Time Value of Money

Time value of money the difference between value of money today (present) and its value tomorrow (future). The money that we have now has more value than the same amount received in the future. The reason is we can use money now to invest make more in the future. Moreover, there is a risk that we may not receive money in the future.

The concept is that one dollar today has more value than one dollar in the future, the differences due to the interest which we can earn by lending or deposit. We can bring $ 1,000 to the bank and make a deposit, one year later, we can take back this amount plus some interest.

The value of money we have now is the Present Value, and the amount which is in the future is Future Value.

Future Value Formula

FV = PV [(1 + (i/n)]^nt

FV: Future Value

PV: Present Value

i: Annual interest rate

t: Number of years

n: Number of compounding periods per year

Example

Mr. A deposits $ 5,000 into a bank with an interest rate of 8% per year. Assume the interest of each year will be deposited into the bank with the same rate.

- FV at the end of 1st year = $ 5,000 + ($ 5,000 * 8%) = $ 5,400

- FV at the end of 2nd year = $ 5,000 + ($ 5,000 * 8%) + ($ 5,400 * 8%) = $ 5,832

Use formula

FV at the end of 1st year =$ 5,0000 (1+ 8%/1)1 = $ 5,400

FV at the end of 2nd year = $ 5,000 (1+ 8%/1 )2 = $ 5,832

Calculate the Future Value at the end of 2nd year again by assuming the interest is quarterly compounding, monthly compounding, and daily compounding.

- Quarterly compounding

FV = $ 5,000 (1 + 8%/4)4 = $5,412

- Monthly compounding

FV = $5,000 (1+ 8%/12)12 = $ 5,415

- Daily compounding

FV = $5,000 (1+ 8%/365 )365 = $5,416

Future Value Calculator

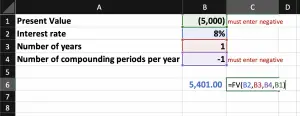

Future Value in Excel

We can use Excel to help us in calculating the future value by using the formula below:

Click here to download future value table in Excel

Click here to download future value table in PDF

| Reason of time value of money | |

|---|---|

| Uncertain future | The longer the time, the higher of risk. |

| Inflation | Inflation will decrease the value of money over time. So it will be good to have money now rather than in the future. |

| Interest | The money will be able to generate more cash by years keep it in the bank. |

How Interest Rates Affect the Time Value of Money

As we know, the interest rate is one of the reasons which cause time value of money and it plays an important rule. Base on the formula, we will get the different future value of money if interest increases or decrease.

In simple words, when interest rates increase, our money will generate more if we put it in the bank. The higher interest rate, the quicker our money growth. For example, if we deposit $ 100 in the bank with an interest of 5% per annum, we will get $5 per year. If the interest increase to 10%, we will get $ 10. On the other hand, it also impacts the present value when we reverse the calculation.

Time Value of Money and Opportunity Cost

From the business point of view, when the company considering any new investment, they will consider the time value of money and opportunity cost.

The time value of money is the income which we receive if we just keep it in the bank without doing anything. So the investment should generate more than that, or it increases the other economic value rather than profit.

On the other hand, the opportunity cost is the option (benefit) which we give up to make another option. Deposit money in the bank is an option. However, we have many more options such as buying stock, real estate or implement many other projects.

Therefore, these are the two factors that company usually pays close attention to when selecting the investment project.

Important of Time Value of Money

The concept of time value of money is important to financial decision making because it differentiates the future and present value of the dollar amount. The sooner we can receive money, the sooner we can invest and generate even more money.

Moreover, in business operations, cash flow is very important for us. We prefer to have $ 10,000 now rather than $ 11,000 in one year as we need this money to pay our bill. Otherwise, our company will out of business and cannot wait for the $ 11,000.

Furthermore, the future is uncertain, it is better to have money now rather than the future. The longer it is, the more uncertainty it is, as we do not know what will happen in next day, next month, or even next year.