Incremental Cash Flows (ICF)

Incremental cash flow is the additional cash inflow which the company generates from investing in any specific project. ICF shows the difference between company net cash flow if the project is accepted and net cash flow if the project is not accepted. It is a tool that helps management to decide whether to invest in a new project or not. The new project may make a profit in the future, however, if it cause a cash flow issue the management needs to reconsider and make a proper decision.

The positive incremental cash flow is a goods sign for the company to make a new investment, but it may not tell the whole story. Management needs to check with other information, as the ICF has many limitations which we can see in the next section. It should not be the only resource of information for the company to rely on while selecting a new investments. Even the negative ICF, it does not mean that we should abandon the investment immediately.

Formula

Incremental Cash Flows Example

ABC is considering investing in new machinery which costs $ 500,000. It has a useful life of 5 years with a scrap value of $ 50,000. Base on the projection, the company will be able to increase the sale of $ 1 million per year with 40% of variable cost.

What is the incremental cash flows of this project?

The cash inflow over the project is $ 5,000,000 ( $ 1,000,0000 * 5 years)

The cash outflow over the project is $ 2,000,000 (40% of the sale is variable cost)

ICF =$ 5,00,000 – $ 2,000,000 – $ 500,000 = $ 2,500,000

Difficulty in Preparing Incremental Cash flows

| Difficulty | |

|---|---|

| Sunk Cost | ICF only looks into the future and predicts the cash flow, which means that we have ignored the sunk cost which is already incurred. |

| Opportunity Cost | Moreover, this tool does not include the opportunity cost which results from investing in a new project. The company may use this cash for other tasks such as purchase a more fixed assets to increase production. |

| Cost allocation | Cost allocation will be a problem when more projects are created. We need to have proper accounting software as well as a strong team to work out on this task. |

| Cannibalization | It happens when the company invest in a new project which takes the revenue from their existing project. So in total, the whole business does not create any new sale or profit. They just separate the sale and profit from the existing project. |

| Base on prediction | The future cash flow is based on past data, management experience and the estimation, so they are highly likely to be incorrect. Even we can get it right, the result may change due to the external factors which we do not have control such as political, economic, technology and so on. |

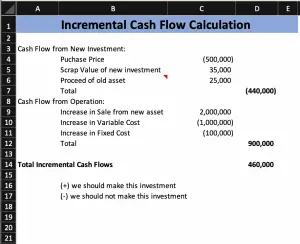

How to calculate incremental cash flow in Excel

In order to help with incremental cash flow calculation, we have built Excel template to analyze the cash inflow and cash outflow for new investment on new machinery.

We need to find the components below to fill in the template:

- Purchase price: the cost we spend on the new assets.

- Scrap Value: the estimated scrap value at the end of assets useful life

- Proceed from old assets: if we need to sell the old asset and replace it with the new one.

- Sale increase: the estimated sale increase raise from new assets, not the total sale.

- Variable Cost: The variable cost associate with sale increase only, not the total cost.

- Increase of fixed cost: if fixed cost change due to increase of operation. Ignore it if fixed cost remains the same.

Based on this information, we decide to accept the project only when the total incremental cash flow is positive.