Unqualified Opinion

Overview

Unqualified opinion is an audit opinion that independent external auditors give when they conclude that the client’s financial statements contain no material misstatement. Likewise, when auditors give an unqualified opinion, it means that they have obtained sufficient appropriate audit evidence to support their opinion that there is nothing wrong with financial statements from a material perspective.

In other words, an unqualified opinion from auditors means that the company’s financial statements present fairly, or give a true and fair view, in all material respects and in accordance with applicable accounting standards.

The term “present fairly” or “give a true and fair view” here means that the information in financial statements are factual and actually exist in the book and records of the company. In addition, they reflect the commercial substance of the business transactions and events of the company. Lastly, they are in compliance with applicable accounting rules and regulations.

It is useful to note that when auditors give an unqualified opinion on the financial statements, it doesn’t mean that the client is doing well nor doing badly. Auditors merely express their opinion that the information in financial statements is true and fair, reflecting the actual economic substance of the client’s business.

Unqualified Opinion Example

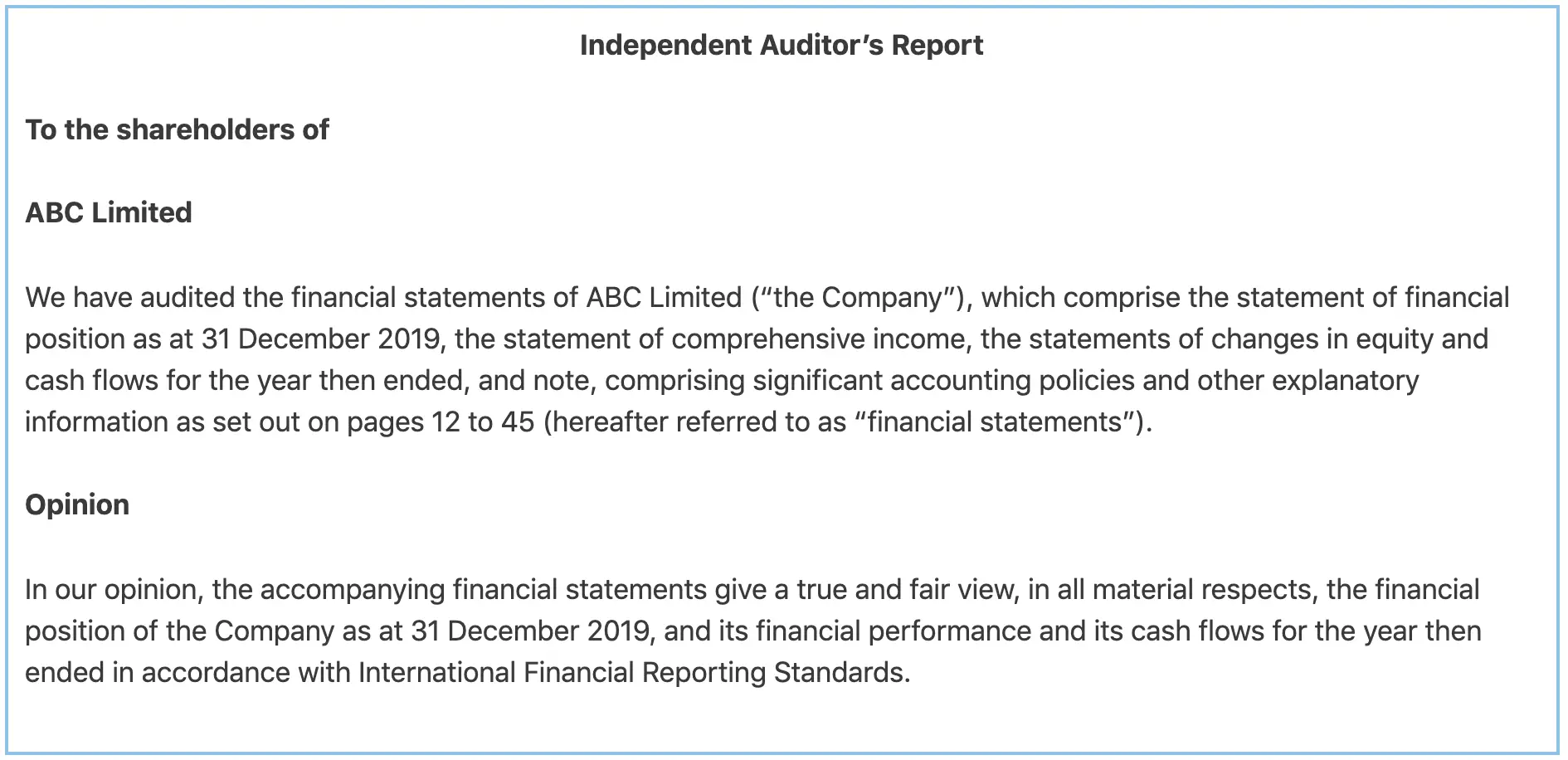

For example, an unqualified opinion that auditors give on the financial statements of ABC Limited in the audit report would look like below:

