Calculate sum of the years’ digits depreciation

Overview

Sum of the years’ digits depreciation is the type of depreciation method that allocates the higher cost of the fixed assets in the early year and reduces the depreciation expense in later years as time passes. The company can calculate sum of the years’ digits depreciation after determining the expected useful life of the fixed asset and the depreciable cost to use as a basis of calculation.

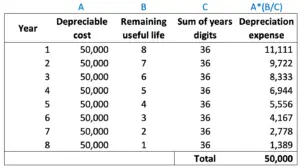

Sum of the years’ digits depreciation uses the assumption that the benefits that the company receives from the fixed asset will go down through the passage of time. It is similar to the declining balance depreciation in which the depreciation expense in the sum of the years’ digits method will go down as time passes making the last depreciation expense the smallest.

However, the depreciation expense in the sum of the years’ digits goes down in the linear line instead of the curve line like those in the declining balance method. After all, the calculation formula of the sum of the years’ digits depreciation is different from that of the declining balance depreciation.

Calculate sum of the years’ digits depreciation

The company can calculate sum of the years’ digits depreciation with the formula of using the remaining useful life of fixed asset to divide by the sum of years’ digits and then multiply the result by the depreciable cost of the fixed asset.

Sum of years’ digits depreciation formula:

The remaining useful life of the fixed asset is determined separately in each year of depreciation in the sum of years’ digits depreciation methods. For example, if the fixed asset has 5 years of useful life, the remaining useful life on the first-year calculation of depreciation is 5 while the last year or fifth year will be 1.

Depreciable cost in sum of years digits depreciation can be calculated with the formula of fixed asset cost deducting its salvage value.

On the other hand, the sum of years’ digits can be determined by totaling the digits in every year of the fixed asset’s useful life. For example, if the fixed asset has 5 years of useful life, the sum of years’ digits can be determined to be 15 (5 + 4 + 3 + 2 + 1).

Sum of years digits depreciation example

For example, on January 1, the company ABC buys a machine that cost $52,000 in order to use for the day-to-day operation. The machine is expected to have 8 years of useful life with a salvage value of $2,000. Due to the nature of the machine, the company ABC decides to use the sum of years’ digits depreciation method to allocate the cost of the machine over its useful life.

Calculate the sum of years’ digits depreciation for each year of the fixed asset above.

Solution:

With the information in the example, the company ABC can calculate the sum of years digits depreciation for the machine with the formula as below:

Sum of years digits depreciation = (Remaining useful life / Sum of years’ digits) x Depreciable cost

Sum of years’ digits = 8 + 7 + 6 + 5 + 4 + 3 + 2 +1 = 36

Depreciable cost = $52,000 – $2,000 = $50,000

In this case, we can calculate depreciation expense each year using the sum of years’ digits depreciation method as below:

Year 1:

Year 1 depreciation expense = (8 / 36) x 50,000= $11,111

Year 2:

Year 2 depreciation expense = (7 / 36) x 50,000 = $9,722

Year 3:

Year 3 depreciation expense = (6 / 36) x 50,000= $8,333

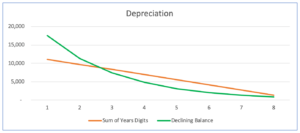

And the depreciation expense for the rest of the years using sum of years depreciation method are in the table below:

Fixed assets suitable for sum of years digits depreciation

Depreciation is the process of the allocation of fixed assets cost over their useful life. However, the company needs to properly allocate the cost so that the depreciation expense charged to the income statement matches the benefits that the company receives from the fixed assets. This is so that the recognition of the depreciation expense in the company’s account is properly in compliance with the matching principle of accounting.

As mentioned, using the sum of years digits depreciation of the fixed assets will make the depreciation expense that the company charged to the income statement higher in the early year, and such expense will go down as time passes. In this case, the company should use the sum of years digits depreciation method on the fixed assets that can produce higher productivity in the early year and such productivity will gradually drop down as time passes.

On the other hand, the fixed asset that provides stable benefits from year to year during its useful life, e.g. building, is not suitable for the sum of years digits depreciation. Instead, the straight-line depreciation method is more suitable if that is the case.

All in all, deciding whether to use the sum of the years’ digits depreciation or another depreciation method on a specific fixed asset will require appropriate judgment and careful analysis of the nature of the asset and how it is used in the business operation. After all, the company should try to match the expense coming from the depreciation of the fixed asset with the benefits that it provides to the company.