Opportunity Cost

Opportunity Cost is the benefit that we give up in order to get the alternative return. In management accounting, it refers to the profit from the investment project, which we give up to invest in the current project.

The opportunity cost is not always involved the monetary amount, it can be the time or other resources spend as we decide not to implement. It is hard to quantify the exact amount of opportunity cost as it is not happening; it just only the estimated amount.

The opportunity cost will never record in the financial statement, and it is the concept which helps to improve management decision only. Because of capital scarcity, every decision involves a cost that we have to give up.

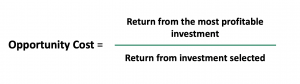

Opportunity Cost Formula

Some may refer to:

Some may refer to:

Opportunity Cost = What we give up / What we gain

Example of Opportunity Cost

We give up the time of enjoying with Youtube or Facebook and decide to read some articles on accountinguide.com. The time of watching Youtube which we give up is the opportunity cost.

Company A has made a new investment of $ 10 million on the production equipment in a new factory instead of investing in the stock market. The profit from the stock market is the opportunity cost, and it is the profit that Company A gives up in order to invest in new factory.

Mr. A decides to invest $ 10,000 in the stock market instead of putting it in a fixed deposit, which makes him 6% annually. After two years, he sells the stock and makes a $1,000 profit.

The opportunity cost will be: $ 1,200 / $1,000 = 1.2

Opportunity Cost in Production

There will the opportunity cost in the production process every time we allocate our resources to produce any specific product. For example, By producing product A, we need to give up a chance to make other products. It means we give up the potential profit from other products to receive profit from product A.

Explicit costs

Explicit cost is the cost which the company needs to pay to acquired the inputs or other expenses. If we decide to spend it on one material, we will lose a chance to spend on other materials, labor, or other expenses. It is the cost of losing opportunity to make a profit from a giving up the product.

Implicit costs

Implicit Cost is the cost that we lose due to the usage of our resources such as material, labor, and machinery. The company has the ability to produce many different products from their available resources, however, we decide to produce only one product. We give up the opportunity cost on the profit from the other products.

What Are the Important of the Opportunity Cost?

| Important of Opportunity Cost | |

|---|---|

| Efficient allocation of the available resource | The company will be able to allocate resources more efficiently when they have enough information regarding the option. The company will be able to compare all the option and select the best one. |

| For management decision | It will help the management to make a proper decision when we included all the options. They will make sure that the selected option will make a higher profit compare to the abandoned option (opportunity cost). If the selected project does not make a profit, they not only lose that money, but they also lost the opportunity to make money from the give up project. |

| Benchmark for target profit margin | The products’ profit margin may be different base on top management decisions. However, if we have all the information about all available products and the margin, it will be the sources for our benchmark. |

What are the Limitations of Opportunity Cost in production?

| Limitations of Opportunity Cost | |

|---|---|

| Difficult to calculate | The opportunity cost is very hard to calculate. We can only estimate the profit base on the budget. |

| Perfect competition | Opportunity cost exists when the concept of perfect competition which almost impossible in real life. |

| Alternative | Not all the production resource can use to make another products. So there is no appropriate way to know the opportunity cost. |

Law of Increasing Opportunity Cost

The Law of increasing opportunity cost is the concept that every time the decisions made over resource allocation will increase the opportunity cost. What does the law of increasing opportunity cost?

Opportunity cost is not a variable cost that will change depending on the unit production. For example, the company is producing product A & B equally. However, the company is planning to reduce product A and increase B production. For the first unit increase in product A, we need to reduce 2 units of product B. After the company keeps swapping the production, the last unit of product A requires the scarification of 10 units of product B. How does it happen?

If we look closely, this issue happens due to machine production and workers’ skill. Some core workers are very skillful with product B, but when we change them to work for product A, they lose all of their efficiency and become normal workers.

Secondly, the production equipment also different between these two products. It was almost impossible to customize them and keep the same production capacity.

The Opportunity Cost of Holding Money

If we have $ 10,000 and keep it in the locker in our room for ten years. What is the opportunity cost of holding it? There is no clear answer due to many different options which we can use the money, let discuss them one by one.

First, money loses its value due to the time value of money, at least they should keep in the bank and earn some interest around 3% – 8% per year.

Second, $ 10,000 now is much less than $ 10,000 in the last 10 years because of inflation. If inflation is 2% per year, we lost 20% of our money just by keeping money in the locker.

Finally, we lose the opportunity cost of investment this money. If we invest in a stock like Apple or Amazon, our money will increase more than 10 times over these periods. However, it is exceptionally subjective as we look back to the data, which is very easy. On the other hand, we may select some bad performing stock and end up losing money as well.

Opportunity Cost of Capital

The opportunity cost of capital is the return of investment which the company has forgone to use the fund in the internal project. Thus, the management must ensure that the internal project can generate a higher profit compared to the alternative investment such as stock, bond or real estate.

For example, the company is planning to expand its operation oversea by investing in a new production that expects to generate a 7% return. However, we can make around 10% per year from investing in the capital market. So the opportunity cost of capital is 3% (10% – 7%) if we decide to invest in new operations instead of the capital market.