Liquidity Ratio

Liquidity ratio is the ratio that is used to measure the company’s ability to generate cash in order to pay back the short term liability or debt. Liquidity refers to the amount of cash that the company can generate quickly to pay back its short term debt when it is due.

It is important for the company to keep a fair level of liquidity to survive as the main reasons many companies fail is due to a lack of cash to pay back its short term liability or debt.

Two commonly used liquidity ratios are Current Ratio and Quick Ratio.

2 Types of Liquidity Ratio

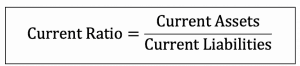

Current Ratio

Current ratio is the type of liquidity ratio that measures the company’s ability to pay its short term liability by comparing the current assets, which the company can convert to cash within one year, to its current liabilities which the company will need to pay within one year.

The current assets include cash, cash equivalents, inventory, and account receivables, etc. The current liabilities include interest payables, account payables, and tax payables, etc.

The higher the ratio is, the more liquid the company. It might look like that the higher the ratio is, the better the company; however it is not the case. The very high ratio would usually mean that the company’s fund is tied up in cash or other current assets that do not earn the highest return possible.

The liquidity level in the current ratio is different from one industry to another. Some companies may need to have a ratio above 2.0:1 to feel safe while others may only need to be above 1.0:1. It is best to compare the current ratio of one company to another company that is in the same industry.

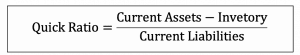

Quick Ratio

Quick Ratio or Acid Test Ratio is also the ratio that measures the company’s ability to pay its short term liability. However, this type of liquidity ratio uses the current assets which exclude inventory to compare with current liabilities.

Quick Ratio excludes the inventory in its calculation because the inventory may take a long time to convert to cash. Also, inventory on the balance sheet may not be the actual value when the company sells it. For example, when the company is in a period of severe cash shortage and needs cash urgently, it might sell the inventory at a big discount to ensure the sales.