Cost of Common Stock

Cost of common stock is the required rate of return of the common stockholders. The investor expects to get a return over a specific time. The capital market allows investors to invest in different companies in form of equity or debt, so they will be seeking a good opportunity to maximize their return.

The company can raise new funds by issuing new common stock to the market or reinvesting the return from the prior year (retained earnings). Any change in common stock will have an impact on the return of investors. When we decide to invest in one company, we lose the investing opportunity in other companies that may be able to generate higher return.

Common stock is the most basic form of ownership in a corporation. It represents the shareholders (owners) of the corporation’s assets and earnings. Common stockholders are on the bottom of the priority ladder for claims on assets, meaning they will only receive payment after bondholders and preferred shareholders have been paid in full. However, common stockholders do have voting rights, which allow them to elect the board of directors and participate in other major decisions. While common stock does not offer the same level of protection as bonds or preferred shares, it does offer greater potential for growth. For this reason, common stock is often seen as a more risky but also more rewarding investment.

How to access cost of common stock?

When valuing common stock equity, there are two common models or techniques that can be used. The first is the constant-growth valuation model, also known as the Gordon Model. This model assumes that dividends will grow at a constant rate in perpetuity. In order to calculate the value using this model, we need to know the current dividend per share, the expected dividend growth rate, and the required rate of return. The Gordon Model is a relatively simple way to value common stock equity, but it has some limitations. For example, it does not account for variations in dividend growth or changes in the required rate of return.

The second common model for valuing common stock equity is the capital asset pricing model (CAPM). This model takes into account the risk of the investment and requires estimates of both the expected return and the risk-free rate. The CAPM is a more complex model than the Gordon Model, but it is generally considered to be more accurate. In addition, the CAPM can be used to estimate the cost of equity for publicly traded firms. However, like all valuation models, the CAPM has its limitations and should be used in conjunction with other information when making investment decisions.

There are three methods to access the cost of common stock:

1. Dividend Discount Model

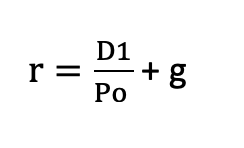

Dividend Discount Model uses the common stock dividend as the basis to evaluate the rate of return. The price of common stock can be determined by the present value of all future dividends.

The constant-growth model is a way to value a stock by assuming that the growth rate remains constant. This means that the present value of the stock equals the sum of all future investor dividends, paid out over an indefinite time period. While this model may seem oversimplified, it can provide a useful starting point for the valuation. After all, many stocks do tend to grow at a fairly steady rate, at least over the long term. And by discounting future cash flows back to the present, we can get a sense of what investors are really paying for today. In particular, it doesn’t account for changes in the growth rate over time. Nevertheless, it remains a valuable tool for valuing stocks and understanding how they are priced in the market.

Example

The share price of company ABC is $ 100 and manager expects to have a dividend of $ 5 at the end of the year. Based on the historical data, ABC has the dividends as follows:

| Year | Dividend |

|---|---|

| Y1 | 3 |

| Y2 | 3.5 |

| Y3 | 4.8 |

| Y4 | 5 |

| Y5 | 5.5 |

Please calculate the cost of common stock by using the dividend discount model.

First, we need to calculate the growth rate.

| Year | Dividend | Growth rate |

|---|---|---|

| Y1 | 3 | 16.67% |

| Y2 | 3.5 | 37.14% |

| Y3 | 4.8 | 4.17% |

| Y4 | 5 | 10.00% |

| Y5 | 5.5 | |

| Average rate | 17% |

r= (D1/Po) + g

D1= $5

Po= $ 100

g = 17%

r = (5/100)+17% = 22%

The cost of common stock is 22%.

2. CAPM (Capital Asset Pricing Model)

The Capital Asset Pricing Model (CAPM) is a tool used by financial analysts to evaluate the expected performance of an investment. The model takes into account both the risk and return of investment and provides a way to compare different investment opportunities. The CAPM relies on the concept of beta, which measures the volatility of an investment relative to the market as a whole. Investments with a higher beta are seen as riskier, but also have the potential for higher returns. The CAPM can be used to determine the expected return of an investment and is, therefore, an important tool for financial planning.

The capital asset pricing model is the relationship between the expected return and the risk attached. The expected return is equal to the return of risk-free assets plus the risk premium.

Risk premium is the additional return over the risk-free return which will compensate the investors for investing in a higher-risk asset.

Based on CAPM, the return is calculated by:

re = Rf + Bi(Rm – Rf )

- Rf : is the risk-free return rate

- Bi: is the stock’s beta coefficient

- Rf : is the risk premium

3. Bond Yield plus risk premium approach

We assume that the cost of debt is lower than the cost of equity of the same company because the risk of investment in debt is lower than equity.

Based on this concept, the return of common stock equal to the Bond Yield plus Risk Premium.

Er = Bond Yield + Risk Premium

Conclusion

The cost of common stock equity is the rate of return that a shareholder requires for investing in a company. This rate is used to discount the future cash flows from the equity investment, which presents the value of the equity today. There are two common methods to calculate this cost, the constant-growth model and the capital asset pricing model (CAPM). The main drawback of using CAPM is that it relies on estimations of beta, which might not be accurate. Additionally, this model doesn’t take into account flotation costs, which are an important element to consider. On the other hand, the constant growth valuation model does adjust for flotation costs and only requires information that is easily available. As a result, it is often seen as a more reliable method for calculating the cost of equity.