Accounting for Goods in Transit

Goods in transit are the products or materials which already leaves the seller’s warehouse but not yet received by the buyer. Due to the time spend during shipping, these goods may spend a few weeks or months in the sea. Both buyer and seller need to set determine the specific point in which goods are delivered/received.

Goods in transit are not the problem for local sellers, as the time of delivery is short and mostly the seller will take full responsibility until the buyer receives the package. However, international trade is another story, the goods may spend weeks on the ship, so they have to know exactly who takes responsibility for the package.

The goods will belong to the seller until the risk and reward to the buyer. The buyer will respond when receiving goods, they have to record the inventory as risk and reward are transferred.

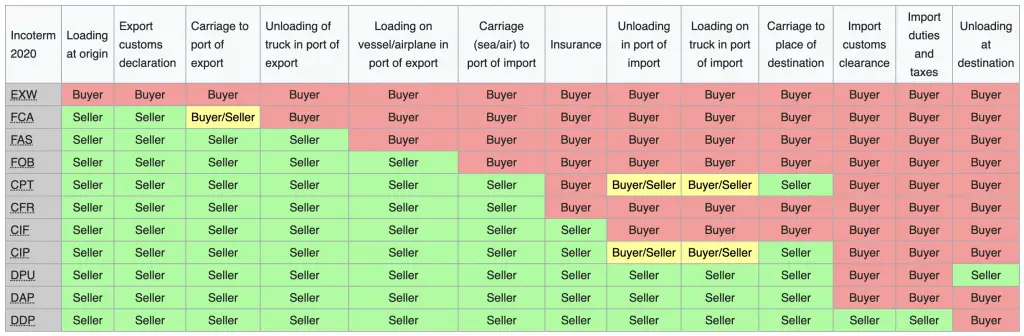

Therefore, the goods will be deducted from the seller’s balance sheet and record by the buyer when risk and reward are transferred. So when exactly the risk and reward move from seller to buyer. The International Chamber of Commerce (ICC) has published the international commercial term (Incoterms) which is intended primarily to clearly communicate the tasks, costs, and risks associated with the global or international transportation and delivery of goods. Incoterms will determine exactly the responsible party on each point during transit. It is focused on the shipmen.

Incoterms

These are the general term, both seller and buyer must include one them in their purchase agreement.

Goods in Transit Example

For example, company ABC purchases $ 10,000 of raw materials from oversea on 01 June 202X. They use FOB in the purchase agreement, which means that the seller will take all responsible up to the port (seller). On 05 June 202X, the package has left the seller’s port. Company ABC will record inventory in transit as soon as the material leaves the shipping dock. This inventory is classified as “inventory in transit” until they arrive in our warehouse. The seller also requires to record revenue and credit inventory on 05 June 202X.

Another example, on 03 June 202X, Company XYZ, purchase $ 20,000 material from oversea. The intercom term in the purchase agreement is FAS which the seller will take all risks until the package arrives at the buyer port. So the seller will record revenue and credit inventory on the day they arrive at the buyer port. The buyer will record the inventory at the same time.

Goods In Transit Valuation

After a long discussion, we know exactly when to record inventory, which depends on our contract with the seller. But another issue is the goods in transit valuation which we need to recognize in our balance sheet. We need to account for shipping, insurance, Freight in, transportation fees into the inventory valuation. The problem is should we accrue costs with inventory in transit or wait until they arrive.

It will depend on the agreement of the responsible person over each cost. If we (buyer) responsible for, we should estimate the cost make accrue expenses as part of the inventory in transit. We will make accrue when we have an obligation to the supplier, so all the costs will not record at the same time with goods in transit.

Treatment of Goods in Transit in Consolidated Balance Sheet

In the consolidated financial statement, we will combine the parent and subsidiary’s income statement and balance sheet. If there are the goods in transit during the reporting date, we must ensure that both party account correctly on those goods. The goods in transit still belong to the group (parent and subsidiary), so the balance must exist in the consolidated balance sheet. However, the goods must be not double count. It can happen when the parent does not record the sale of goods but subsidiary record inventory and accounts payable.