Petty Cash Book

Petty Cash book is the book which records small cash payment and receipt during daily business operation. It is recorded in a separated chart account which enables to reconcile daily between accounting record and logbook. It is usually the cash balance that company use for expenses which require immediate payments.

The petty cash helps accountants to process some small and routine payment without authorization from top management. Accountants need to use petty cash as the suppliers do not allow to purchase on credit. However, the amount must be within their level of approval.

What kinds of transactions are suitable with petty cash?

Not all transactions are suitable with petty cash, the company should strictly allow the settlement with petty cash as follows:

- Postage stamp

- Paid for taxi

- Paid for the delivery man

- Purchase stationary

- And other small and urgent payments

Imprest system on Petty Cash

Imprest system is the form of a financial accounting system which commonly use to control petty cash. The petty cash start at any fixed balance at the beginning of the month, and it will reduce over time due to expense. At the month-end, the balance must be replenished back to the float limit.

The cashier can only spend what they have (float amount) and will claim what they already spend. The replenished form should attach with the supporting documents as the top management did not approve of the individual transaction, so he needs to approve the total amount. This system will only allow the petty cash amount within the float amount.

Petty Cash Book Example: Accounting Record for Petty Cash transaction

In order to gain deep understand, please refer to the Petty Cash Book Example below:

Set Up Petty Cash

For example, the company has decided to set the petty cash float of $ 1,000 and this cash is withdrawn from bank account on 01 Jan 202X.

Journal Entry: The company make journal entry by debiting petty cash and crediting cash at bank. Company transfer cash from bank account to petty cash balance.

| Account | Debit | Credit |

|---|---|---|

| Petty Cash | $ 1,000 | |

| Cash at Bank | $ 1,000 |

Replenishment

During the month, the cashier summary the report, and the total expense is $ 800 and the remaining balance $ 200. So she prepares to replenish report to claim $800 from the accounting department. After reviewed, management approves and agrees to withdraw $800 from bank to refill the petty cash balance.

Journal Entry:

To record expense which paid by petty cash: The company record debit expense $ 800 and credit petty cash $ 800. These are the expenses that company paid using petty cash during the month. The company may record expense into small chart account such as stationary, taxi and so on.

| Account | Debit | Credit |

|---|---|---|

| Expense | $ 800 | |

| Petty Cash | $ 800 |

To record the transfer of cash from bank to petty cash: The company need to debit petty cash $800 and credit cash at bank $800. It will refill the petty cash balance back to $ 1,000.

| Account | Debit | Credit |

|---|---|---|

| Petty Cash | $ 800 | |

| Cash at Bank | $ 800 |

Internal Control for Petty Cash

The petty cash must keep in a proper locker in order to prevent any thief or miss place which can lead to the loss of company assets. If the amount is significant, the cash should keep in safe and key need to separate to more than one person.

In order to prevent any risk of error, all transactions must record during the day it occurs. The actual cash and record must be reconciled on a regular basis. If there is any variance, the responsible person must investigate.

How to Set Up Petty Cash?

- Set petty cash float

Petty cash float is the amount which company allows the responsible person to control, and any amount over that must be deposit to the bank. It depends on several factors, such as the demand for petty cash during regular operation. However, we also need to consider the risk of fraud if the float amount is too high as the payment through petty cash does not go through management approval.

- Assign Responsible person

The person responsible for controlling petty cash can be various from company to company. However, most companies assign cashier to control it.

- Petty Cash Voucher

We can use the voucher with a sequential number as the supporting reference. The cashier can use it as the template to complete some basic information and signature of the requested person.

- Petty Cashbook

It is the logbook that controls all movement and the balance at any specific time. We can use the excel file to fill the balance or the actual book.

- Cash deposit and withdrawal

The cash needs to transfer or deposit to bank account when the balance more than the float. It will help to ensure that only enough balance keeps in petty cash balance.

- Petty Cash top-up

The cashier needs to prepare petty cash top up when the amount falls below the minimum balance. The total balance cannot be higher than the float limit.

- Petty Cash reconciliation

It depends on the company policy to reconcile the petty cash, we usually reconcile at the month-end in order to ensure there is no missing cash. Moreover, it also the basis for financial statement preparation.

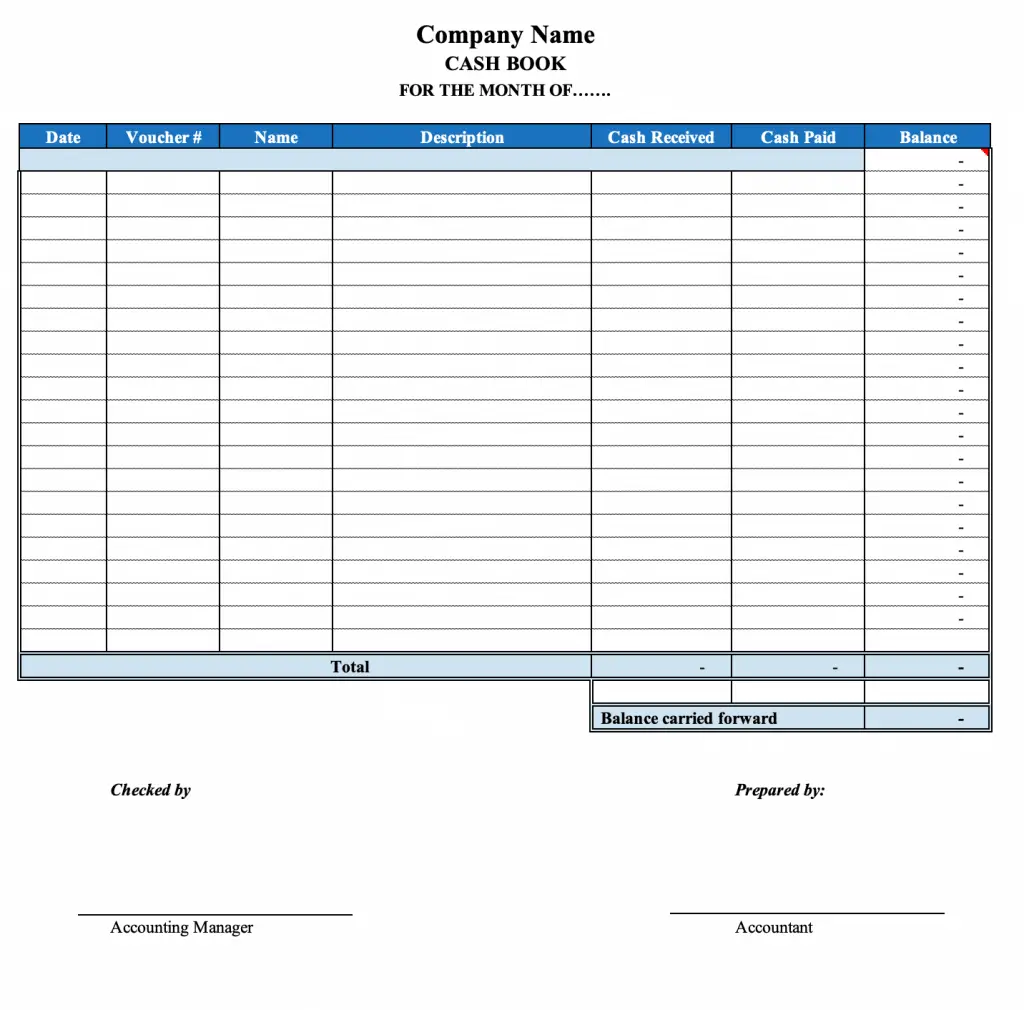

Petty Cash Book Template

Here is the simple petty cash book which can help the accountants to control the cash flow.

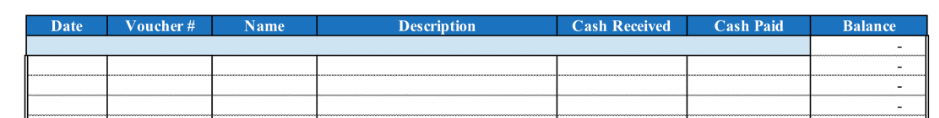

How to use this template?

Please follow the instruction as follows:

- Change the company name

- Change the month

- Key in the beginning balance of petty cash: it is the balance that remains from the prior month or the balance transfer from Bank (if this is the first month).

- Next, the form is ready for you to use, please complete it carefully as following:

- Date: is the date that the transaction takes place.

- Voucher number: is the number that pre-print on the petty cash voucher. It will help us to cross-check with supporting documents when need.

- Name: is the name of a responsible person who requests to use petty cash.

- Description: a short narrative of transaction nature.

- Cash Received: is the amount that we receive from other sources.

- Cash Paid: is the amount which we pay to the supplier. Between cash received and cash paid, we complete only one. We can’t complete both of them in the same row.

- Balance: the Excel formula will automatically calculate. Please don’t change it.

Download Petty Cash Book in Excel

Download Petty Cash Book in PDF

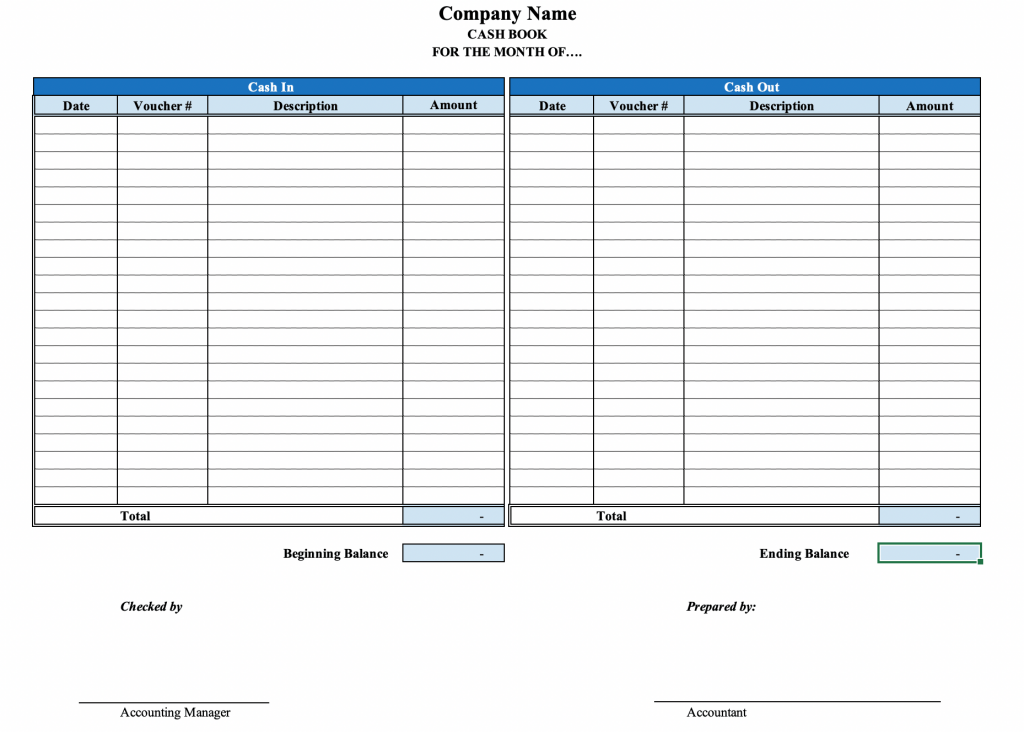

Petty Cash Template 2

Here is another template which also useful for accountants to control their petty cash balance.

The usage is similar to the above template, but we separate the cash in and cash out (cash received and cash paid) into two columns. We can tract the total cash flow easily by looking at the total balance of both columns.

In the balance column, it will show how much cash remains within our box.