Accounts Receivable

Definition

Accounts receivable (A/R) or receivables are the amounts customers owe to the company for the goods delivered or services provided. Likewise, the company makes the journal entry for accounts receivable to recognize the assets that it has a claim as well as to recognize the revenue that it has earned for the period.

Accounts receivable are recorded when the company sells its goods or services on credit to customers. In this case, the company expects to receive cash in the near future. Likewise, the accounts receivable are the current assets that are shown on the balance sheet for which the balances are due within one year.

Accounts Receivable Journal Entry

When the company sells the goods on credit, the company still records sales on the credit side the same as cash sales; but on the debit side, instead of cash, the company will record the accounts receivable instead.

Likewise, the company can make the accounts receivable journal entry by debiting the accounts receivable and crediting the sales revenue account.

| Account | Debit | Credit |

|---|---|---|

| Accounts receivable | 000 | |

| Sales revenue | 000 |

In this journal entry, total assets on the balance sheet as well as total revenues on the income statement increase by the same amount.

Settle accounts receivable

When the company receives cash for the credit sale on a later date, they will debit cash as it comes in and credit accounts receivable to settle the amount received in cash.

The journal entry would look like below:

| Account | Debit | Credit |

|---|---|---|

| Cash | 000 | |

| Accounts receivable | 000 |

This journal entry is made to eliminate (or reduce) the receivables that the company has previously recorded in its account.

Accounts receivable example:

For example, on July 10, the company ABC sells goods for $200 on credit to one of its customers. Later, on August 10, the customer pays the $200 to settle the account on the credit purchase.

What are the accounts receivable journal entries for the above transactions?

Solution:

On July 10

When the company ABC sells the goods on credit for $200 on July 10, it can make the accounts receivable journal entry by debiting the $200 into the accounts receivable and crediting the same amount into the sales revenue account.

| Account | Debit | Credit |

|---|---|---|

| Accounts receivable | 200 | |

| Sales revenue | 200 |

In this journal entry, both total assets on the balance sheet and total revenues on the income statement increase by $200 on July 10.

On August 10

Later, on August 10, when the company ABC receives the $200 payment from the customer for the previous credit sales, it can make the journal entry to eliminate the $200 of accounts receivable that it has previously recorded as below:

| Account | Debit | Credit |

|---|---|---|

| Cash | 200 | |

| Accounts receivable | 200 |

In this journal entry, there is no impact on the total assets of the balance sheet as it increases one asset (cash) and at the same time, decreases another asset (accounts receivable) by $200.

Accounts Receivable Aging

Accounts receivable aging or A/R aging is the report used by the company to manage and control the receivables. The company usually it to alert the accounts receivable managing team on long-overdue customers in order to take appropriate action, such as calling or visiting customers to collect cash.

A/R Aging Report shows all the receivables classified by the day overdue which details all customers that still owe the company.

Example of accounts receivable aging:

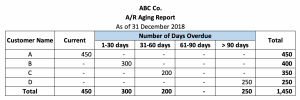

For example, the company ABC has accounts receivable from 4 customers in which 3 of the customers has overdue their payment for some days already.

The A/R Aging Report of the company ABC looks like below:

*“Current” column means the balance is still within the credit term.

**“1-30 days” column means the balance is overdue from 1 to 30 days.

Accounts receivable aging report template:

The accounts receivable aging report template in the excel file of the picture above is in the link here: Accounts receivable aging report excel

Allowance for Doubtful Accounts

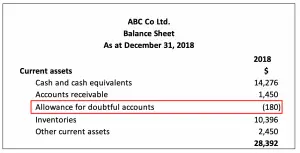

Accounts receivable are the amount the company expects to receive in the future, but sometimes not all balances are collectible. Hence, the company might need to estimate the uncollectable amount which is called “allowance for doubtful accounts”.

Allowance for doubtful accounts is used for making provisions on the receivables. As a result, the amount of receivables is reduced by the provisioning amount. Allowance for doubtful accounts is a contra account on receivables balance and shown in the balance sheet as a negative current asset.

The allowance for doubtful accounts will help to reflect the actual value on the accounts receivable that the company have (accounts receivable – allowance for doubtful accounts). After all, the receivables that the customer is not going to pay have no value as they are the assets that have no economic benefits inflow to the company.

Calculate Allowance for Doubtful Accounts

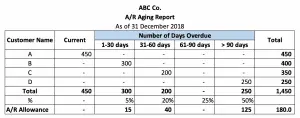

A/R Aging report is very useful in making allowance for doubtful accounts. Usually the longer the overdue the more likely that the customers are not going to pay back the money. Hence, A/R Aging report can be used to make allowance for doubtful accounts by allocating the percentage on the number of days overdue in which the longer the overdue the bigger the percentage allocated.

For example, on 31 December 2018, the company ABC uses the A/R Aging report to make allowance on accounts receivable by allocating the percentage as below

*The percentage of each column (5%, 20%, 25%, 50%) varies from company to company based on the business industry and their own experiences.

The journal entry of A/R Allowance here would be:

| Account | Debit | Credit |

|---|---|---|

| Bad Debt Expense | 180 | |

| Allowance for Doubtful Accounts | 180 |

Why sell on credit?

Many companies provide credit programs to their regular customers to encourage them to buy more and to create a close relationship with their customers by allowing them to purchase goods without needing to have money at the moment. This way their customers will be happy as they can receive goods without the need to pay the money today.

The credit term usually ranges from 30 days to 90 days for customers to pay the amount owed on the credit purchase.