Gearing Ratios

What are Gearing Ratios?

Gearing ratios are the financial ratios that look at the extent to which the company is financed by outside parties in its financing arrangement and structure. Likewise, the level of gearing in the company is very important as the higher amount of borrowings in the company indicates the higher risk the company faces in paying back the interest and principal of the debts.

In general, once the company borrows the money from the outsiders such as banks it already commits to pay the interest charged and all principal back in the future. As a result, it is considered as a financial burden and increase the risk of insolvency if the company has high gearing.

The commonly seen gearing ratios include capital gearing and interest coverage ratio.

Capital Gearing

Capital gearing, also known as financial leverage, is the financial ratio that looks at the proportions of the company’s borrowings and its capital which are used for funding the business. In general, the company is usually considered risky if it has a large proportion of the borrowings. This is due to the interest and principal repayment is a legal obligation that the company must meet to avoid insolvency. As a result, a higher capital gearing usually means a higher risk for the company.

The levels of capital gearing vary from one industry to another, hence it is difficult to determine what level of capital gearing is considered too high. However, it can be considered too high for many companies when the proportion of debts exceeds the proportion of equity.

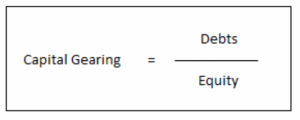

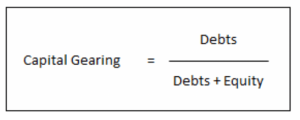

Capital Gearing Formula

Capital gearing can be calculated by comparing the total debts to total equity which is often referred to as debt to equity ratio.

Capital gearing can also be calculated by comparing the total debts to total debts plus equity which is often referred to as debt to equity + debt ratio.

Interest Coverage Ratio

Interest coverage ratio is the financial ratio that looks at the amount of time the company can the interest to its lenders by comparing the earnings before interest and tax (EBIT) to the interest expenses. Likewise, it shows the company’s ability to pay interest to its lenders.

Although interest coverage is not involving with paying back the principal to lenders, it is still very important to the company to properly manage it. Inability to pay the interest on outstanding debts to lenders can result in breaching the borrowing covenant. In this case, the company may receive fine or the lenders may request the company to pay back all principal immediately. Hence, the company should make sure that it always have sufficient fund to pay interest to lenders.

In general, a lower level of interest coverage ratio means a higher risk that the company cannot make interest payments to lenders.

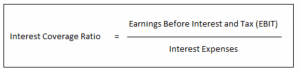

Interest Coverage Ratio Formula

Interest coverage ratio can be calculated by comparing the earnings before interest and tax (EBIT) to the interest expenses.