Break-Even Point

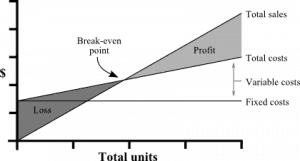

Break-Even Point is the point at which company generates total revenue equal to the total cost. In other words, the company does not make any profit or loss.

At the planning stage, company must define the break-even point which is the amount of sale required to cover all costs. It is a useful ratio for management to set the target for more profit. Before making a profit, we need to know the break-even point first. It is the minimum sale volume that needs to continue the operation. Any sale above break-even will generate profit for the company. The Break-even point can represent both the sale amount ($) and sale quantity (units).

It is very important because it helps the company to know their minimum sales which they have to make to recover the cost. The cost includes both variable and fixed costs. Any sale quantity above this will make a profit for the company. If the sale is below this point, it means the company is making a loss. Management must set a new strategy to increase sales.

It also helps us to understand the overall business performance whether the break-even point is too high or not. The higher the break-even point, the higher the risk we are facing. The operation requires a huge amount of fixed cost, so the break-even is very high to hit. Company must make a huge sale to generate enough contribution margin to cover the fixed cost.

Formulas of Break-Even point

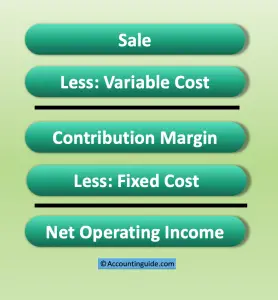

In order to understand these formulas, we have to understand the relationship between fixed cost and variable cost in the brief income statement.

In order to understand these formulas, we have to understand the relationship between fixed cost and variable cost in the brief income statement.

Each unit sold will generate the contribution margin for the company, and the contribution will be used to net off fixed costs to arrive at the net operating income. The Break-even point happens when the total contribution margin is equal to the fixed cost, so the net operating income is equal to zero.

There are a few ways to calculate the Break-Even point, such as:

Break-Even Point (units) = Fixed Cost / (Sale price per unit-VC per unit)

Break Even Point (units) = Fixed Cost/Contribution per unit

Break Even point (dollar) = Break-Even point (units) x selling price

Break-Even point (dollar) = Fixed Cost /Contribution %

All of the formulas above will provide the same result as they find the specific point where the contribution margin is equal to fixed cost, and the profit/net income is zero.

Example

Company ABC manufactures premium pens and supplies them to the retail shops in the US.

We have set the selling price of $ 5 per unit.

The variable cost per unit includes:

- Rubber $ 1

- Worker wage $ 1

- Other material $ 1

Monthly operating cost includes:

- Depreciation expense on building and machinery $ 5,000

- Rental fee on warehouse $ 2,000

- Salary for all staffs $ 10,000

- Marketing expense $ 3,000

- Other expenses $ 1,000

Total $ 21,000

Calculate the Break-Even Point

Solution:

All materials and direct labor are the variable cost with a total of $ 3 per unit.

All operating expenses are the fixed cost total of $ 21,000, as we assume that they will not change due to production output.

Break-Even point = $ 21,000 / ($ 5 – $ 3) = 10,500 units

The company needs to sell 10,500 units of pens to meet the break-even point. Any sale of more than 10,500 units will make a profit for the company.

If the sale is 10,500 units, the sale will be $ 52,500 ( 10,500 units * $ 5 per unit). The total cost will be $ 52,500 [(10,500 units * $ 3 per unit) + 21,000]. So the sale amount is equal to total cost, the company makes zero profit.

What are the Advantages of Break-Even Point?

| Advantages of Breakeven point | |

|---|---|

| Calculate profit at multiple sale quantity | It helps to calculate profit at a different level of sale volume. By doing so, the company can see the full picture and decide whether increasing sale/production volume is worth or not. |

| Help management to set sale target | Easy for management to set a specific target sales volume in order to have profit. It is very important for top management to prepare business plans and target growth. The higher the breakeven point, the higher the risk the company is facing while low breakeven indicates a low-risk position. |

| Additional information for make or buy | It is a tool to help management on make or buy a certain component. It happens when the company has the option to produce or purchase components from suppliers. If the require quantity is less than the break-even, so we should buy from suppliers rather than produce ourselves. |

| To prepare for market change or price drop | It can tell the negative movement of profit if price changes in the market. With the break-even point, the company can revise its sales budget according to the market price drop and management can keep a closer look at company performance. |

| Show the costing behavior | The breakeven point will show the characteristic of both variable cost and fixed cost. |

What are the disadvantages of Break-even point?

| Disadvantages of Break-even point | |

|---|---|

| Depend on certain assumption | The calculation of breakeven with assume that selling prices and costs are the same. In reality, both cost and price always change according to market demand and supply. By using fixed figures, the company is less flexible to respond to any change in the market. |

| Difficult for company produce multiple products | Not effective to use in a company that produces more than one product. When come to multiple products, we need to assume the allocation of fixed costs between products and use those figures with other assumptions such as fixed selling price, fixed variable costs, etc. The result will be less reasonable and accurate. |

| Sale less than production quantity | The sale is not always equal to production output. It is another miss assumption in real business. We will not be able to sell all production output; it depends on many actual situations. |

| Time-consuming | It is very time-consuming to calculate breakeven points while it has many limitations. |