Journal entry for non interest bearing note receivable

Overview

In accounting, the face value of a non-interest-bearing note is usually the maturity value of the note which is also known as future value. Likewise, the company needs to calculate the note’s present value which is its fair value at the present date before it can make the journal entry for the non-interest-bearing note receivable.

It is different from the interest-bearing note where its face value usually represents the present value and its maturity value is the total of the face value and the interest. On the other hand, the face value of the non-interest-bearing note is the maturity value itself as it does not have interest attached.

That is why the company needs to discount the face value of the non-interest-bearing note which is the maturity value or the future value of the note to the present date before it can be recorded on the balance sheet. This is the concept of the time value of money where the money today is more valuable than the same money receiving in the future.

For example, a $1,000 non-interest-bearing note maturing in 3 months will have a value less than $1,000 today. After all, this $1,000 non-interest-bearing promissory note would simply imply that the issuer promises to pay $1,000 after 3 months. And that’s it; no interest nor any financial value is added to this $1,000 amount at all.

Journal entry for non interest bearing note receivable

At receiving date of non-interest-bearing note

The company can make the journal entry for non-interest-bearing note receivable by debiting the note receivable account at its fair value and crediting the revenue account or cash account as the counterpart depending on whether the company receives the promissory note for the sales or other reasons that results in the cash outflow in exchange, such as lending.

| Account | Debit | Credit |

|---|---|---|

| Note receivable | 000 | |

| Revenue/cash | 000 |

In this journal entry, the amount of note receivable is the fair value of the note which is the present value of the note’s face value. Likewise, the company needs to calculate the present value which is the amount to be recorded in this journal entry by discounting the note’s face value to the present date using an appropriate discount rate.

At month-end adjusting entry

At month-end adjusting entry, the company can make the journal entry to increase the balance of the note receivable by debiting the note receivable with the amount of present value multiplying with the discount rate.

| Account | Debit | Credit |

|---|---|---|

| Note receivable | 000 | |

| Interest income | 000 |

In this journal entry, the balance of note receivable will increase by the amount of interest income of the month. Likewise, at the end of the note maturity, the balance of non-interest-bearing note receivable will increase to the amount of its face value.

Even though there is no cash inflow, the company records the credit of interest income here in the amount of the present value multiplying with the discount rate. This is the concept of the time value of money in which the present value of the note will increase bit by bit as the time passes until it reaches the end of the note maturity when the note is honored.

At honoring date of non-interest-bearing note

When the note is honored at the end of its maturity, the company can make the journal entry for honoring of non-interest-bearing note by debiting cash account as it receives the money promised by the note issuer and crediting the note receivable account to remove the debt that the note issuer owes.

| Account | Debit | Credit |

|---|---|---|

| Cash | 000 | |

| Note receivable | 000 |

By the time the non-interest-bearing note is honored, its balance will already equal to its face value written on the promissory note. Likewise, this journal entry will eliminate the debt of the note issuer as a result of honoring the promissory note.

Non interest bearing note receivable example

For example, on November 1, the company ABC receives a $10,000 promissory note from one of its customers in exchange for the goods it sells to that customer. The promissory note has a maturity of 3 months, in which it will be honored by the customer after 3 months pass.

The promissory note that the company receives is the type of non-interest-bearing note in which it only states that the customer promises to pay $10,000 to the company ABC after 3 months without any interest or interest rate included in there.

The appropriate discount rate is 10% per annum.

What is the journal entry for non-interest-bearing note receivable?

- When the company receives the promissory note

- At the month-end adjusting entry from the first month to the third month

- When the note is honored by the customer after 3 months

Solution:

With the information in the example, we can calculate the present value of the non-interest-bearing note as below:

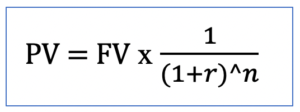

Present value of the note = FV x (1/(1+r)^n)

Present value of the note = $10,000 x (1/(1+10%/12)^3) = $9,754.11

The “10%/12” here is to determine the monthly rate as the maturity period of the note is 3 months.

After calculating the present value of the non-interest-bearing note, we can calculate the interest each month by multiply the present value with the discount rate as below:

Interest on the first month = $9,754.11 x (10%/12) = $81.28.

Likewise, we can make the table for the 3 months of the note as below:

| Month | Face Value | PV

(FV*(1/(1+r)^n)) |

Interest

(PV*r) |

Month-end

balance |

|---|---|---|---|---|

| 1 | 10,000 | 9,754.11 | 81.28 | 9,835.39 |

| 2 | 10,000 | 9,835.39 | 81.96 | 9,917.36 |

| 3 | 10,000 | 9,917.36 | 82.64 | 10,000.00 |

At receiving date of the non-interest-bearing note

In this case, the company ABC can make the journal entry for non-interest-bearing note by debiting the present value of the note which is $9,754.11 into the note receivable account as below:

| Account | Debit | Credit |

|---|---|---|

| Note receivable | 9,754.11 | |

| Sales revenue | 9,754.11 |

At month-end adjusting entry

At the month-end adjusting entry, the company ABC can make the journal entry to increase the balance of the note receivable month by month to reach its face value as below:

First month

| Account | Debit | Credit |

|---|---|---|

| Note receivable | 81.28 | |

| Interest income | 81.28 |

Second month

| Account | Debit | Credit |

|---|---|---|

| Note receivable | 81.96 | |

| Interest income | 81.96 |

Third month

| Account | Debit | Credit |

|---|---|---|

| Note receivable | 82.64 | |

| Interest income | 82.64 |

By this time, the balance of note receivable will equal $10,000 ($9,754.11 + $81.28 + $81.96 + $82.64) which equals to the face value of the note.

At honoring date of the non-interest-bearing note

When the note is honored by the customers at the end of note maturity, the company can make the journal entry at the honoring date of the non-interest-bearing note by debit the cash of $10,000 as it receives from the customer and crediting the $10,000 of note receivable to remove it from the balance sheet.

| Account | Debit | Credit |

|---|---|---|

| Cash | 10,000 | |

| Note receivable | 10,000 |

Calculate the present value of non interest bearing note

As mentioned, the company needs to record the present value of the note in the journal entry of non-interest-bearing note receivable upon receiving the promissory note. In this case, the company can calculate the present value of non-interest-bearing note with the formula below:

Formula of the present value of non-interest-bearing note:

Where,

- PV is the present value which is the fair value of the non-interest-bearing note that the company should record at the receiving date of the note

- FV is the future value which is the face value of the non-interest-bearing note which is also the maturity value of the note at the maturity date

- r is the appropriate discount rate that is usually presented as a certain percentage per annum (e.g. 8% per annum)

- n is the number of the period which is usually measured as the number of years or number of months depending on whether the measurement of the discount rate is per year or per month.

For example, the non-interest-bearing note that the company XYZ receives is a $1,000 promissory note with a 2-year maturity and an appropriate discount rate is 8% per annum.

In this case, the company XYZ can calculate the present value of the non-interest-bearing note with the formula below:

PV = FV x (1/(1+r)^n)

PV = $1,000 x (1/(1+8%)^2)= $857.34

As a result, the present value of a $1,000 non-interest-bearing note with a 2-year maturity is calculated to be $857.34 using the discount rate of 8% per annum.