Debit and Credit

What are Debit and Credit?

In the double-entry accounting rule, every business transaction that is recorded must result in at least two entries being made, in which one is the debit and another is the credit; the total debits must equal the total credits.

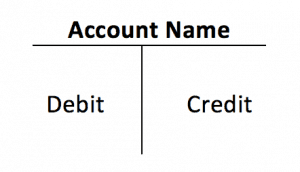

Debit refers to the left side of an account while credit refers to the right side. You might need to think about the general ledger account in “T” format as below:

Debit and Credit are generally used in abbreviation form as Dr and Cr respectively.

Debit and Credit in Balance Sheet

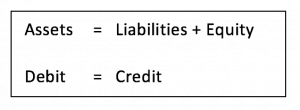

In the accounting equation, assets are on the left side and liabilities and equity are on the right side of the equation. If we put the debit and credit here next to accounting equation it would look like:

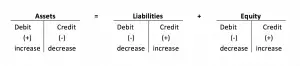

That is why it is generally considered that:

That is why it is generally considered that:

- Assets are the debit accounts so the assets will increase when debit and decrease when credit

- Liabilities are the credit accounts so the liabilities will increase when credit and decrease when debit.

- Equity is the credit account so the equity will increase when credit and decrease when debit.

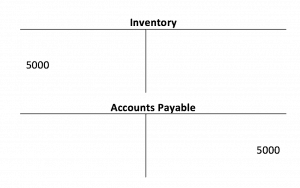

For example, on 21 Jan 2018, ABC Co. purchased the inventory in $5,000 on credit.

In the example, the inventory will increase $5,000 and the inventory is an asset so it means Debit which is on the LEFT.

The accounts payable (purchased on credit) will also increase $5,000 and it is a liability so it means Credit which is on the RIGHT.

So the ledger accounts in this transaction are:

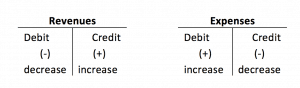

Debit and Credit in Income Statement

For the income statement items, it is useful to think about how income statement links to the balance sheet. The bottom line of an income statement which is net income or net profit shows in the balance sheet as current year profit on the equity side. And we already know that the equity is considered the credit account.

So it makes sense to think that credit will increase net income and debit will decrease net income.

That is why it is generally considered that:

- Revenues are the credit accounts so revenues will increase when credit and decrease when debit.

- Expenses are the debit accounts so the expenses will increase when debit and decrease when credit

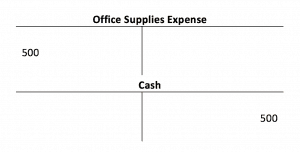

For example, on 22 Jan 2018, ABC Co. bought the office supplies for $500 on cash.

In the example, the office supplies expense will increase $500 and the office supplies expense is an expense so it means Debit which is on the LEFT.

The cash will decrease $500 and the cash is an asset so it means Credit which is on the RIGHT.

So the ledger accounts in this transaction are:

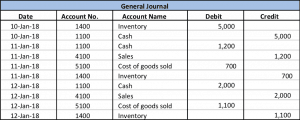

Debit and Credit in General Journal

Debt and credit also appear in general journal following the rule that Debit is only Left and Credit is on the Right.

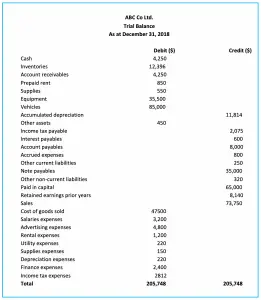

Debit and Credit in Trial Balance

Similar to the general journal, debit and credit also appear in the trial balance following the rule that Debit is only Left and Credit is on the Right.