Portfolio Yield

Overview

Portfolio yield is the ratio that is usually used in banks or microfinance institutions to measure the average income that the company receives from their loans. This ratio is usually calculated on the average of the total loan portfolio.

However, it may be broken down into further detail, e.g. by loan size, for detailed analysis. This is useful when the management wants to use it as an indication of the pricing strategy for each type of loan portfolio.

Portfolio yield is a good indicator to measure how much advantage or disadvantage the company has in pricing compared to other companies in the same industry. The company may use the portfolio yield to decide whether they should increase or decrease the interest and fee on new loans after comparing with the industry average.

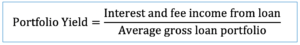

Portfolio Yield Formula

Portfolio yield can be calculated by using the formula of interest and fee income from loan dividing by the average gross loan portfolio.

- Interest and fee income from loan: this includes all interest and fee as well as penalty income that the company may receive from the late payment of the loan during the accounting period.

- Average gross loan portfolio: gross loan portfolio at the current period plus gross loan portfolio at the end of the last period and divide by 2.

Portfolio Yield Example

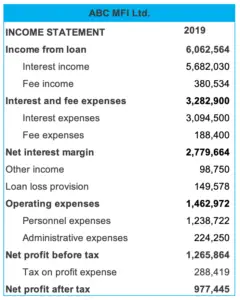

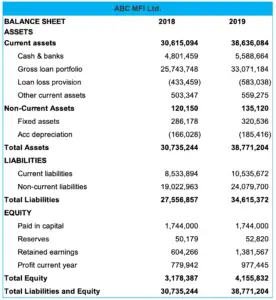

For example, we have the balance sheet and income statement of ABC MFI Ltd. which is the microfinance institution below:

Calculate portfolio yield as of 2019

Solution:

With the financial information in the example above, we can calculate portfolio yield as below:

Interest and fee income from loan = USD 6,062,564

Average gross loan portfolio = (33,071,184 + 25,743,748) / 2 = USD 29,407,466

Portfolio yield = 6,062,564 / 29,407,466 = 20.62%

Note:

The portfolio yield of 20.62% above is the result of calculation when we include all interest and fee income that the company earned during the year which contains both cash received and the amount accrued.

However, sometimes portfolio yield may be calculated as a cash measure instead. In that case, interest and fee income from loans will only include the cash received. So, the amount of USD 6,062,564 above will need to be adjusted by removing the accrued amount.