Residual Income

Definition

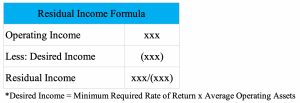

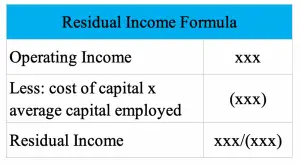

Residual income (RI) is the remaining income the company earns after deducting the desired income or the minimum rate of return. In the residual income formula, the desired income can be calculated using the minimum required rate of return to multiply with operating assets or using the cost of capital to multiple with the capital employed.

RI is usually used for the performance measurement of the project, division or department in a company. The positive figure indicates that the company’s management is doing well in generating the income more than the minimum required return of the company. On the other hand, the negative figure usually means that the performance of the management does not meet the expected requirement.

Residual Income Formula

Residual income formula can be calculated as in the table below:

Operating income should be the figure that the division or department has control over. Any non-controllable figures, either income or expense, should be excluded from the calculation.

This is due to it is used to measure the internal performance of the division or department in the company, hence any inclusion of transactions or events which are outside control of the division or department manager will not appropriately justify their performance.

Sometimes, the capital employed is used instead of operating assets while the cost of capital is used for the minimum required rate of return. In this case, the residual income formula can change to:

Residual Income Example

For example, calculate residual income of two divisions in a company that have the performance results as below:

| Division A | Division B | |

|---|---|---|

| Operating income | $150,000 | $300,000 |

| Opening operating assets | $500,000 | $1,200,000 |

| Ending operating assets | $800,000 | $1,500,000 |

| Minimum required rate of return | 16% | 15% |

*The different minimum required rate of return of these two divisions reflect the different levels of risk in their respective area.

Solution

With the residual income formula above we can calculate RI of Division A and Division B as below:

Division A:

Average operating assets = (500,000+800,000)/2 = 650,000

Desired income = 650,000 x 16% = 104,000

RI = 150,000 –104,000 = $46,000

Division B:

Average operating assets = (12,000,000+1,500,000)/2 = 1,350,000

Desired income = 1,350,000 x 15% = 202,500

RI = 300,000 – 202,500 = $97,500