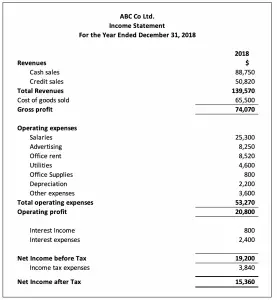

Income Statement

Income statement shows the company’s performance during the accounting period (usually one year). It consists of revenues from the sale of goods or services provided by the company and expenses which incur in the period.

The bottom line of the income statement is net income (or net loss) which comes from deduction of all expenses from revenues.

The income statement always have the formula as:

Income Statement Example

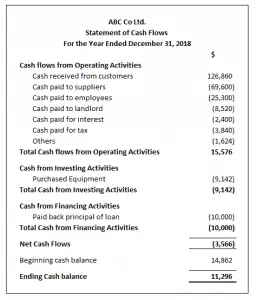

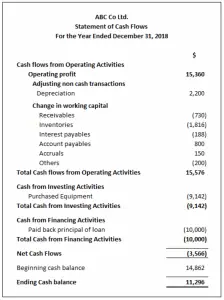

Statement of Cash Flows

Statement of cash flows show the company’s cash inflows and cash outflows from three activities including operating activities, investing activities and financing activities during the accounting period.

It is the cash movements that include beginning cash balance, net cash flows and ending cash balance.

Statement of Cash Flows Example

Direct Cash Flows Method Example

Indirect Cash Flows Method Example

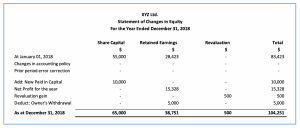

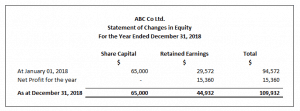

Statement of Changes in Equity

Statement of changes in equity shows the movement in owner’s equity during the accounting period. The transactions that cause the movement include new capital investment, the dividend paid and net income/loss.

Statement of Changes in Equity Example

And another example with revaluation and owner’s withdrawal