Predetermined Overhead Rate

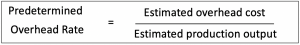

Predetermined overhead rate is the estimated overhead that will allocate to each product at the begining of accounting period. It is equal to the estimate overhead divided by the estimate production quantity.

The company needs to use predetermined overhead rate to calculate the cost of goods sold and inventory balance. Cost of goods sold equal to the sales quantity multiply by the total cost per unit which include the overhead cost. The overhead cost per unit is the predetermined overhead rate. We also use the same rate to calculate the inventory balance at the end of accounitng period. However, the variance between actual overhead and estimated will be reconciled and adjust to the financial statement.

Many accountants always ask about specific time which we need to do this, at what point in time is the predetermined overhead rate calculated. The predetermined rate usually be calculated at the beginning of the accounting period by relying on the management experience and prior year data.

Predetermined Overhead Rate Formula

Example

Company A calculates the predetermined rate for its coming year. The company uses labor hours as the basis for allocation. The production manager has told us that the manufacturing overhead will be $ 500,000 for the whole year and the company expected to spend 20,000 hours on direct labor. The management concern about how to find a predetermined overhead rate for costing.

Calculating predetermined overhead rate can be done as follow:

Predetermined overhead rate = $ 500,000 / 20,000 hours = $ 25 per direct labor

The product requires 2 hours of labor work so that it will require $50 of overhead ($25 * 2 hours). Based on this information the predetermined overhead rate is $ 25 per labor hour.

What are the Advantages of Predetermined Overhead Rate?

| Advantages of Predetermined overhead rate | |

|---|---|

| To set pricing | The predetermined overhead rate will help to calculate the total cost per unit. It helps us to set the proper selling price. The company will be able to build a sales strategy and compete with others. We can decide to reduce price to gain market share or increase price to maximize profit. |

| Basic for actual overhead | The predetermined rate will be the basis for future adjustment which support by the actual cost. |

| Reporting purpose | Not all inventory will be sold, some will remain in the warehouse, they need to have proper cost. The predetermined rate will ensure that all the inventory has a proper valuation. |

What are the Disadvantages of using Predetermined Overhead Rate?

| Disadvantages of predetermined overhead rate | |

|---|---|

| Not accurate | All figures are the estimates, so it may not reflect the actual overhead and impact on management decision making. |

| Variance | There will be variance between the predetermined rate and actual. If it is significant, it will have a huge impact on the financial statement. It will have a huge impact on inventory and cost of goods sold. |

| Rely on management estimation | This method relies on the management team who will try to make the financial statement look good. They will provide only positive information to ensure that the bottom line is high and make a good bonus. |