Accounting for Subsidiary

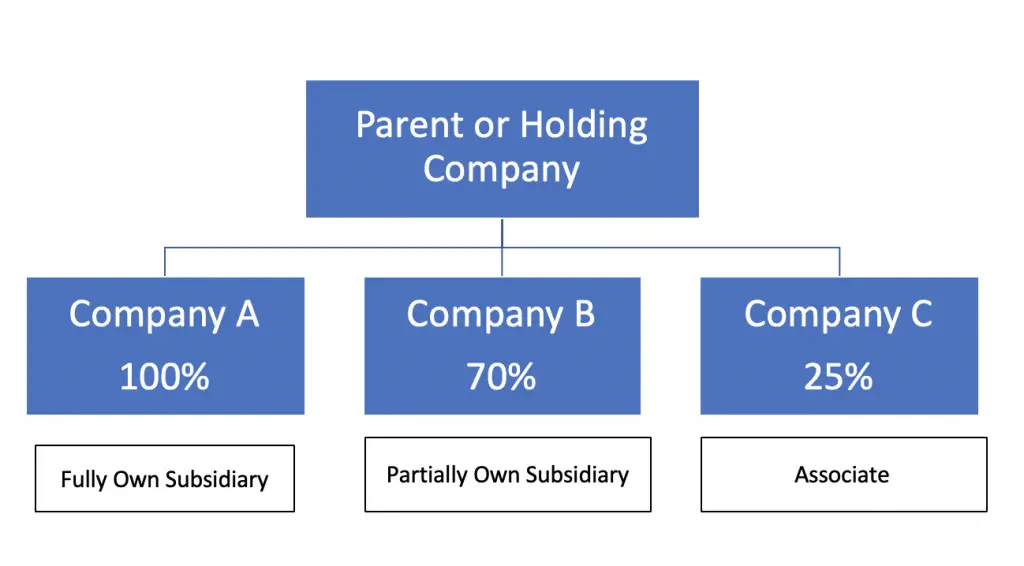

Subsidiary is a company that is owned by another company, parent or holding company. The subsidiary usually owned by the parent or holding company from 50% up to 100%. If the Parent company owned less than 100% of the total share, it is called Partially own subsidiary. Fully own subsidiary is the company that parent owned 100% of the total share. Any investment less than 50% of the total share will consider as an associate or non controlling interest. The subsidiary is either set up or acquired by the parent company.

Subsidiary is the independent legal entity that follows tax, law, and other regulations where they located.

Parent company is a company that operates its own business activities and own another company which runs similar or related business operation. For example, Beats is an electronic company that focuses on the headphone and speakers. It is the subsidiary of Apple, which is a company focus on hardware, software, and online service.

Holding company does not have its own operation; it only share or investment in other company. For example, HSBC Holding is a holding company which does not run any business activities but only control other subsidiaries.

Investment in Subsidiary Equity Method

The equity method is accounting for investment when the parent company holds significant influence over the investee but not fully control. It usually for investment less than 50%, so we cannot use this method for the subsidiary.

However, there is a case when the parent has an influence on the subsidiary but does have the majority voting power. The parent may own more than 50% but doesn’t have control due to the type of share they own. In this circumstance, the parent company needs to report its subsidiary as the investment by using the equity method. It is called the unconsolidated subsidiary.

Subsidiary Journal Entry

- To record initial investment: The parent company makes journal entry by debiting investment in subsidiary and credit cash paid.

| Account | Debit | Credit |

|---|---|---|

| Investment in Subsidiary | 000 | |

| Cash | 000 |

- To record net income: At the end of accounting period, the company will record debit investment in subsidiary and credit revenue.

| Account | Debit | Credit |

|---|---|---|

| Investment in Subsidiary | 000 | |

| Investment Revenue | 000 |

- To record dividend: When subsidiary declare dividend, the parent will debit cash and credit investment in subsidiary.

| Account | Debit | Credit |

|---|---|---|

| Cash | 000 | |

| Investment in Subsidiary | 000 |

Consolidation entries for subsidiary

When the parent has legal control over the subsidiary, parent will consolidate subsidiary financial statement. It also means that parent has more than 50% of share voting right in the subsidiary.

