Audit Process

Introduction

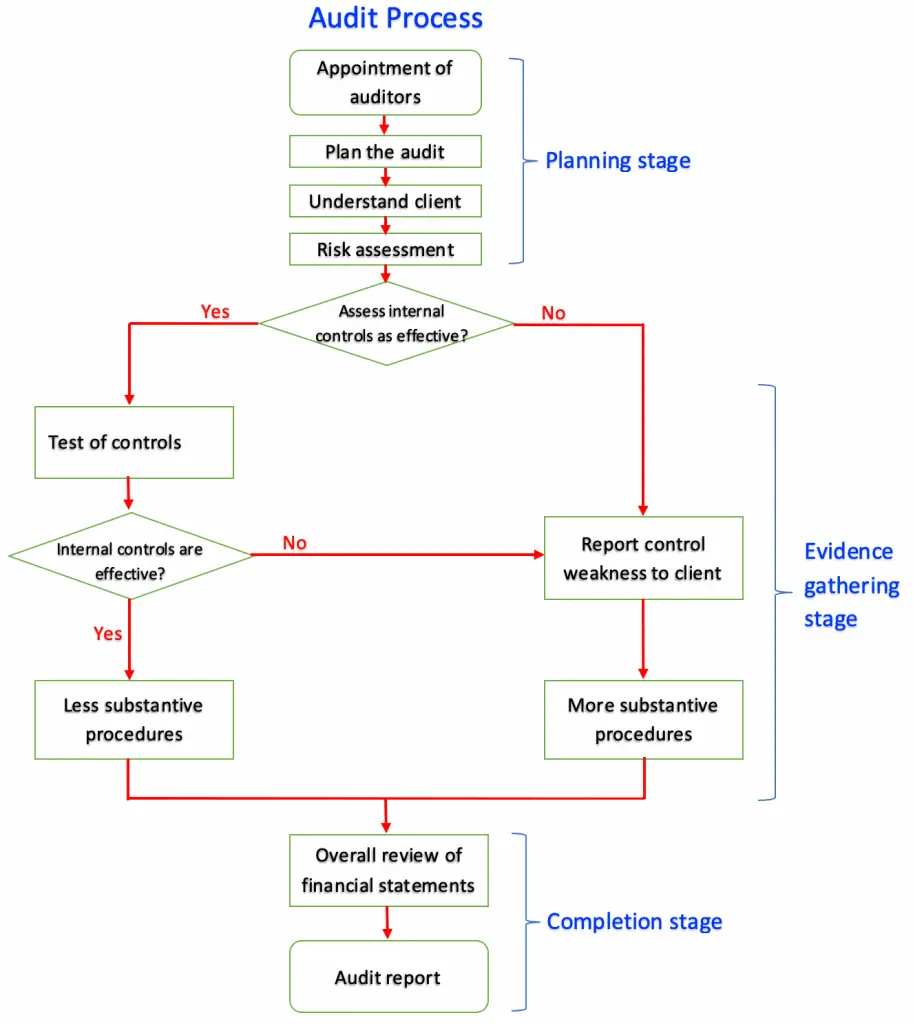

Audit process usually starts from the appointment of auditors until the issuance of the audit report as shown in the audit process flowchart. As auditors, we usually need to follow many audit steps before we can issue the audit report.

However, those audit steps can be categorized into the main stages of audit, including the planning stage, audit evidence-gathering stage, and completion stage which is the final stage of audit where we can issue the report.

Audit Process Flowchart

Below is the audit process flowchart that shows an overview of auditing and the main stages of audit.

Summary of Audit Process

To make it easy we can make a summary which follows the audit process flowchart above as in the table below:

| Summary of Audit Process | |

|---|---|

| 1. Appointment | This is the first step in the audit process flowchart above where we, as auditors, are appointed to perform the audit work on the client’s financial statements. |

| 2. Plan the audit | After being appointed as auditors, we can start the initial planning of the audit. This may include evaluating compliance and ethical matters as well as forming appropriate audit team members. |

| 3. Understand client | This is where we obtain an understanding of the client’s business and controls environment. While obtaining an understanding of the client in this stage of audit process, we also need to identify any risks that the client’s accounts expose to. |

| 4. Risk assessment | In this step of audit process flowchart, we assess the risk of material misstatement that can occur on the client’s financial statements. This step also includes how we respond to the assessed risk, e.g. we will perform the test of controls or go directly to substantive audit procedures by ticking the control risk as high. |

| 5. Test of controls | This where we perform the test of controls to support our assessment of internal controls. However, we only perform this type of test if we believe the client’s internal controls can reduce the risk of material misstatement; and we intend to rely on internal controls to reduce our substantive procedures.

If we assess that the internal controls are ineffective, we will go directly to substantive procedures. |

| 6. Substantive audit procedures | This step of audit process flowchart is where we gather audit evidence by testing various audit assertions of the client’s accounts. Substantive audit procedures include substantive analytical procedures and tests of details. |

| 7. Overall review of financial statements | After we have obtained sufficient appropriate audit evidence, we will perform an overall review of financial statements before we express our opinion. This is to see if the financial statement as a whole looks reasonable and is in conjunction with the conclusion drawn from other audit evidence obtained. |

| 8. Audit report | This is the final audit process where we issue the audit report by giving our opinion on financial statements. Usually, we give an unqualified or clean opinion as most of the time the audit adjustment is usually made if there’s any material misstatement.

However, sometimes other audit opinions such as qualified opinion, adverse opinion, or disclaimer of opinion may be given instead. |

For the report of internal control weaknesses which shows in the audit process flowchart, we do not include in this summary of audit process. This is due to this type of report is not the audit report and it’s not the main objective of our audit.

Though, we will issue this report when we found that internal controls are ineffective to prevent or detect material misstatement, either during the risk assessment or after the test of controls. This way, it can add more value to the client as they can make more improvements in the internal control to prevent or detect the risk of error or fraud.

This type of report describes the client’s internal control deficiencies and provide recommendations for the client to implement.