Difference Between Notes Receivable and Accounts Receivable

Notes Receivable

Notes receivable is the promissory note which the company owns and expect to collect in the future base on term and condition. The promissory note gives the legal right to the holder to receive a specific amount in the future. The borrower has the obligation to pay otherwise they need to face with law.

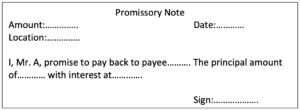

Promissory Note is the legal written document that states clearly the name of the payee, issuer, principal amount, interest, and date of payment. Both parties need to follow the term and conditions of this document. It will become legal evidence in the court if one party does not comply.

Note receivable is recorded separately from accounts receivable on the balance sheet. It is classified as current assets or noncurrent assets depend on the term on a promissory note. If the customer promise to pay within a year, it will be classified as current assets. On the other hand, it will be the noncurrent asset if the due date is more than a year from the balance sheet date.

Interest from note receivable will be recorded as interest income in the income statement.

Component of Note Receivable

- Principal: is the amount payee needs to pay to the issuer on the due date.

- Payee: is the party who owes the money to the issuer.

- Issuer: is the holder of note receivable, he/she has the right to receive payment on the due date.

- Interest Rate: is the rate that applies to the principle.

- Time frame: is the time which requires the payee to pay back to the issuer

Note Receivable Format

Accounts Receivable

Accounts receivable is the amount of sale which the company makes but not yet collect cash. It is the credit sale that company expects to collect money in the future. The company sells on credit to their customers and they not yet pay.

Accounts receivable is recorded as current assets in the balance sheet. It is expected to collect from clients within a year. The company usually allows customers to owe for one or two months which depends on their credit term. It is the business strategy which can increase sale and build a good relationship with customers. The customers have obligation to pay the accounts receivable on the due date.

Not all accounts receivables are going to be collected, some of them may be uncollected. Uncollected accounts receivable will become bad debt expenses which impact the income statement.

Accounts Receivable Journal Entries

Accounts receive is records when the company sale on credit. They record accounts recievable on the debit side while credit sale.

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable | 000 | |

| Sale | 000 |

When customers pay cash, the company credit accounts receivable and debit cash.

| Account | Debit | Credit |

|---|---|---|

| Cash | 000 | |

| Accounts Receivable | 000 |

Difference Between Notes Receivable and Accounts Receivable

| Notes Receivable | Accounts Receivable |

|---|---|

| Incur from the conversion from accounts receivable or extending of the credit line. It the amount that we expected to receive from the borrower in the future. | Incur from the sale of goods or services on credit. The amount that customers owe to company. |

| It can be classified as current or non-current assets depend on the term on the promissory note. | Classified as current assets as the company mostly allow the customer to owe within a year only. |

| It is strong evidence in court in case any party fails to comply. | It does not have any written agreement besides the commercial invoice. |

| Note receivable can be transferred to another party like the financial instrument. | It can’t transfer to other parties, but only sold at discount. |

| Include interest. | No interest include. |