Qualified Opinion

Overview

Qualified opinion is an audit opinion that independent external auditors express when they found that financial statements contain material misstatement but such misstatement is not pervasive in nature.

Additionally, the qualified opinion is also given when auditors could not obtain sufficient appropriate audit evidence about certain matters and their effect is material but not pervasive. This happens when there is a scope limitation in an audit.

Likewise, auditors usually give a qualified opinion by expressing that the financial statements are free from material misstatements, except for specific transactions or balances, or circumstance.

In this case, the auditors indicate that while there are material misstatements or material scope limitations, they are confined to a specific element of the financial statements which could be isolated; the rest of financial statements are reliable.

Auditors use the phrase “except for” to describe the issues that give rise to the qualification of the opinion in the audit report. Likewise, a qualified opinion in the audit report usually states that “except for…, the financial statements present fairly (or give a true and fair view)….”.

Qualified Opinion Example

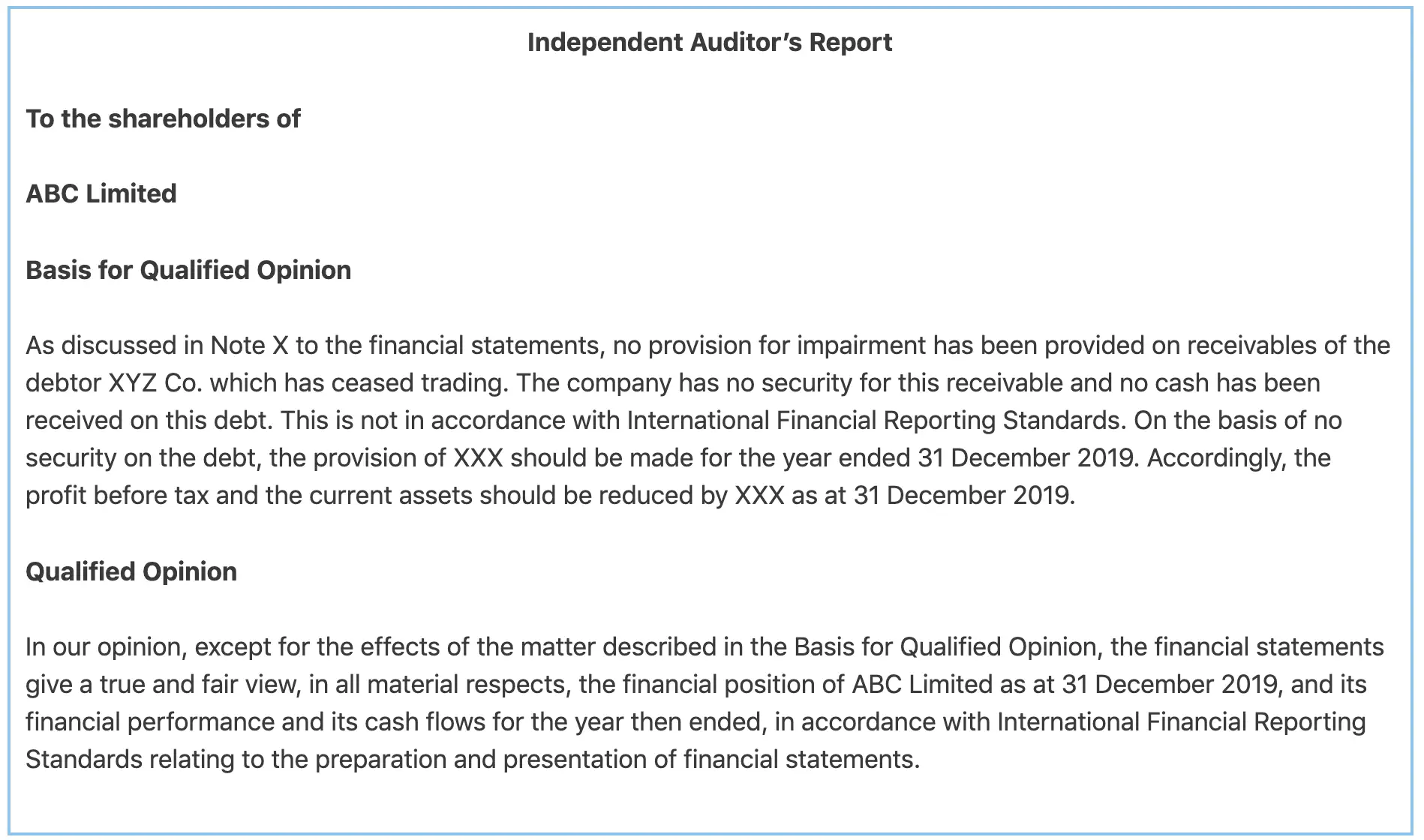

For example, a qualified opinion that auditors give on the financial statements of ABC Limited would look like below:

Basis for Qualified Opinion

In the qualified audit opinion report, a basis for qualified opinion paragraph is required as a separate paragraph to explain the circumstances that lead to auditors modifying the opinion in the audit report.

In this case, the basis for qualified opinion paragraph would explain what misstatements are and how they affect the individual line items in financial statements. It would also describe how the balance sheet and income statement would be different if the financial statements are prepared in accordance with applicable accounting standards.

Qualified opinion given by auditors in the audit report can be the result of any of the two conditions as follow:

- On basis that the financial statements contain the material, but not pervasive, misstatement

- On basis that auditors could not gather sufficient and appropriate evidence and the effects are deemed to be material, but not pervasive, on the financial statements.

