Journal Entry

What is Journal Entry?

Journal entry is the process of recording the business transaction in the journal. It is the first entry that the business transaction from the real world is recorded into the accounting system.

The journal entry takes place each time the business transaction occurs. It is a day-to-day recording of business transactions.

Every journal entry must have at least one debit and one credit, in which the total debit amount must equal the total credit amount. This is to comply with the double-entry accounting rule.

For example, on 28 May 2018, ABC Co. made cash sales of $1,200 which its total cost was $700.

The journal entry would be:

| Account | Debit | Credit |

|---|---|---|

| Cash | 1,200 | |

| Sales | 1,200 |

| Account | Debit | Credit |

|---|---|---|

| Cost of goods sold | 700 | |

| Inventory | 700 |

In the past, every transaction requires the journal entry with debit and credit before it can be processed further to appear in the general ledger and the trial balance. However, with today accounting software such as QuickBooks, transactions can be recorded into the system with the software interface without the need to specify the debit or the credit.

What is Journal?

Journal is simply a chronological record of the business transactions in the accounting system. Basically, all the transactions recorded in the journal are in order by the date that the event occurs.

All the business transactions that are recorded will firstly go to the journal. That is why sometimes the journal is called “the book of original entry”.

What is General Journal?

There may be many types of the journal that the company has in its accounting, however, the simplest and most flexible type is general journal.

General journal contains all the business transactions that do not belong to one of the special journals. Basically, all transactions are recorded in general journal if they are not included in the special journal.

Example of General Journal

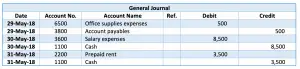

On 29 May 2018, ABC Co. bought the office supplies for $500 on credit.

On 30 May 2018, ABC Co. paid $8,500 in cash to its employees for salary expenses in May.

On 31 May 2018, ABC Co. paid $3,500 in cash to its landlord for the next month’s rent (for June rental).

The general journal of the 3 transactions above would look like:

Some small businesses use only one type of journal which is general journal so all their transactions are recorded in the general journal. However, most companies, especially big companies have several types of journals besides general journal which are usually called special journals.

What is Special Journal?

Special journal is the type of journal that is created to group similar transactions together in chronological order to have better management in those transactions.

Special journal makes the company easy to monitor and review the specific type of transaction such as cash receipts and credit sales etc.

In the general journal, although in chronological order, all types of transactions are mixed together which is difficult for the company to review a specific type of transaction such as cash receipts. This is where the special journal comes to play an important role.

For example, with the cash receipts journal, the company can easily monitor and review all its cash receipts from all sources of income as the whole cash receipts journal contains only the transactions of cash that come into the business.

The commonly used special journals are:

- Cash receipts journal: For recording the transaction of cash that comes into the business including cash from sales, cash from interest and cash from dividend received, etc.

- Cash disbursements journal: For recording the transaction of cash payment in the business including cash payment for the purchase of inventory, office supplies, and salary expenses, etc.

- Credit sales journal: For recording the transaction of all sales on credit; the cash sale transaction will not be included here.

- Credit purchase journal: For recording the transaction of all purchases on credit; the cash purchase transaction will not be included here.