Net Charge Off

Overview

Net charge off is the measurement that is usually used in microfinance institution or bank to analyze loan performance with the loans that have been charged off. It is the remaining amount of gross charged off after deducting the amount that have recovered or collected back after charging off.

Net charge off ratio is usually measured by comparing the charged-off amount to the average loan outstanding that the company has. Additionally, the ratio may be breakdown into different categories of loans, e.g. by product type, sector, or size, to have a detailed analysis.

Also, in order to have a better analysis of loan performance, microfinance or bank (the company) may need to benchmark the ratio to the prior period or the industry average.

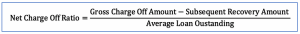

Net Charge Off Ratio Formula

We can calculate net charge off ratio with the formula of using the amount of loans charged off to minus the subsequent recovery amount during the period; then divide the result with the average loan outstanding.

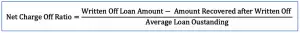

The term “charge off” and “write off” usually have the same meaning in accounting. This is due to the loans that have been charged-off or written off would be removed from the balance sheet.

In this case, the net charge off ratio formula can also be calculated using the amount of loans written off to minus the amount of loans recovered after written off during the period.

In the formula, we may need to calculate net charge off ratio by annualizing the figure of the loan amount recovered when it is not a full year. For example, if the figure is in the 3rd month of the 12-month accounting period, we may need to annualize the figure by multiply with 4.

Net Charge Off Ratio Calculation

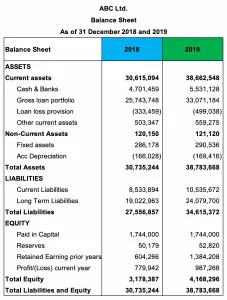

For example, ABC Ltd. which is the microfinance institution has the balance sheet as of 31 December 2018 and 2019 as below:

The company charged-off the loan amount of USD 230,000 during 2019 and has recovered the loan amount of USD 22,393 in the same period.

Calculate net charge off ratio in 2019.

Solution

With the net charge off ratio formula above, we can calculate as below:

Average loan outstanding = (25,743,748 + 33,071,184) / 2 = USD 29,407,466

Net Charge Off = 230,000 – 22,393 = USD 207,607

Net Charge Off Ratio = 207,607 / 29,407,466 = 0.71%

The excel calculation and data in the picture of the example above can be found in the link here: Net charge off calculation excel.

Net Charge Off vs. Provision

Provision is the amount of expense that the company (e.g. bank) makes against its non-performing loans or expected loan losses while net charge off is the amount of the charged-off loan deducting any subsequent recoveries.

Below is a brief summary of the difference between net charge off and provision:

| Net Charge Off | Provision |

|---|---|

| Any charged-off loan will be removed from the balance sheet. | Provision is made against expected loan losses or non-performing loans, but the loan is not removed from the balance sheet. |

| In the event of the subsequent recovery, the recovery amount is recorded as the income item on the income statement (e.g. charge-off recovery income). | In the event of recovery, the recovery amount will deduct against loan outstanding the same as the normal principal payment. |

| In the event of charge off, any existing provision of the charged-off loan will be removed from the balance sheet. | In the event of provision, the new provision amount will replace the old one. |

| Charged off loans are unlikely to be recovered. | There is still some portion of the loan expected to be collected after making provision. |