The consolidated financial statement is the combination of subsidiary and parent financial reports. The parent company will not record the investment in subsidiary, which we have seen in the equity method. But we need to combine the whole report of subsidiary into consolidated report.

Balance Sheet: The consolidated report will combine all assets and liability of parent and subsidiary. We include all balance even parent does not own 100% of the share. In Equity part, it will show balance of Non-Controlling Interest, represents the share of others beside parent company.

Income Statement: the consolidate 100% revenue and expense into the consolidated income statement. The proportion of NCI net income will be subtracted, only parent profit will show in the consolidated income statement.

Elimination Entries: is the adjusting entries aim to eliminate duplicated balance in the consolidated financial statement. For example, subsidiary may have a balance with parent, so they both record Account Receivable and Account Payable. But when we consolidate, this balance must be eliminated; otherwise, we will overstate assets and liability. The same thing happens to revenue as the parent sells goods to the subsidiary, the parent will record revenue. Then subsidiary sells the same goods to third party, subsidiary will record revenue too. That is ok for the separate report, but in consolidate, we can’t record double revenue for the same goods.

In parent financial reports, they record investment as the asset, so this balance must be eliminated, as we have added subsidiary whole balance sheet.

Example of Consolidated Financial Statement

For example, Parent company owns 80% of share and voting right in its subsidiary. Below is the financial statement of both parent and subsidiary. During the year both company has related transaction as following:

- Parent record investment of $ 40,000 to represent amount invest in subsidiary

- Parent sale products of $ 20,000 to subsidiary and subsequently the subsidiary sale to the customer for $ 30,000. The parent spends 15,000 to purchase this product from supplier.

- At year-end, the subsidiary still owe $ 15,000 to parent

| Parent | Parent | Subsidiary | Elimination | Consolidated |

|---|---|---|---|---|

| Cash | 10,000 | 15,000 | 25,000 | |

| Account Receivable | 35,000 | 15,000 | (15,000) | 35,000 |

| Inventory | 25,000 | 20,000 | 45,000 | |

| Investment | 40,000 | – | 40,000 | |

| Fixed Asset | 80,000 | 40,000 | 120,000 | |

| Total Asset | 190,000 | 90,000 | 280,000 | |

| – | ||||

| Account Payable | 20,000 | 15,000 | (15,000) | 20,000 |

| Other Liability | 5,000 | – | 5,000 | |

| Retain Earning | 35,000 | 25,000 | 60,000 | |

| Share Capital | 130,000 | 50,000 | 170,000 | |

| Non Controlling interest | 10,000 | |||

| Total Lia & Equity | 190,000 | 90,000 | 280,000 |

| Parent | Parent | Subsidiary | Elimination | Consolidated |

|---|---|---|---|---|

| Revenue | 800,000 | 100,000 | (20,000) | 880,000 |

| COGS | (500,000) | (50,000) | 15,000 | (535,000) |

| Expense | (100,000) | (40,000) | – | (140,000) |

| Net Income | 200,000 | 10,000 | – | 210,000 |

| Attributable to: | ||||

| Group | 208,000 | |||

| NCI | 2,000 |

Accounting for sale of investment in subsidiary

Partial disposal of an investment in a subsidiary will have implications to the parent financial statement.

If parent lost control over the subsidiary, we need to stop consolidation and recognize investment by using the equity method. We need to recognize the investment at fair value, and any subsequent gain or loss will impact the investment. It is no longer the subsidiary, but we need to recognize it as the associate.

If the parent still has major control over subsidiary, we need to keep consolidating financial statement. However, the non-controlling interest will differ due to the change of ownership percentage.

Subsidiary vs. Branch or Division

The branch or division is different from subsidiary, it just a part of the company while subsidiary is a separate legal entity. Branch act more like the agency with the same structure, internal policy, rule, and regulation.

Disadvantages of a Subsidiary

The parent company will not be able to make a major decision related to the product, market, issue new share, and so on. The decision must be agreed upon by the other shareholders as well. The subsidiary management may not follow, and it cause many issues before any new policy is getting done. It is more complicated if we compare to the branch in which top management can enforce strategy policy immediately.

The other problems are tax and local regulation, and the group company needs to prepare additional reports to comply with the local law for the subsidiary. And the tax also a problem with parent and subsidiary has many transactions with each other as it will raise the concern of transfer price.