Adjustment in Bank Reconciliation

Introduction

Bank reconciliation is the process of matching the bank balance in the company’s accounting record to the balance shown on the bank statement and identifying any difference between the two records.

Bank reconciliation is the process of matching the bank balance in the company’s accounting record to the balance shown on the bank statement and identifying any difference between the two records.

All the transactions on the bank statement are the transactions recorded by the company’s bank which are shown on the bank statement at the end of the month including beginning and the ending balance.

The bank usually sends the bank statement to the company shortly after the end of the month. The transactions and balances on the bank statement will be used to perform bank reconciliation.

4 Adjustments in Bank Reconciliation

The process of bank reconciliation is to compare the bank statement with the bank balance in the company’s accounting record. It is often that the balances on the two records are different.

Hence the easiest way of preparing the bank reconciliation is to consider the reasons for the differences and record the reconciliation items or adjust/ add the entry in the accounting record based on the types of difference.

The four adjustments in bank reconciliation include:

- Timing differences

- Transactions initiated by the bank

- Transactions omitted by the company

- Incorrect transactions recorded

| Adjustments in Bank Reconciliation | |

|---|---|

| Timing differences | Timing difference is the difference that occurs due to transactions recorded by the company and the bank are in a different period. Deposit in transit and outstanding check are the examples of such timing differences.

Deposit in transit: is the deposit made by the company into the bank but not recorded by the bank yet. Outstanding check: is the check that is issued by the company but the receiver has not presented to the bank for the payment yet. The timing differences are the reconciling items which should be included on the bank reconciliation statement. No additional entry is required to make in the company’s accounting record. |

| Transactions initiated by the bank | This is the difference that occurs due to transactions initially recorded by the bank, such as interest or fee charge, but the company is not aware of such transactions and only know about it after receiving the bank statement from the bank. Bank charges, interest paid and NSF check are the examples of such transactions that are initiated by the bank that the company is not aware of.

Bank charge: is the fee or commission the bank charged on the company’s bank account. Interest paid: is the interest that was paid to the company’s account by the bank. Not sufficient fund check (NSF): is the check deposited by the company but it was rejected by the bank due to insufficient fund in the bank account or the account has already been closed. The company usually is not aware of such circumstances until receiving the bank statement. It is required to record those transactions that are initiated by the bank to have accurate bank balances in the accounting record. |

| Transactions omitted by the company | It is the straight matter as the company may forget to record the transactions related to its bank balance.

In this case, the company is required to record back the transactions that are omitted to have accurate bank balances in the accounting record. |

| Incorrect transactions recorded | This is the difference that occurs dues to transactions recorded are incorrect. This may be due to the error either made by the bank’s staff or the company’s staff.

In this case, if the error is due to the bank’s fault, it should be included in the bank reconciliation as the reconciliation item; and no entry is required in the company’s accounting record. However, if the error is due to the company’s fault, an adjustment is required in the company’s accounting record to correct the bank balance. |

It is recommended that the company perform the bank reconciliation at least once a month to prevent and detect error or fraud on its bank balances. By doing so the company can investigate and correct any error on time.

It also helps to ensure that the bank balances in the company accounting record are accurate and reliable.

Bank Reconciliation Example

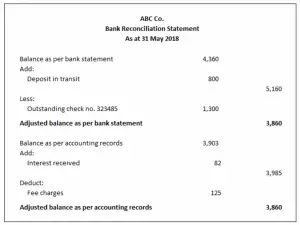

At 31 May 2018 ABC Co.’s bank balance in accounting records was $3,903 and the bank statement showed $4,360.

ABC Co. has the following information:

- On 31 May 2018, ABC Co. deposited $800 into its bank account; however, this balance was not shown on the bank statement as at 31 May 2018.

- Check number 323485, which ABC Co. issued to a supplier with an amount $1,300 was not shown on the bank statement.

- The bank debited ABC’s account with charges of $125 during May. However, ABC has not recorded these charges yet.

- On the bank statement, the interest of $82 was credited to ABC Co.’s account, but ABC Co. has not recorded it in the accounting record yet.

The bank reconciliation statement is as below:

It is useful to note that from the perspective of the bank when the bank debits the company’s account, it means deducting. On the other hand, when the bank credits the company’s account, it means adding.