Accounts Payable Debit or Credit

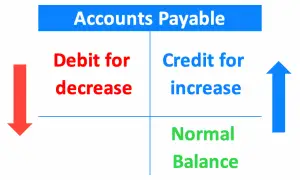

Accounts payable (A/P) is a type of liabilities account, so it stays on the credit side of the trial balance as the normal balance. It is the amount that we owe to suppliers for the goods or services that we have already received but have not paid yet.

Accounts payable (A/P) is a type of liabilities account, so it stays on the credit side of the trial balance as the normal balance. It is the amount that we owe to suppliers for the goods or services that we have already received but have not paid yet.

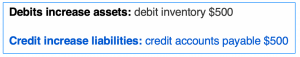

In this case, when we purchase goods or services on credit, liabilities will increase. Hence, we will credit accounts payable in a journal entry as credit will increase liabilities.

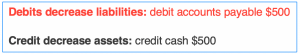

On the other hand, when we make payment for the purchased goods or services, liabilities will decrease. So, we will debit accounts payable as debit will decrease liabilities.

In short, as a liability account, we credit accounts payable when it increases and we debit when it decreases.

Example

For example, on February 05, 2020, the company ABC Ltd. bought the inventory in with a cost of $500 on credit. Then on February 18, 2020, it paid $500 to its supplier for purchased inventory on February 05, 2020.

In this case, the company purchased on credit, the journal entry is as below:

And when the company made the payment, the journal entry is:

Accounts payable debit or credit normal balance

As the liabilities, accounts payable normal balance will stay on the credit side. Actually, this is the same for all liability accounts. On the other hand, the asset accounts such as accounts receivable will have a normal balance as debit.

It is useful to note that A/P will only appear under the accrual basis of accounting. For those that follow the cash basis, there won’t be any A/P or A/R on the balance sheet at all. This is due to under the cash basis of accounting, transactions only be recorded when there is cash invovled, either cash in or cash out.