Accounts Payable

Definition

Accounts payable (A/P) or payables are the amount the company owes to its suppliers for the goods delivered or services provided by the suppliers. It occurs when the company buys goods or services on credit from its suppliers. Likewise, the company needs to make accounts payable journal entry in order to recognize the liability that occurs on the balance sheet as of the purchasing date.

The accounts payable are the current liabilities that are shown on the balance sheet for which the balances are due within one year. In this case, the company has an obligation to pay suppliers based on the credit term which is usually shown on the supplier invoices. Credit duration in the credit term is usually 30 days, but it can vary depending on the type of business and the relationship between the company and its suppliers.

Accounts payable journal entry

When the company buys or purchases on credit, the liability will occur when goods or services are received. Hence the company will debit goods received or services expended and credit accounts payable as liabilities increase. In this case, goods can be inventory, fixed assets or office supplies, etc. and services can be consultant fee, maintenance, and advertising expense, etc.

Likewise, the company can make the accounts payable journal entry by debiting the asset or expense account based on the type of goods it purchases and crediting the accounts payable.

The journal entry would look like below:

| Account | Debit | Credit |

|---|---|---|

| Inventory/Fixed Assets/Expenses | 000 | |

| Accounts payable | 000 |

When the company makes payment to settle the payables, it will debit the accounts payable to clear the liability and credit the cash account as the payment results in the cash outflow from the company.

The journal entry would look like below:

| Account | Debit | Credit |

|---|---|---|

| Accounts payable | 000 | |

| Cash | 000 |

Accounts payable example:

For example, on 23 June 2019, the company ABC Ltd. purchases inventory for $1,500 on credit from XYZ Supply Co., one of its regular suppliers.

And then it makes the payment of $1,500 to settle this debt on 22 July 2019.

What are the accounts payable journal entries for the above transactions?

Solution:

The company ABC can make the accounts payable journal entry for the credit purchase of $1,500 on 23 June 2019 as below:

| Account | Debit | Credit |

|---|---|---|

| Inventory | 1,500 | |

| Accounts payable | 1,500 |

On 22 July 2019, after the company ABC make the payment of $1,500 to settle the accounts payable that it has previously recorded, it can make the journal entry as below:

| Account | Debit | Credit |

|---|---|---|

| Accounts payable | 1,500 | |

| Cash | 1,500 |

Accounts Payable Aging

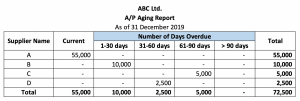

Accounts payable aging or A/P aging is the report used by the company to control and monitor its payables. The company that has many suppliers may need to use the A/P aging report to easily manage its payment to the supplier.

This is due to paying late may result in bad relationships with suppliers. Hence, it is important for the company to pay its suppliers on time. Making a payment on time usually results in the increase of good relationships with suppliers, and may lead to having a better purchase term in the long run.

A/P aging report shows all the payables classified by the day overdue of the payment which details all suppliers that the company still owes.

Example of A/P Aging:

Accounts payable aging report template:

The accounts payable aging report template in the excel file of the picture above is in the link here: Accounts payable aging report excel

Accounts Payable vs. Account Receivables

Accounts payable are the amount that the company owes to its suppliers while account receivables are the amount that the customers owe to the company. The payables are current liabilities when the receivables are the current assets.

The payables when settled will result in the outflow of the company’s resources which is “the cash that will be paid out” while the receivables when settled will result in the inflow of economic benefits to the company which is “the cash that will flow in”.

It’s also useful to note that the company’s payables are the receivables of its suppliers. While the company shows accounts payable as current liabilities on its balance sheet, its suppliers show the account receivables as current assets on their balance sheet.

Example:

From the example above, ABC Ltd. purchased inventory for $1,500 on credit from XYZ Supply Co., one of its regular suppliers.

The journal entry for both companies would be as below:

In the accounting record of ABC Ltd. while In the accounting record of XYZ Supply Co.

Accounts Payable vs. Trade Payables

Some companies treat the accounts payable the same as the trade payables. However, there is a small difference between accounts payable and trade payables.

Accounts payable in general refer to all payables owed to its suppliers and others including suppliers of inventory goods and other supplies of items or services while trade payables only refer to payables that the company owed its suppliers of inventory goods which are the items of its main business activities.

In this case, if the company has and uses the trade payables in its chart of account, the credit purchase of trade items, such as inventory, is usually recorded in the trade payables. And the other payables, which are not related to the main operation of the business, are usually recorded in accounts payable.

Example:

On 29 July 2019, ABC Ltd. purchases inventory for $2,000 on credit from XYZ Co. And on the same day, it also bought office supplies for $150 on credit from BA Book Store.

In the transactions above, ABC Ltd. can record and make the accounts payable journal entry for the credit purchases as:

| Account | Debit | Credit |

|---|---|---|

| Inventory | 2,000 | |

| Accounts payable | 2,000 |

| Account | Debit | Credit |

|---|---|---|

| Office supplies | 150 | |

| Accounts payable | 150 |

If the company uses trade payables in its general ledger, it can make the trade payables journal entry for the $2,000 purchase and make the accounts payable journal entry for the $150 purchase.

| Account | Debit | Credit |

|---|---|---|

| Inventory | 2,000 | |

| Trade payables | 2,000 |

| Account | Debit | Credit |

|---|---|---|

| Office supplies | 150 | |

| Accounts payable | 150 |