Most of the time, auditors give an unqualified opinion in the audit reports. This is due to auditors usually accumulate all misstatements they identify during their audit work. Then they will communicate to the client’s management to propose the audit adjustments in order to correct those misstatements. As a result, the financial statements after adjustments usually contain no material misstatements.

However, sometimes the client may refuse the audit adjustments due to some reasons such as the adjustments would have a negative effect on the loan covenant or financial outlook, etc. In this case, auditors need to evaluate whether giving an unqualified opinion on the client’s financial statements is still appropriate.

Unqualified opinion with emphasis of matter paragraph

Unqualified opinion with emphasis of matter paragraph is the case where auditors conclude that the financial statements contain no material misstatement but they believe that additional disclosure is important for the users’ understanding of financial statements.

In this case, auditors will give an unqualified opinion with the emphasis of matter paragraph below the opinion paragraph to disclose the matter that they believe to be significant in the audit report. Likewise, the main purpose of the emphasis of matter paragraph is to draw users’ attention to the matter disclosed.

Some examples of circumstances that cause auditors to give an unqualified opinion with emphasis of matter paragraph include:

- Material uncertainty

- Subsequent events

- Major catastrophe

- Related party transactions, etc.

Unqualified opinion with going concern

In an audit, going concern is defined as the company’s ability to continue its operations for the foreseeable future (i.e. at least 12 months from the reporting date).

Likewise, auditors have responsibilities to evaluate whether there is significant doubt about the client’s ability to continue as going concern and assess whether the client’s use of the going concern basis of accounting is appropriate.

Examples of conditions that cause the client’s going concern status to be questionable may include:

- Deterioration of financial performance for a prolonged period of time.

- Adverse financial ratios

- Negative cash from operations

- Default on loan payments

- Significant outstanding court case, etc.

If auditors conclude that the client’s use of going concern status is appropriate and there is no significant uncertainty, auditors will issue a standard audit report with an unqualified opinion.

On the other hand, if the client’s going concern status is appropriate (with adequate disclosure in the financial statements) but there is a material uncertainty that still exists as reporting date, auditors need to issue an unqualified opinion with a disclosure about such uncertainty in the audit report.

In this case, a separate paragraph, which is material uncertainty related to going concern, is required in the audit report to disclose such related events and conditions.

Unqualified opinion vs qualified opinion

Unlike unqualified opinion, qualified opinion is an audit opinion that auditors give when financial statements contain material misstatement, but such misstatement is not pervasive. Additionally, auditors also give a qualified opinion when they could not obtain sufficient appropriate audit evidence about specific transactions or balances, and their effect is deemed material but not pervasive.

In other words, while an unqualified opinion given by auditors means that financial statements present fairly in material respects, a qualified opinion means that there is something wrong with some parts of financial statements but it does not affect the financial statements as a whole.

However, there is also a similarity between unqualified opinion and qualified opinion. Similar to unqualified opinion, auditors also state that financial statements present fairly (or give a true and fair view) in a qualified opinion report. But they include the word “except for” in the opinion to point out to the area of financial statements, where they qualified the matter, in the basis of qualified opinion paragraph.

For example, in a qualified opinion report, auditors usually state “In our opinion, except for the effects of the matter described in the Basis for Qualified Opinion, the financial statements present fairly, in all material respects…”

It might be easier to look at the summary of the comparison between unqualified opinion and qualified opinion in the table below:

| Unqualified opinion vs qualified opinion | |

|---|---|

| Unqualified opinion | Qualified opinion |

| Financial statements are free from material misstatement. | Financial statements contain misstatement that is material but not pervasive. |

| Auditors obtained sufficient appropriate audit evidence on which to base the opinion. | Auditors may not be able to obtain evidence about certain matters resulting in the qualification of related transactions or balances. |

| Auditors usually state in the report as “In our opinion, the financial statements present fairly…” | Auditors usually state in the report as “In our opinion, except for…, the financial statements present fairly…” |