Journal Entry for Held to Maturity Securities

Introduction

Held-to-maturity security is a type of investment asset that we intend to hold until it matures. Likewise, we need to make the journal entry for held-to-maturity securities at the time of the purchase in order to account for the increase in the investment assets on our balance sheet.

The held-to-maturity security includes a promissory note, commercial paper, government or corporate bonds, etc. This type of security usually provides us with a regular interest income and returns the principal amount back at the maturity date.

In this case, we will also need to record the interest income that we earn for the period on the income statement. This may include any accrued interest that we have not received in cash yet. Later, when we receive back the principal amount at the maturity date, we can make another journal entry to derecognize the securities from the balance sheet.

In accounting, the held to maturity is measured and recorded at amortized cost on the balance sheet while the interest generated will be recorded on the income statement. This means that, unlike trading securities or available-for-sale securities, held-to-maturity securities are not affected by the change in market value.

Purchase of held-to-maturity securities

We can make the journal entry for the purchase of held-to-maturity securities at the purchase date by debiting the held-to-maturity securities account and crediting the cash account.

| Account | Debit | Credit |

|---|---|---|

| Held-to-maturity securities | 000 | |

| Cash | 000 |

In this journal entry, the held-to-maturity securities are recorded as investment assets on the balance sheet. Likewise, there is no impact on the total assets of the balance sheet as a decrease in cash (credit) is offset by an increase in investment assets of the held-to-maturity securities.

Interest on held-to-maturity securities

Interest income is a type of income that is generated or earned through the passage of time. Hence, we need to record the interest that we earn from the held-to-maturity securities on the income statement for the period.

In this case, at the period-end adjusting entry, we can make the journal entry for accrued interest on the held-maturity-securities by debiting the interest receivable account and crediting the interest income account.

| Account | Debit | Credit |

|---|---|---|

| Interest receivable | 000 | |

| Interest income | 000 |

And later, when we receive the interest payment, we can make the journal entry for the interest received by debiting the cash account and crediting the interest receivable account.

| Account | Debit | Credit |

|---|---|---|

| Cash | 000 | |

| Interest receivable | 000 |

Return principal back at maturity date

At the maturity date when we receive the principal amount of the securities back, we can make the journal entry with the debit of the cash account and the credit of the held-to-maturity securities account.

| Account | Debit | Credit |

|---|---|---|

| Cash | 000 | |

| Held-to-maturity securities | 000 |

This journal entry is made to derecognize the held-to-maturity that we have received the principal back at the maturity date. Likewise, the investment assets on the balance sheet will decrease by the amount matured.

Example held-to-maturity securities

For example, on July 1, 2022, we purchase a $100,000 commercial paper, which is a type of debt security that we intend to hold until its maturity. This $100,000 commercial paper provides an interest rate of 6% per annum and has a maturity of 6 months.

We will receive both interest and principal amount at the maturity date which is on January 1, 2023. And our period-end adjusting entry is on December 31.

In this case, on July 1, 2022, we can make the journal entry for the purchase of $100,000 commercial paper which is classified as a held-to-maturity security by debiting the $100,000 to the held-to-maturity securities account and crediting the same amount to the cash account as below:

July 1, 2022:

| Account | Debit | Credit |

|---|---|---|

| Held-to-maturity securities | 100,000 | |

| Cash | 100,000 |

Later on, on December 31, 2022, which is our period-end adjusting entry, we need to record the $3,000 ($100,000 x 6% x 6/12) interest on the held-to-maturity securities to the income statement of 2022.

In this case, we can make the journal entry for the $3,000 accrued interest on held-to-maturity securities by debiting the interest receivable account and crediting the interest income account with the $3,000 amount as below:

December 31, 2022:

| Account | Debit | Credit |

|---|---|---|

| Interest receivable | 3,000 | |

| Interest income | 3,000 |

And when we receivable both the interest and principal amount of the securities on the maturity date of January 1, 2023, we can make the journal entry as below:

January 1, 2023:

| Account | Debit | Credit |

|---|---|---|

| Cash | 103,000 | |

| Interest receivable | 3,000 | |

| Held-to-maturity securities | 100,000 |

Held to maturity securities at amortized cost

As mentioned, held-to-maturity securities need to be measured and recorded at the amortized cost in order to comply with the accounting rule. So, we need to make sure that the value of the held-to-maturity securities on the balance sheet is fairly presented at their amortized cost at the reporting date.

