Calculate Variable Overhead Spending Variance

Overview

Variable overhead spending variance is the difference between the standard variable overhead rate and the actual variable overhead rate applying to the actual hours worked during the period. Likewise, the company can calculate variable overhead spending variance for the period with the formula of the actual hours worked during the period multiplying the difference between the standard variable overhead rate and the actual variable overhead rate.

The variable overhead spending variance emphasizes mainly the variable overhead rate by comparing the actual and the standard rate. Likewise, the variance can either be favorable or unfavorable depending on whether the actual overhead rate is higher or lower than the standard variable overhead rate that is usually predetermined in the budget plan before the production starts.

If the standard variable overhead rate is higher than the actual variable overhead rate, the result is favorable variable overhead spending variance. On the other hand, if the actual variable overhead rate is higher, the variance is unfavorable. This means that the actual variable overhead cost during the period is higher than the overhead cost that is applied to the actual hours worked using the standard variable overhead rate.

Calculate variable overhead spending variance

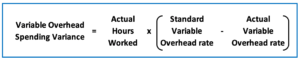

The company can calculate the variable overhead spending variance with the formula of actual hours worked in the production during the period multiplying with the difference between the standard variable overhead rate and the actual variable overhead rate.

Variable overhead spending variance formula:

Applying this formula of variable overhead spending variance in the calculation, the favorable or unfavorable variance can be simply determined by whether the result of the calculation is positive or negative. If the result is positive, the variance is favorable; otherwise, the variance is unfavorable.

Actual hours worked are the hours that have actually been used for the units produced or the production during the period. The actual hours can be labor hours or machine hours depending on how much manual or automated work is required in the production process.

Meanwhile, the actual variable overhead rate can be determined by dividing the actual variable overhead cost by the actual hours worked.

On the other hand, the standard variable overhead rate can be determined with the budgeted variable overhead cost dividing by the level of activity required for the particular level of production.

The level of activity can be in labor hours, machine hours, or units of production. In this case, the level of activity can either be labor hours or machine hours as it is paired in the formula that has the hours worked in it.

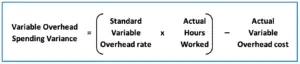

Alternatively, the variable overhead spending variable formula can also be written as the standard variable overhead rate multiplying with actual hours worked and then using the result to deduct the actual variable overhead cost.

Variable overhead spending variance formula (2):

This formula has the same end result as the above formula. However, with this formula, we don’t have to calculate the actual variable overhead rate if the actual cost in this area is given.

The favorable or unfavorable variance will also be determined based on whether the result is positive or negative the same as the above formula. If it is positive, it is favorable; otherwise, it is unfavorable.

Variable overhead spending variance example

For example, the company ABC, which is a manufacturing company, incurs $11,000 of variable overhead costs with 480 direct labor hours of works during September. The company ABC has the standard variable overhead rate of $20 per direct labor hour.

Requirement:

Calculate variable overhead spending variance in September.

Solution:

With the information in the example, the company ABC can calculate the variable overhead spending variance in September with the formula below:

Variable overhead spending variance = (Standard variable overhead rate x Actual hours worked) – Actual variable overhead cost

Variable overhead spending variance = ($20 per hour x 480 hours) – $11,000 = $1,400 (U)

In this case, the company ABC has a $1,400 unfavorable variable overhead spending variance in September. This is due to the standard variable overhead rate is $20 per hour while the actual variable overhead rate is $22.917 per hour ($11,000 / 480 hours).

This $2.917 per hour ($22.917 per hour – $20 per hour) higher actual rate results in the company ABC actually spends $1,400 more than budgeted for the variable overhead.

Alternatively, we can calculate the variable overhead spending variance with the first formula as below:

Variable overhead spending variance = actual hours worked x (standard variable overhead rate – actual variable overhead rate)

Likewise, the actual variable overhead rate can be determined as below:

Actual variable overhead rate = $11,000 / 480 hours = $22.917 per hour

Variable overhead spending variance = 480 hours x ($20 per hour – $22.917 per hour) = $1,400 (U)

The $1,400 of unfavorable variable overhead spending variance can be used with the variable overhead efficiency variance to determine the total variable overhead variance. This is due to the total variable overhead variance equal the variable overhead spending variance plus the variable overhead efficiency variance.

It is useful to note that the variable overhead spending variance is also known as the variable overhead rate variance. This name properly makes it easier to understand that the concept of this variance is about the difference between the standard variable overhead rate and the actual variable overhead rate.