Accounting for Sales Return

Overview

Sales return is the transaction or event when customers return purchased goods back to the company due to various reasons, such as the wrong product, late delivery, or the goods are damaged or defective. Hence, accounting for sales return is important in this case.

The company may grant a reduction of the purchase price to customers so that customers can keep the goods. In this case, the customers do not need to return goods back to the company. However, the company still need to make allowance for such transactions in their accounting system.

In this case, the “sales returns and allowances” account is required for recording such transactions. Sales returns and allowances account is the contra account to sale revenues. It offsets the revenue account in the income statement.

It is very important for the management to review the information regarding the sales return. This is due to a big volume or amount of sales return transactions can suggest various problems that may prevent the company from achieving its goal. Those problems may include inferior goods, problems in filling orders, errors in billing customers, late delivery, wrong product shipment, etc.

Hence, the company usually use sales returns and allowances account to record the total amount of sales return transactions for review and monitoring purposes.

Sales Return Journal Entry

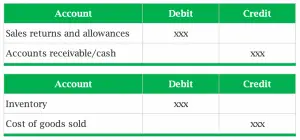

The sales return journal entry is required to debit sales returns and allowances account and credit cash or accounts receivable as below:

There are usually three circumstances when the company needs to deal with the sales returns and allowances in the accounting transactions. These circumstances may include:

- Return of goods from customers with good condition

- Return of damaging or defective goods from customers

- No goods returned, but compensation is made

Return of goods from customers with good condition

When goods returned from customers with good condition, the sales returns and allowances are recorded as reverse to the sale revenues with the related accounts receivable as in the above journal entry. And the related cost of goods sold with the original amount is revised back to inventory.

Return of damaging or defective goods from customers

This is usually the case where customers return goods due to they are damaged or defective. In this circumstance, the sales returns and allowances and related accounts are recorded the same as above journal entry.

However, the inventory and cost of goods sold need to be reversed back using the fair value of the goods (damaged or defective), not the value firstly recognized when the sale transactions occurred.

No goods returned, but compensation is made

In this case, the company provides an allowance to customers as compensation and the customers do not need to return goods. Hence, there is no impact on inventory and cost of goods sold transaction. So, only sales return account and its related credit size are recorded in the journal entry.

Sales Return Example

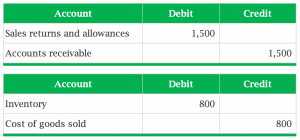

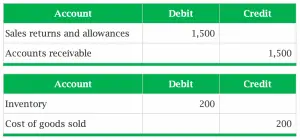

ABC Ltd. sells goods on credit with the price of $1,500 to its customer with the term that the customer can return goods within 14 days if they are not satisfied with goods or the goods has any problem. The cost of goods in the inventory is $800.

What are the sales return journal entries for this example, following the below case scenarios?

- Customer returns goods with good condition

- Customer returns goods due to the damage. The estimated value of damaged goods is $200

- Customer does not return goods but due to some issues with goods, the company provides a $500 allowance to the customer account.

Solution

With the example of sales return, we have the journal entry for each case scenario as below:

- Customer returns goods with good condition

- Customer returns goods due to the damage

- Company provides allowance but no goods are returned

Sales Return without Allowance Account

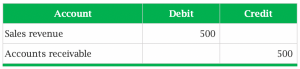

Some companies may not have sales returns and allowances account for some reasons, e.g. they do not have many transactions, so it is not worth keeping track. In this case, the company usually directly debit sales revenue and credit accounts receivable to reverse the original sale transactions when there are sales returns.

For example, a company doesn’t have sales returns and allowances account. However, it sold goods with a price of $500 to its customer where the goods are returned later due to some issues. In this case, the company usually record such sales return transaction by reversing the original transaction in the journal entry as below: