Accounting Rate of Return (ARR)

Accounting rate of return is the estimated accounting profit that the company makes from investment or the assets. It is the percentage of average annual profit over the initial investment cost. This method is very useful for project evaluation and decision making while the fund is limited. The company needs to decide whether or not to make a new investment such as purchasing an asset by comparing its cost and profit.

The company may accept a new investment if its ARR higher than a certain level, usually known as the hurdle rate which already approved by top management and shareholders. It aims to ensure that new projects will increase shareholders’ wealth for sustainable growth.

Accounting Rate of Return Formula

Average Annual Profit is the total annual profit of the projects divided by the project terms, it is allowed to deduct the depreciation expense.

Example: ARR for single project

Company A is considering investing in a new project which costs $ 500,000 and they expect to make a profit of $ 100,000 per year for 5 years.

ARR = 100,000 / 500,000 = 20%

Example: ARR of new equipment

Company ABC is planning to purchase new production equipment which cost $ 10M. The company expects to increase the revenue of $ 3M per year from this equipment, it also increases the operating expense of around $ 500,000 per year (exclude depreciation). The machinery has 10 years of useful life with zero scrap value.

Please calculate the ARR.

- Depreciation pe year = $ 10M / 10 year = $ 1M

- Annual profit = ($ 3M –$ 0.5M –$ 1M) = $ 1.5M

- ARR = 1.5 / 10 = 15%

Example: simple rate of return method with salvage value

Company P is considering to purchase new production equipment with the detail as below;

- Cost of this equipment is $ 800,000

- It expects to use for 5 years with scrape value of 50,000 at the end of year 5

- The company expect to generate sale of 300,000 per year from it, however, it will require the maintaining cost of $ 30,000 per year

Please calculate the ARR.

Depreciation = ($ 800,000 – $ 30,000)/5year = $ 154,000 per year

Average annual profit = ($ 300,000 – $ 30,000 – $ 154,000) = $ 116,000

ARR = $ 116,000/$ 800,000 = 14.50 %

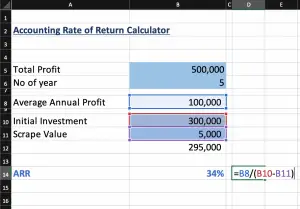

Accounting Rate of Return in Excel

We can use Excel to help us in calculating ARR as following:

Click Here to download Accounting Rate of Return Excel file.

What are the Advantages of Accounting Rate of Return?

| Advantages of ARR | |

|---|---|

| Easy and simple | This method does not require any complicated calculation. Everyone will find it easy to understand. |

| Focus on the most profitable project | It will recommend us to invest in the highest profit project. It is the best use of our investment fund, and it will help to maximize the return. |

| Easy to compare | The company may have limited funds and multiple available projects, the ARR will be able to tell which one is the best by comparing all of their accounting rate of return. |

What are the Disadvantages of Accounting Rate of Return?

| Disadvantages of ARR | |

|---|---|

| Ignore time value of money | This method completely ignores the time value of money. The long-time project will be highly likely to be selected base on ARR. |

| Rely on accounting profit | The accounting profit is very subjective, the management will be able to influence the final figure. The result will be different depending on the accounting treatment and management judgment. |

| Difficult to compare | It is very hard to compare between projects which have different length of time. |

| Ignore whole project return | It is only focused on the profit per year rather than the whole project’s return. Some projects may provide low returns per year but has a longer life. |

| No specific target | We may try to select the highest ARR but we do not know what our target is. The method does not tell us the minimum or best ratio. |