Weighted Average Inventory Method

Definition

Weighted average inventory is the costing method that allocated equal cost to all inventory. It is the method that determines the amount of Cost of goods sold on income statement and remains inventory in the balance sheet. At the end of the month, some inventory may remain in the store, and some are sold to the customers. We can the quantity of inventory from physical count or system generated. The quantity of inventory is the same, but its valuation may be different if we apply different methods.

Weighted average allocate the same cost to all product, it happens when the items are hard to assign a specific cost. Most of the products are quite similar or the same, so it is not necessary to separate the costs of each inventory type. We simply apply the same cost to all of them.

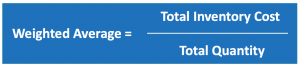

The weighted average cost per unit depends on the total cost and the total number of units. This method can be applied to both manufacturing and trading company.

Formula

Weighted Average Inventory Example

For example, ABC is a retail company that purchases cloth from oversea and sell to the local customer. During the month, ABC has the following transaction:

- 01 Jan 202X, purchase 1,000 units @ $ 12

- 15 Jan 202X, purchase 1,500 units @ $ 15

- At the end of Jan, 2,000 units of clothes are sold, and 500 units remain in the store

By using a weighted average, please calculate inventory cost, total inventory in Balance Sheet, and Cost of Goods Sold.

Solution

Total cost of inventory = (1,000 x $ 12) + (1,500 x $ 15) = $ 34,500

Total inventory quantity = 1,000 units + 1,500 units = 2,500 units

Weighted average cost = $ 34,500 / 2,500 units = $ 13.8 per units

Cost of Goods Sold = 2,000 units x $ 13.8 = $ 27,600

Inventory balance at end of Jan 202X = 500 units x $ 13.8 = $ 6,900

Periodic Weighted Average Inventory

The periodic inventory system will calculate the average cost once per month. This cost will apply to all inventory sold and remaining balance. It is much more easy and simple. The example above reflect with periodic weighted average inventory because we calculate the cost per unit only one time ($ 13.8) and use it to determine COGS for the whole month.

Perpetual Weighted Average Inventory

Perpetual inventory system, the average cost will be calculated every time the average cost change due to the new purchase. When the company purchases a new inventory with a cost higher or lower than the average price, the accountant will calculate the new average cost.

Perpetual Weighted Average Inventory Example

Continue from above example, assume that the 2,000 units sold separately into :

- From 02-14 Jan 202X sold 800 units

- From 16-31 Jan 202X sold 1,200 units

Please calculated average cost, COGS, and Inventory balance by using a perpetual system.

Solution

- First weighted average = $ 12 per unit

- Second weighted average = (200 x 12 ) + (1,500 x 15) / (1,500 + 200) = $ 14.64 per unit.

This is the average when we purchase new products at different prices.

| Date | Transaction | Qty (unit) | Cost ($) | Total Cost ($) |

|---|---|---|---|---|

| 01 Jan 202X | Purchase | 1,000 | 12 | 12,000 |

| Average | 12 | |||

| 02-14 Jan 202X | Sale | (800) | 12 | 9,600 |

| 15 Jan 202X | Purchase | 1,500 | 15 | 22,500 |

| Average | 14.64 | |||

| 16-31 Jan 202X | Sale | (1,200) | 14.64 | 17,568 |

| 31 Jan 202X | Remaining | 500 | 14.64 | 7,320 |

Cost of goods sold = (800 x 12) + (1,200 x 14.64) = $ 27,168

Inventory = 500 x 14.64 = 7,320

By using perpetual weighted average, we got two different weighted average cost per unit, as the system require to recalculate every time the cost per unit change.

To understand more about periodic and perpetual inventory system, please read article in the link.