For example, on January 1, we purchase a $100,000 discount corporate bond for only $95,000. This corporate bond gives an annual interest of 5% per annum and has a maturity of 5 years. The interest is payable annually on December 31 which is at the end of our accounting period. And we intend to hold this $100,000 corporate bond until its maturity.

In this case, on January 1, we can make the journal entry for the purchase of held-to-maturity security which is a corporate bond at a discount by debiting the discounted price of $95,000 to the held-to-maturity securities account and crediting the same amount to the cash account as below:

| Account | Debit | Credit |

|---|---|---|

| Held-to-maturity securities | 95,000 | |

| Cash | 95,000 |

As we purchased this corporate bond security at a discount, at the period-end adjusting entry, we need to amortize the $5,000 discount ($100,000 – $95,000) for the 5 years period of the security using the effective interest rate method.

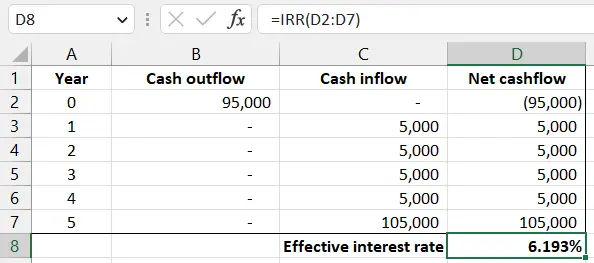

The effective interest rate can be calculated by IRR() formula in the Microsoft Excel tool. This IRR() formula is equivalent to the calculation of the effective interest rate by using the discounted future cash flow of the security provided that the cash flow is on a yearly basis.

After determining that the effective interest rate is 6.193%, we can generate the schedule for the $100,000 discount bond security for 5 years period as below:

| Year | Security value | Annual interest | Effective interest | Discount |

|---|---|---|---|---|

| 0 | 95,000 | – | – | – |

| 1 | 95,884 | 5,000 | 5,884 | 884 |

| 2 | 96,822 | 5,000 | 5,938 | 938 |

| 3 | 97,818 | 5,000 | 5,996 | 996 |

| 4 | 98,876 | 5,000 | 6,058 | 1,058 |

| 5 | 100,000 | 5,000 | 6,124 | 1,124 |

The detailed calculation is in the Excel file with the link here: amortized cost of held-to-maturity securities.

And at the end of the first year, we can make the journal entry for the amortized cost of the discount securities at the period-end adjusting entry as below:

Year 1:

| Account | Debit | Credit |

|---|---|---|

| Cash | 5,000 | |

| Discount on securities | 884 | |

| Interest income | 5,884 |

Likewise, the amortized cost of the held-to-maturities that we purchased on the discount cost of $95,000 will be $95,884 ($95,000 + $884) at the end of the first year.

| Held-to-maturity securities | $95,000 |

| Discount on securities | $884 |

| Amortized cost of securities | $95,884 |

And the rest of the journal entries for the discounted held-to-maturity security from the second year until its maturity will be as follows:

Year 2:

| Account | Debit | Credit |

|---|---|---|

| Cash | 5,000 | |

| Discount on securities | 938 | |

| Interest income | 5,938 |

Year 3:

| Account | Debit | Credit |

|---|---|---|

| Cash | 5,000 | |

| Discount on securities | 996 | |

| Interest income | 5,996 |

Year 4:

| Account | Debit | Credit |

|---|---|---|

| Cash | 5,000 | |

| Discount on securities | 1,058 | |

| Interest income | 6,058 |

Year 5:

| Account | Debit | Credit |

|---|---|---|

| Cash | 5,000 | |

| Discount on securities | 1,124 | |

| Interest income | 6,124 |

Likewise, at the end of year 5, the amortized cost of held-to-maturities will be $100,000.

| Held-to-maturity securities | $95,000 |

| Discount on securities | $5,000 |

| Amortized cost of securities | $100,000 |

Return of principal at maturity date:

| Account | Debit | Credit |

|---|---|---|

| Cash | 100,000 | |

| Discount on securities | 5,000 | |

| Held-to-maturities securities | 95,000 |