Efficiency Ratios

What is Efficiency Ratio?

Efficiency ratios, also known as activity ratios, are the ratio that is used to measure the company’s ability to utilize its assets to generate income in an efficient manner. They show how well the company manages its assets in order to convert into cash or sales.

Efficiency ratios are usually used in comparing to the prior period or industry average in order to evaluate how efficiently the company performs to manage its assets in order to generate revenues.

The commonly seen efficiency ratios include accounts receivable days, accounts payable days, and inventory days.

Accounts Receivable Days

Accounts receivable days or receivables collection period is the ratio that looks at the average amount of time it takes for the company to collect the debts from its customers. Likewise, accounts receivable days ratio is used as an indication of how well the company performs in the receivables or debts collection process.

Most companies give credit terms to its customer in order to increase their sales; however providing credit to customers, the company also bear some costs, such as the opportunity cost that the cash is tied up in financing receivables and the cost carrying with the risk that customers may not pay back their debts. Therefore, the company usually wants to collect its receivables or debts as soon as possible.

As a result, the shorter accounts receivable days are the better it is for the company as it will aid the company’s cash flow. However, if the company puts too much pressure on its customers to pay back the debts quickly, it can damage the company’s ability to generate sales.

Accounts receivable days are usually used in comparing with the prior period or industry average in order to evaluate the performance of the company’s credit control and the effectiveness of the discount provided in credit terms in order to collect cash quickly.

Accounts Receivable Days Formula

Accounts receivable days can be calculated by comparing accounts receivable at the end of the period to the total credit sales during the period and multiply by 365 days.

Accounts Payable Days

Accounts payable days or payables payment period is the ratio that looks at the average amount of time the company takes to pay its suppliers. Likewise, accounts payable days ratio is used as an indication of how good the company’s cash flow is.

Usually, it would mean the company is having cash flow difficulties if accounts payable days increase, because the company may need to use the suppliers as a free source of finance, hence delaying the payments.

Long accounts payable days may look good for the company as it can use it as a free source of finance. However, delaying accounts payable days may also damage the relationship the company have with its suppliers and not receiving any cash settlements or discounts that may be offered by its suppliers.

Accounts Payable Days Formula

Accounts payable days can be calculated by comparing accounts payable at the end of the period to the total credit purchase or total cost of goods sold during the period and multiply by 365 days. Because the purchase is usually not available for external users, cost of goods sold may be used instead in the calculation of accounts payable days.

Inventory Days

Inventory days, or inventory turnover period, is the ratio that looks at the average amount of time it takes the company to convert its inventory into sales. Likewise, inventory days is used as an indication of how well the company performs in managing its inventory.

The lower inventory days means the shorter number of days that inventory is held in the company. This usually indicates the good performance of the company in managing its inventory as it reduces the cost of holding inventory such as inventory obsolete, damage or risk of theft. Also, it is free from cash flow constraint that is due to holding inventory for long periods of time.

However, the company should always ensure that there is sufficient inventory to meet the demand of its customers or to support the production. Too little inventory can upset customers or result in production stoppages.

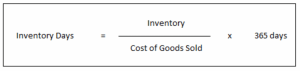

Inventory Days Formula

Inventory days can be calculated by comparing inventory at the end of the period to the total cost of goods sold during the period and multiply by 365 days.