The words “material but not pervasive on financial statements” mean that the maters, either material misstatements or lack of evidence with material effects on financial statements, can be isolated. In this case, even though they are material, their effects are only on certain transactions or balances; they do not affect the financial statements as a whole. As a result, auditors express only a qualified opinion with the word “except for” (i.e. except for that, everything is good).

On the other hand, if the matters are both material and pervasive, auditors may either express adverse opinion stating that the financial statements do not present fairly (or do not give a true and fair view), or they do not express their opinion on the financial statements at all, which is referred as disclaimer of opinion.

Qualified opinion vs adverse opinion

Unlike qualified opinion, an adverse opinion is an audit opinion that auditors give when financial statements contain misstatement that is both material and pervasive.

While a qualified opinion means that except for specific transactions or balances, everything is okay, an adverse opinion means that financial statements do not present fairly at all.

Another difference to note is that while a qualified opinion could be either due to the material misstatement found or material scope limitation, auditors can only express an adverse opinion when they have obtained sufficient appropriate evidence to support their opinion.

In case that auditors could not obtain sufficient appropriate evidence due to scope limitation and their effect is deemed to be both material and pervasive, auditors need to disclaimer the opinion instead.

However, there is also a similarity between qualified opinion and adverse opinion in addition to the materiality matter. The similarity, in this case, is that both qualified opinion and adverse opinion need a separate paragraph for the basis for modification opinion in the audit report which is “basis for qualified opinion” and “basis for adverse opinion” respectively.

Below table is the summary of the comparison between qualified opinion and adverse opinion:

| Qualified opinion vs adverse opinion | |

|---|---|

| Qualified opinion | Adverse opinion |

| Financial statements contain misstatement that is material but not pervasive. | Financial statements contain misstatement that is both material and pervasive. |

| Auditors may not be able to obtain evidence about certain matters resulting in the qualification of related transactions or balances (e.g. due to scope limitation). | Auditors obtained sufficient appropriate evidence to support their opinion that the financial statements do not present fairly. |

| Auditors usually state in the report as “In our opinion, except for…, the financial statements present fairly…” | Auditors usually state in the report as “In our opinion, because of…, the financial statements do not present fairly…” |

| Have a basis for qualified opinion paragraph in audit report. | Have a basis for adverse opinion paragraph in audit report. |

Reasons for qualified audit opinion

Auditors can express a qualified opinion due to any of the three reasons below:

- Material misstatement

- Scope limitation

- Inadequate disclosure

Qualified opinion due to material misstatement

Qualified opinion due to material misstatement is the case where auditors obtained sufficient appropriate audit evidence to prove that there is a material misstatement in financial statements but such misstatement is not pervasive in nature.

For example, the client’s inventories were not at the lower of cost and net realizable value, and the client’s management was not willing to write down the value of inventories to net realizable value. In this case, auditors need to qualify this matter in the audit report.

Qualified opinion due to scope limitation

Qualified opinion due to scope limitation is the case where auditors could not obtain evidence on certain transactions or balances. However, the effect of such transactions or balances is material but not pervasive.

Some examples of scope limitation include:

- loss of supporting documents

- loss of accounting records

- the client does not allow auditors to send confirmation to its customers or suppliers

- the client does not allow auditors to observe the counting of the physical inventories

- auditors are hired too late to observe the counting of the physical inventories, etc.

Qualified opinion due to inadequate disclosure

Qualified opinion due to inadequate disclosure is the case where the client has not fully disclosed certain matters, that auditors believe to be significant for users, in financial statements. Had the client fully disclosed such matters, auditors may give an unqualified opinion in the audit report instead.

The inadequate disclosure that leads to qualified opinion is usually due to the client does not include all necessary disclosures or the disclosures are not in accordance with applicable accounting standards.

Qualified opinion with going concern

Going concern is usually defined as the company’s ability to continue its operations for the foreseeable future. In general, the foreseeable future here means at least 12 months after the reporting date.

The client usually prepares the financial statements based on the going concern basis of accounting. In other words, the client prepares financial statements based on the assumption that it will continue to operate at least 12 months after reporting date.

Likewise, the client’s managements have responsibilities to assess the company’s ability to operate as going concern and make adequate disclosure in financial statements.

Hence, in an audit, auditors have responsibilities to evaluate whether the management’s use of the going concern basis of accounting is appropriate and whether there is any substantial doubt about the client’s ability to continue its operation to foreseeable future.

So, a qualified opinion with going concern here is the case where auditors express a qualified opinion due to the client’s disclosure or assessment about its going concern status.

Likewise, qualified opinion due to going concern usually happens in two circumstances:

- Inadequate disclosure: this is the case where the client’s use of going concern assumption is appropriate, but a material uncertainty exists. However, the client has not fully disclosed such uncertainty in financial statements.

- Inability to obtain sufficient appropriate evidence: This is the case where the client is unwilling to make or extend its assessment on the going concern to at least 12 months after the reporting date. Hence, auditors will not be able to evaluate management’s assessment of the company’s ability to continue as a going concern (as there is no assessment of 12 months or more to begin with).

Of course, in case that the client’s use of going concern assumption is inappropriate, auditors will have to give an adverse opinion instead if the client did not change its basis of preparation of financial statements (e.g. to liquidation or break-up basis).