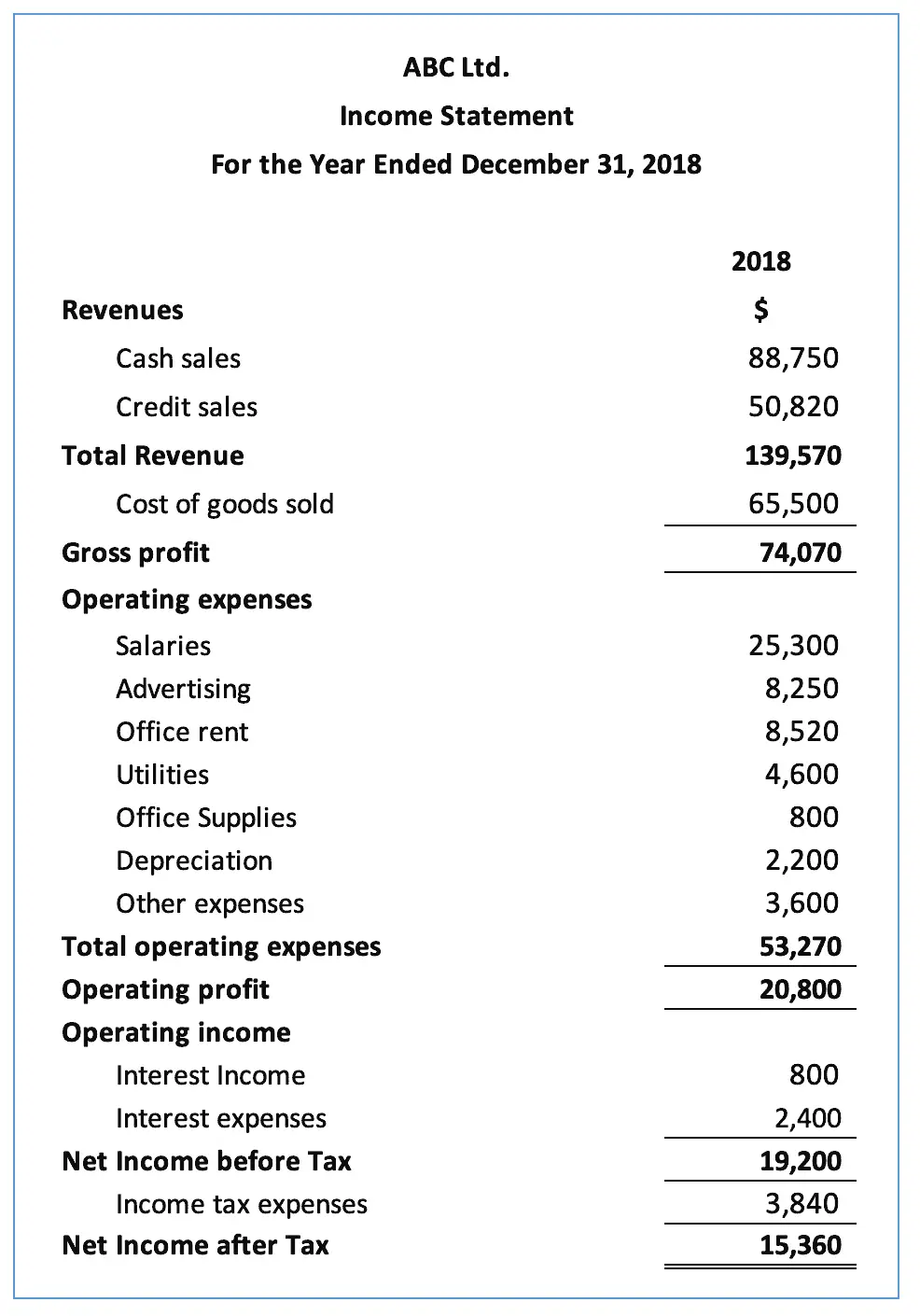

Income Statement

Introduction

Income statement, profit and loss statement, or statement of financial performance, is one of the four financial statements which shows the company’s financial performance over a period of time. It is prepared by following the applicable accounting standards such as US GAAP, IFRS, or Local GAAP. It is usually prepared at the end of the accounting period, which could be monthly, quarterly, or annually.

The income statement provides financial information to the users, such as shareholders, investors, lenders, and suppliers, on how the company is doing during the accounting period. In this case, the users can use the income statement, together with other financial statements, such as balance sheet and statement of cash flows, to make a business decision involving the company.

For example, shareholders may only decide whether to invest more funds into the company or withdraw their investment back from the company after looking at financial statements and other ratios, such as return on equity, return on assets and return on investment.

The income statement summarizes all revenues and expenses in the business transactions during the accounting period by following the general form of “Revenues minus Expenses equals Net Income” which are the three main elements of the income statement.

3 Elements of Income Statement

The three main elements of income statement include revenues, expenses, and net income.

Revenues

Revenues are the incomes that the company generates from the sale of goods or services or other activities related to the main operation of the company’s business. For a trading company like ABC Co. above, the revenues are the total sales that it makes during the accounting period. In general, revenue stays at the top in the income statement which is why sometimes revenue is referred to as a top-line item.

Revenues are the first element of income statement which always stays on top. In the accrual basis of accounting, revenues are recognized when goods are delivered or services are provided regardless of when the company will receive the payment.

Expenses

Expenses are the money or cost the company spends in the business to generate revenues. Expenses are the second element of income statement which consists of two main categories which are the cost of goods sold and operating expenses.

Cost of Goods Sold

Cost of goods sold is the cost that occurs directly related to the sale that the company makes, which is usually referred to as direct cost. It is the expense element of income statement that ties directly with sale revenue.

Cost of goods sold is the cost that occurs directly related to the sale that the company makes, which is usually referred to as direct cost. It is the expense element of income statement that ties directly with sale revenue.

For a trading company like ABC Co above, it is the cost that the company spent on the purchase it makes on the materials or goods for resale. For a manufacturing company, it may include the cost of material, labor, manufacturing overhead, and depreciation expenses associated with the production.

For the service companies, such as accounting and law firms, the income statement usually does not have the cost of goods sold on it. This is due to they do not have or have only a small amount which is usually not directly related to the main services they provide in their operations.

Operating Expenses

Operating expenses are expenses other than the cost of goods sold that the company spends in the operation of the business, including salaries, advertising, rental, utilities, office supplies, and depreciation expenses. Operating expenses are the expense element that can be classified into selling expenses and administration expenses.

Operating expenses are expenses other than the cost of goods sold that the company spends in the operation of the business, including salaries, advertising, rental, utilities, office supplies, and depreciation expenses. Operating expenses are the expense element that can be classified into selling expenses and administration expenses.

Selling expenses are the expenses that may occur directly or indirectly related to the sale of goods, including salespeople’s salaries, advertising expenses, commissions, warehouse cost, and shipping cost. They are usually the expenses that occur for taking orders and fulfilling them.

Administration expenses are the operating expenses that are not directly related to the sale that the company makes, including non-sales staff’s salaries, rent, utilities, office supplies, and depreciation expenses.

Net Income

Net income or net profit is the profit that the company earns after deducting all the costs and expenses including the interest and tax expenses. Net income is the third main element of income statement which shows the net result of the company’s performance during the accounting period.

Net income is used for calculation in many ratios in order to evaluate the company’s performance, including net profit margin, return on assets, return on equity, and earnings per share (EPS).

Income Statement Example

Below is an example of an income statement: