Calculate Bad Debt Expense

Overview

Bad debt expense is the loss that incurs from the uncollectible accounts, in which the company made the sale on credit but the customers didn’t pay the overdue debt. The company usually calculate bad debt expense by using the allowance method.

This is due to calculating bad expense using the direct write off method is not allowed in reporting purposes if the company has significant credit sales or big receivable balances.

However, if the company doesn’t focus on credit sales and only made a few credit sales during the year with only a small balance of receivables, they may use the direct write off method in calculation of bad debt expense.

Calculate bad debt expense allowance method

Under the allowance method, the company needs to estimate the losses from bad debt at the end of the period. In this case, there are two bases that the company may use to calculate bad debt including:

- Percentage of sales

- Percentage of receivables

Whether the company uses the percentage of sales or percentage of receivables, the estimation is usually based on past experience and the current economic condition as well as the credit policy that the company has in place. For example, the expected losses from bad debt are normally higher in the recession period than those during periods of good economic growth.

Percentage of sales

The percentage of sales method is an income statement approach, in which bad debt expense shows a direct relationship in percentage to the sales revenue that the company made. Likewise, the calculation of bad debt expense this way gives a better result of matching expenses with sales revenue.

Under the percentage of sales basis, the company calculates bad debt expense by estimating how much sales revenue during the year will be uncollectible.

For example, the company ABC Ltd. had $95,000 credit sales during the year. Based on past experience and its credit policy, the company estimate that 2% of credit sales which is $1,900 will be uncollectible.

In this case, the company can calculate the bad debt expense as below:

Bad debt expense =$95,000 x 2% = $1,900

And the adjusting entry of bad debt expense at the end of the year will be as below:

| Account | Debit | Credit |

|---|---|---|

| Bad debt expense | 1,900 | |

| Allowance for doubtful accounts | 1,900 |

It is useful to note that when the company uses the percentage of sales to calculate bad debt expense, the adjusting entry will disregard the existing balance of allowance for doubtful accounts.

Also, the company may use either net sales or credit sales during the year to calculate the bad debt expense. (*net sales = total sales including both cash sales and credit sales – sales discounts – sales returns and allowances)

Either net sales or credit sales method is acceptable in the calculation of bad debt expense. However, if the credit sales fluctuate a lot from one period to another, using the net sales method to calculate bad debt expense may not be as accurate as using credit sales.

Percentage of receivables

The percentage of receivables method is a balance sheet approach, in which the company estimate how much percentage of receivables will be bad debt and uncollectible. In this case, the company usually use the aging schedule of accounts receivable to calculate bad debt expense.

Aging schedule of accounts receivable is the detail of receivables in which the company arranges accounts by age, e.g. from 0 day past due to over 90 days past due. In this case, the company can calculate bad debt expenses by applying percentages to the totals in each category based on the past experience and current economic condition.

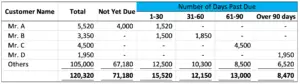

For example, the company ABC Ltd. had accounts receivable balance of $120,320 as at the end of the year and the aging schedule of accounts receivable as below:

Based on past experience and current economic condition, ABC Ltd. set the credit policy to estimate losses from bad debt as the total of:

- 1% of receivables that are not due yet

- 3% of receivables that are 1 to 30 days past due

- 10% of receivables that are 31 to 60 days past due

- 20% of receivables that are 61 to 90 days past due

- 40% of receivables that are past due more than 90 days

The company had the existing credit balance of $6,300 as the previous allowance for doubtful accounts.

Calculate bad debt expense and make adjusting entries at the end of the year.

Solution:

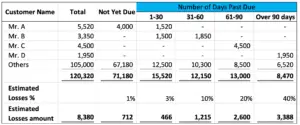

With the information in the example above, we can calculate bad debt expense as below:

As the company had the existing allowance for doubtful accounts of $6,300, the calculation of bad debt expense during the year and the adjusting entry is as below:

Bad debt expense = $8,380 – $6,300 = $2,080

The adjusting entry of bad debt expense at the end of the year will be as below:

| Account | Debit | Credit |

|---|---|---|

| Bad debt expense | 2,080 | |

| Allowance for doubtful accounts | 2,080 |

Usually, the longer a receivable is past due, the more likely that it will be uncollectible. That is why the estimated percentage of losses increases as the number of days past due increases.

Calculate bad debt expense direct write off method

Under the direct write-off method, the company calculates bad debt expense by determining a particular account to be uncollectible and directly write off such account. Unlike the allowance method, there is no estimation involved here as the company specifically choose which accounts receivable to write off and record bad debt expense immediately. Likewise, the company may record bad debt expense at any time during the period.

For example, the company XYZ Ltd. had few credit sales so far. One of the biggest credit sales is to Mr. Z with a balance of $550 that has been overdue since the previous year. The company decides to write off Mr. Z’s account as uncollectible.

In this case, the company can calculate bad debt expense to be $550 directly and make the journal entry as below:

| Account | Debit | Credit |

|---|---|---|

| Bad debt expense | 550 | |

| Accounts receivable – Mr. Z | 550 |

Though calculating bad debt expense this way looks fine, it does not conform with the matching principle of accounting. That is why unless bad debt expense is insignificant, the direct write-off method is not acceptable for financial reporting purposes.