Absorption Costing

Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and inventory at the end of accounting period.

Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and inventory at the end of accounting period.

Absorption costing is an easy and simple way of dealing with fixed overhead production costs. It is assuming that all cost types can allocate base on one overhead absorption rate. The absorption rate is usually calculating in of overhead cost per labor hour or machine hour. The products that consume the same labor/machine hour will have the same cost of overhead.

Absorption Costing Components

Absorption cost, also known as full costing, allocate all the cost in production into the finished products and only charge to the income statement when they are sold. These costs include:

- Direct material

- Direct labor

- Variable Overhead

- Fixed Overhead

Example

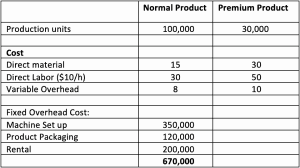

Company ABC produces two main products, Normal and Premium products. Base on company standard costing, the cost of both products includes:

How do we allocate the production cost of $ 670,000?

Solution

We will use overhead absorption costing, which is absorption by labor hour.

- Labor cost $ 10 per hour

- Normal product will require: 300,000 (100,000 x 3h) working hour to complete 100,000 units

- Premium product will require: 150,000 (30,000 x 5 h) working hour to complete 30,000 units

Therefore, fixed overhead will be allocated by $ 1.50 per working hour ($ 670,000/(300,000h+150,000h)).

Production overhead of Normal product: $1.50 x 3h = 4.50

Production overhead of Premium product: $1.50 x 5h = 7.50

| Cost | Normal | Premium |

|---|---|---|

| Direct Material | 15 | 30 |

| Direct Labor ($10/h) | 30 | 50 |

| Variable Overhead | 8 | 10 |

| Fixed Overhead | 4.50 | 7.5 |

| Total production cost | 57.5 | 97.5 |

What are the Advantages of Absorption Costing?

| Advantages | |

|---|---|

| Allocate fixed overhead cost into finished product. | Besides direct material and direct labor, absorption costing take into account for all fixed cost such as salaries, factory rental, depreciation, utilities, etc. It will help the company calculate the total product cost. The company will be able to set a precise selling price. |

| Simple and easy to calculate the cost of goods sold | Absorption costing simply takes all overhead costs to divide by machine hour or labor hour and allocate it to each product base on the required machine or labor hour. It is very simple and easy for most of the company. We do not require any complicated accounting software, only normal spreadsheet can get the work done. |

| Suitable for small SMEs who do not have enough resources | Unlike the large company, SMEs only has few products type, absorption costing is a good option for them. Absorption costing does not require a huge human resource as well as a complicated accounting system, so it is the best option for start-ups and SMEs. Moreover, the cost is not very expensive to compare to other methods. |

| Track profit more accurately | Absorption costing is not only used variable cost but also allocates fixed cost into the product to ensure an accurate cost of product. When all costs are included in each product, the company can easily tract its profit by-product as well as the total profit. |

What are the Disadvantages of Absorption Costing?

| Disadvantage | |

|---|---|

| Mispresented profit during a given period of time | As the total overhead costs will not deduct during the period unless the products sold, so the income statement may look more favorable than its actual. |

| Difficult the prepared budget | It is hard for management to forecast and make a proper business plan due to the allocation of total fixed cost to product. |

| Wrong cost calculation | Overhead costs share with the product base only the labor or machine hour, so it may lead the wrong calculation while some activities are related to different cost drivers. To solve this problem, activities based costing is the best solution. |

| Cost volume profit analysis | It is hard to calculate cost volume profit analysis (CVP) because there is no separation between the fixed and variable cost of product. |