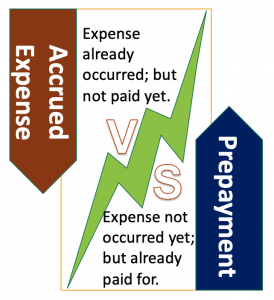

Accrued Expense and Prepayment

What is Accrued Expense?

An accrued expense or accrual is the expense that has already occurred to the company, but the company has not received supplier invoice for payment for yet.

An accrued expense or accrual is the expense that has already occurred to the company, but the company has not received supplier invoice for payment for yet.

In the accounting rule which follows the accrual concept, incomes and expenses should be recognized in the period they occur.

This means the company needs to recognize and record the expenses that have occurred in the period even though the company has not received the invoice on such expenses yet.

The transactions that need to be recorded in the case accrued expense are:

- Expense: it is the income statement item as the company need to recognize it since it already occurs in the period

- Accrued expense: it is recognized as a current liability in the balance sheet as the company has not paid for the expense that has occurred yet so it still owes someone.

The accounting record would be:

| Account | Debit | Credit |

|---|---|---|

| Expense | 000 | |

| Accrued expense | 000 |

Example

ABC Co. requires to pay interest of $600 to its bank on 02 January 2019 but the interest expense already occurred in December 2018.

So the company should recognize and record interest expense of $600 in December 2018.

The accounting entry on 31 December 2018 would be:

| Account | Debit | Credit |

|---|---|---|

| Interest expense | 600 | |

| Accrued interest payable | 600 |

On 02 January 2019 after the company paid interest to the bank, the accounting entry would be:

| Account | Debit | Credit |

|---|---|---|

| Accrued interest payable | 600 | |

| Cash | 600 |

It is also useful to note that some expenses such as electricity bill and water utility bill, at the end of the month, the company usually does not know the amount it requires to pay since it usually only receives the invoices in a few days after the end of the month. So how does record such expenses at the end of the month?

In such case, the company will usually make an estimate on the amount that should be recognized based on the prior periods. And sometimes the company just records the same amount as in the prior period/month if it is estimated that the different amount would be immaterial.

Example of Utility Expense:

On 31 December 2018 ABC Co. needs to record the electricity expense but the company has not received the invoice till a few days in the next month.

The electricity bill in November 2018 is amount to $250.

So the company records electricity expense amount of $250 in December 2018 as it estimates the difference between the two months would be immaterial.

| Account | Debit | Credit |

|---|---|---|

| Electricity expense | 250 | |

| Accrued expense | 250 |

What is Prepayment?

Prepayment (prepaid expense) is the amount the company paid on certain expenses that have not occurred yet. It is the payment in advance.

In the accounting rule which follows the accrual concept, incomes and expenses should be recognized in the period they occur.

This means the company should not recognize the expense that has not occurred yet even though the company has paid for it in advance.

The transactions that need to be recorded in the case of prepayment are:

- Prepayment: it is recognized as a current asset in the balance sheet which will be settled with the expense in the future period.

- Cash

The accounting record would be:

| Account | Debit | Credit |

|---|---|---|

| Prepayment | 000 | |

| Cash | 000 |

Example

On 31 December 2018, ABC Co. paid $3,000 to its landlord in advance for office rent in January 2019.

The accounting entry on 31 December 2018 would be:

| Account | Debit | Credit |

|---|---|---|

| Prepayment | 3,000 | |

| Cash | 3,000 |

At the end of January 2019, the prepayment would be settled with the expense:

| Account | Debit | Credit |

|---|---|---|

| Office rental expense | 3,000 | |

| Prepayment | 3,000 |

It might be easy to remember that the accrued expense and prepayment are shown on the balance sheet as in the reverse position as the accrued expense is the current liability and prepayment is the current asset.