Audit Cost of Goods Sold

Introduction

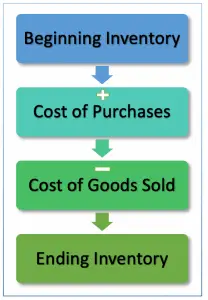

The cost of goods sold might be the biggest cost or expense for many companies since it is usually the main cost that directly links to the sale of goods.  As auditors, we usually audit cost of goods sold together with the audit of inventory. This is due to cost of goods sold is directly linked to inventory, in which the beginning inventory plus cost of purchases and minus cost of goods sold equal to the ending inventory.

As auditors, we usually audit cost of goods sold together with the audit of inventory. This is due to cost of goods sold is directly linked to inventory, in which the beginning inventory plus cost of purchases and minus cost of goods sold equal to the ending inventory.

Cost of goods sold may be categorized into the cost of production and selling of goods in the manufacturing company or the cost of purchase and re-sold in the trading company. Cost of goods sold is also known as the cost of sales.

Depend on the size and type of business that the client operates, we may need to perform the cost of goods sold audit by breaking down into different parts such as by product line, division or by other business segments. This will assist us in building our own expectations and provide better audit evidence for us in forming our audit opinion related to the cost of goods sold.

Audit Procedures for Cost of Goods Sold

Due to the cost of goods sold is directly linked to the inventory, including the inventory in and the inventory out, we usually perform the audit of cost of goods sold at the same time of the audit of inventory.

In the accounting and audit, cost of goods sold can be calculated by using the beginning inventory plus cost of purchases then minus ending inventory.

So when the ending inventory has been verified and the new purchases have been tested, the cost of goods sold can be directly calculated. This is why we usually audit cost of goods sold by performing the substantive analytical procedures.

With the formula of cost of goods sold above, we can build our expectations after we have the audited figures of ending inventory and new purchases as well as reliable beginning inventory which is usually the last period audited figure.

If there is any significant discrepancy between our expectations and the client’s cost of goods sold figures, we need to perform an investigation on the variance by probably performing further work on the inventory test.

Other procedures

We might also look at the trend of the cost of goods sold from month to month. This is to make sure that we do not miss or overlook the risky factor such as significant unexplainable fluctuation which could result from fraud or error.

Also, the cost of goods sold is usually in line with the sale of goods, so we should review the trend and ratio of the cost of goods sold compared with the sales from month to month. Any significant variation should be investigated further by inquiry of the client and inspecting the supporting documents as evidence of the explanation.

Summary

We may summarize the audit procedures and cost of goods sold as below:

| Audit | Procedures |

|---|---|

| Cost of Goods | Analytical procedures |

| = Beginning Inventory | Last period audited figures |

| + Cost of Purchases | Test of details on inventory addition |

| – Ending Inventory | Test of inventory (e.g. inventory count) |