Closing Entry For Net Income

Overview

At the end of the period, the company will need to make the closing entry for net income by transferring all revenues and expenses to the income summary account. Likewise, all revenue accounts and all expenses accounts will be closed by transferring all revenues and expenses to the income summary account.

After that, the income summary account will be transferred further to the retained earnings account in the balance sheet. In this case, the income summary journal entry for the net income will be opposite from that of the net loss, in which one results in the increase of retained earnings while another results in the decrease of retained earnings.

Closing entry for net income

Closing entry for revenues

The company can make the closing entry for revenues by debiting all the revenues accounts and crediting the income summary account.

| Account | Debit | Credit |

|---|---|---|

| Revenues | 000 | |

| Income summary | 000 |

Closing entry for expenses

The company can make the closing entry for expenses by debiting the income summary account and crediting all expenses accounts.

| Account | Debit | Credit |

|---|---|---|

| Income summary | 000 | |

| Expenses | 000 |

The income summary account is a temporary account that the company uses at the end of the accounting period to transfer the resulting of net income or net loss to the retained earnings account.

Likewise, after transferring all revenues and expenses to the income summary account, the company can make the journal entry to close net income to retained earnings.

Closing the net income to retained earnings

If the company makes a profit during the year, it can make the closing entry for net income by debiting the income summary account and crediting the retained earnings account.

| Account | Debit | Credit |

|---|---|---|

| Income summary | 000 | |

| Retained earnings | 000 |

Closing the net loss to retained earnings

On the other hand, if the company makes a loss during the period, the closing entry will reverse from that of the net income with the debit of the retained earnings account and the credit of income summary account instead.

| Account | Debit | Credit |

|---|---|---|

| Retained earnings | 000 | |

| Income summary | 000 |

Closing entry for net income example

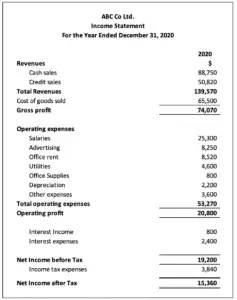

For example, on December 31, 2020, the company ABC has the income statement as below:

Prepare closing entry for the net income of the company ABC above.

Solution:

With the information of ABC’s income statement above, we can make the closing entries for revenues and expenses as below:

Closing entry for revenues

| Account | Debit | Credit |

|---|---|---|

| Cash sales | 88,750 | |

| Credit sales | 50,820 | |

| Interest Income | 800 | |

| Income summary | 140,370 |

Closing entry for expenses

| Account | Debit | Credit |

|---|---|---|

| Income summary | 125,010 | |

| Cost of goods sold | 65,500 | |

| Salaries | 25,300 | |

| Advertising | 8,250 | |

| Office rent | 8,520 | |

| Utilities | 4,600 | |

| Office Supplies | 800 | |

| Depreciation | 2,200 | |

| Other expenses | 3,600 | |

| Interest expenses | 2,400 | |

| Income tax expenses | 3,840 |

Closing entry for net income

With the journal entries above, the balance of income summary is $15,360 (140,370 – 125,010) which is on the credit side. In this case, the company ABC can make the closing entry for net income as below:

| Account | Debit | Credit |

|---|---|---|

| Income summary | 15,360 | |

| Retained earnings | 15,360 |

It is useful to note that with the current computerized systems, the closing entry for net income is no longer required as even the spreadsheet can automatically transfer the net income to retained without complication process through income summary account.