Optimal Hedge Ratio

The optimal hedge ratio is the minimum level of assets or liabilities which the company should hedge to reduce the risk exposure. It is the percentage in which we should protect our assets or liabilities from the impact of price adverse. We should reduce the risk by using other kinds of hedging.

The optimal hedge ratio has a close relationship with the cost of hedging which is known as hedging fee. Our purpose is to minimize loss, but if the cost of hedging is too high, there are no points to use those kinds of instruments.

The hedge fund firm who has a huge portfolio of investments will face with various type of risk. It is very hard to hedge all the types of investments, so they have to set a certain percentage of their total investment. This percentage is the optimal hedge ratio which different from firm to firm.

Optimal Hedge Ratio Formula

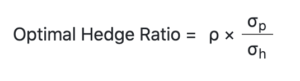

The optimal hedge ratio can be calculated by the following formula :

ρ: is the correlation

σ: is the standard deviation

Optimal Hedge Ratio Example

If we have a portfolio of stock in EUR 100,000 that we will hold for 6 months. For now, we do not want any exchange rate movement which will have an adverse impact on our investment. So we decide to hedge this investment to prevent any loss from the exchange rate movement. The question is how much we should hedge. Assume the volatility of our stock is 9% and the volatility of the futures contract is 12% and the correlation between your portfolio and the futures contract is 0.6.

Optimal Hedge Ratio = 0.6 (9%/12%) = 0.45