Non-Controlling Interest (NCI)

Non-controlling interest is the shares ownership which is less than 50% and has less control or influence over company. It is also known as the minority interest as it has very little influent in the company as well as the voting right.

Non-controlling interest shows in the equity section of the consolidated balance sheet, it shows the share belong to others besides the parent company. This situation happens when the parent company acquires less than 100% share of the subsidiary.

Non-controlling interest is measured base on the company’s net asset value at the acquisition date. When the parent company owns less than 100% of shares in the subsidiary, it will consolidate a whole financial statement. But some parts of the subsidiary do not belong to the parent. As a result, We need to present this balance in the balance sheet to present a portion that does not belong to the company. At the same time, the parent company also require to separate the net profit during the year which will be allocated base on share percentage.

There are two methods used to calculate the NCI which also related to the goodwill method. These two methods are:

- Full Goodwill

- Partial Goodwill

Non-Controlling Interest Example

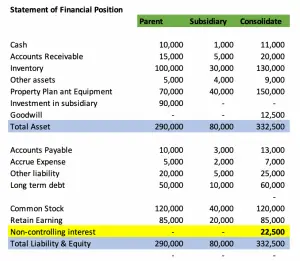

On 01 Jan 202X, Parent company acquires 80% share in its subsidiary for $ 90,000. The fair value of subsidiary’s net asset is $ 100,000 on the acquisition date. As the parent who has a significant influence on the subsidiary, it requires to consolidate the financial statement. Please refer to the balance below.

-

Full Goodwill

- Implied value of subsidiary = 90,000 /80% = $ 112,500

- Goodwill = Implied value of subsidiary – Net Asset fair value

= $ 112,500 – $ 100,000 = $ 12,500

- Non-controlling interest = $ 112,500 * 20% = $ 22,500

Please refer to the consolidate statement of financial position below:

Note: As we can see, parent owns only 80% of its subsidiary, but it consolidates the whole financial statement. So in order to present to other shareholder ownership, we need to add the non-controlling interest.

Note: As we can see, parent owns only 80% of its subsidiary, but it consolidates the whole financial statement. So in order to present to other shareholder ownership, we need to add the non-controlling interest.

-

Partial Goodwill

Partial Goodwill is another method which we can use calculate NCI and goodwill in consolidating financial statement.

- NCI = 20% * Net Asset Fair Value

= 20% * 100,000 = $ 20,000

- Goodwill = 90,000 – (80% * 100,000) = $ 10,000

At the end, goodwill and NCI decrease by the same amount, both methods will impact to goodwill and NCI only.

Non-Controlling Interest after Acquisition

Non-controlling interest represents the amount of share ownership by others besides the parent company. The share value is measured by the fair value of the subsidiary’s net asset plus the retain earning portion minus the dividend since the acquisition date. The above example show the NCI balance on the date of acquisition. However, we need to calculate the NCI balance on every balance sheet date, so please check the following formula:

| NCI at the acquisition date |

| Add: Fair value adjustment such as goodwill |

| Add: net income attributable to NCI |

| Less: dividends paid to NCI |

| NCI at the date of consolidation |

Example

One year after the acquisition, the subsidiary has made a profit of $ 60,000 and there is no dividend paid yet.

| NCI at the acquisition date | 22,500 |

| Add: Fair value of adjustment such as goodwill | 0 |

| Add: net income attributable to NCI | 60,000*20% |

| Less: dividends paid to NCI | 0 |

| NCI at the date of consolidation | 34,500 |

Valuation of Non-Controlling Interest

Valuation of Non-Controlling Interest (NCI) is a critical aspect of financial analysis, particularly for companies with subsidiaries or investments in which they don’t hold a majority stake. NCI represents the portion of a subsidiary’s equity that is not owned by the parent company, and accurately assessing its value is essential for financial reporting and decision-making. There are various methods employed for valuing NCI, each with its own set of advantages and limitations.

-

Constant Growth Model:

- The constant growth model, also known as the perpetuity growth model, is rarely used in practice for valuing NCI. This approach assumes that the subsidiary’s performance will remain static indefinitely, leading to a constant growth rate.

- The major drawback of this method is its unrealistic assumption of a consistent growth rate over an extended period, which is rarely reflective of the dynamic nature of businesses.

-

Historical Growth Model:

- The historical growth model relies on past performance trends to forecast the future value of NCI. It involves analyzing the subsidiary’s historical financial data and extrapolating growth rates into the future.

- While this method provides a simple and intuitive approach, it may be unsuitable for companies with dynamic operations, as it does not account for potential changes in market conditions, industry trends, or management strategies.

-

Modeling Subsidiaries Individually:

- This approach involves valuing each subsidiary individually based on its unique characteristics, financial performance, and growth prospects. It is a more flexible method that allows for a tailored valuation, considering the specific circumstances of each subsidiary.

- However, modeling subsidiaries individually requires detailed and accurate financial data for each entity, and it can be impractical for companies with an extensive portfolio of holdings. The complexity and resource-intensive nature of this approach may outweigh its benefits in certain cases.