Statement of Cash Flows

What is Statement of Cash Flows?

Statement of cash flows is one of the four financial statements which shows the cash movement, cash inflow and cash outflow of the business, and the overall change of cash balance of the company during the accounting period which could be monthly, quarterly, or annually. The main purpose of the statement of cash flows is to provide financial information to the users regarding the cash receipts and cash payments of the company.

Statement of cash flows provides important information for users to assess the company’s ability to generate cash and cash equivalents. The users usually use historical cash flow information as the indicator to estimate the amount, timing and certainty of future cash flows.

3 Main Components in Statement of Cash Flows

Statement of cash flows break down into three main components, including cash flows from operating activities, cash flows from investing activities and cash flows from financing activities.

| 3 Main components in statement of cash Flows | |

|---|---|

| Cash flows from operating activities | Cash flows from operating activities are the cash flows received or used in operating activities of the business.

They include cash receipts from sales of goods or services, cash paid to suppliers for the purchase of goods or service, cash paid to employees, cash paid to lenders for interest, and cash paid to the government for taxes, etc. |

| Cash flows from investing activities | Cash flows from investing activities are the cash flows that involve in investing or buying or selling long-term assets such as cash receipts from sales of fixed assets and cash paid for the purchase of fixed assets.

Cash paid to disburse loans or buy equity securities such as shares or bonds from other companies and cash received from collecting principal on loans or selling equity securities of other companies is also included in this category. |

| Cash flows from financing activities | Cash flows from financing activities are the cash flows that involve in raising the fund or capital of the company.

Cash received from issuing of loans or bonds, cash received from selling your company’s shares, cash paid to shareholders as a dividend, cash paid to redeem loans or bonds, and cash paid to reacquire shares capital are all included in this category. |

Direct vs. Indirect Cash Flows

The company may produce the statement of cash flows either by using the direct method or indirect method. The difference between direct and indirect method is the way used in calculating and presenting the cash flows from operating activities.

The cash flows from operating activities under direct method lists all main operating cash flows during the accounting period, such as cash receipts from sales of goods or services and cash payments to suppliers and employees. The direct method provides financial information which is useful in estimating future cash flows. This is the big benefit that the direct cash flows method has over the indirect cash flows method.

The cash flows from operating activities under the indirect method start with net income and then make the adjustment by adding or deducting the items that do not affect cash to determine the net cash provided by operating activities.

The adjustments include:

- Non-cash transactions charged to income statement such as depreciation, provisions, deferred taxes, and unrealized foreign exchange gains and losses, etc.

- Change in specific current assets and current liabilities such as inventory, account receivables, account payables, etc.

Inventory

- Inventory increase means that the company buys more inventory which is the cash outflow, so we need to deduct.

- Inventory decrease means that the company has made sales that generate cash inflow, so we need to make the adjustment to add back.

Accounts receivable

- Accounts receivable increase means that our cash inflow is less than our sale, so we need to deduct.

- Accounts receivable decrease means that our cash inflow is more than our sale, so we need to add back.

Accounts payable

- Accounts payable increase means that our cash outflow is less than our expense amount, so we need to add back.

- Accounts payable decrease means that our cash outflow is more than our expense amount, so we need to deduct.

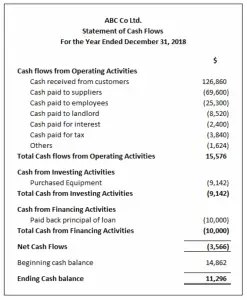

Example of Direct Cash Flows:

Example of Indirect Cash Flows: