Adverse Opinion

Overview

Adverse opinion is an audit opinion that independent external auditors express when there are misstatements in financial statements and such misstatements are both material and pervasive.

Adverse opinion is an audit opinion that independent external auditors express when there are misstatements in financial statements and such misstatements are both material and pervasive.

In this case, the material misstatements affect various accounts or balances of financial statements, in which they cannot be isolated; or such misstatements are so material to the point that the financial statements as a whole are misleading.

Hence, auditors usually give an adverse opinion by expressing that the financial statements do not present fairly (or do not give a true and fair view) in the audit report. In this case, auditors have obtained sufficient appropriate audit evidence to form the basis for their opinion and all substantive reasons have been disclosed in the audit report.

In case that auditors could not obtain sufficient appropriate audit evidence and its effect is both material and pervasive, they will disclaim the opinion (not giving opinion) instead.

An adverse opinion that is given by the auditors usually means that the financial statements as a whole are not reliable. Also, this type of audit opinion may indicate that the integrity of the company’s management is questionable.

As a result, the shareholders or investors should not rely on the financial information provided by the management to make any business decisions regarding the company.

Basis for Adverse Opinion

In an adverse audit report, a basis for adverse opinion paragraph must be added, as a separate paragraph, to explain the nature and circumstances that lead to auditors modifying the opinion in the audit report.

The explanation usually needs to be detailed on the following points:

- what are the misstatements

- how much effect they have on financial statements

- which standards are involved in the misstatements

- what various effects are on the amounts presented in the financial statements.

Additionally, a basis for adverse opinion paragraph describes how the balance sheet and income statement, including their individual line items, would be different if the financial statements comply with applicable accounting standards.

Adverse Opinion Example

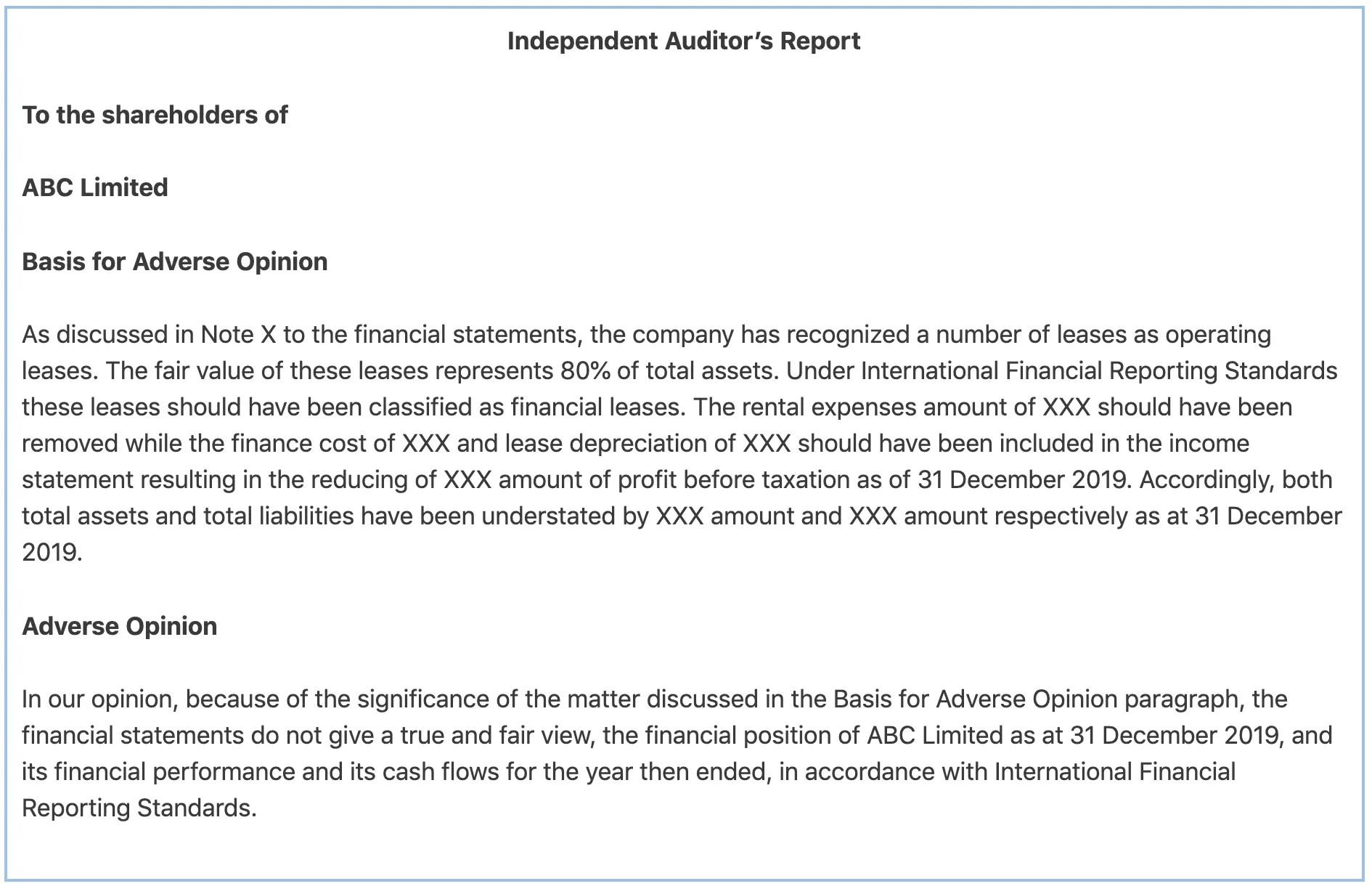

For example, an adverse opinion that auditors express on the financial statements of ABC Limited would look like below:

Adverse opinion vs disclaimer of opinion

While adverse opinion means that auditors obtained sufficient appropriate audit evidence to prove that financial statements do not present fairly, auditors usually disclaim an opinion on financial statements because of scope limitation where they simply could not obtain sufficient appropriate evidence to form a basis for opinion.

In this case, unlike adverse opinion where auditors still give an opinion, a disclaimer of opinion means that auditors do not give an opinion on financial statements at all. Likewise, we may conclude that a disclaimer of opinion is more serious as auditors actually state that they are ‘unable to form an opinion’.

However, there is also a similarity between adverse opinion and disclaimer of opinion, in which the problems that lead to auditors modifying the audit report are both material and pervasive in nature.

Another similarity is that both adverse opinion and disclaimer of opinion need a separate basis for modification paragraph in the audit report which is “basis for adverse opinion” and “basis for disclaimer of opinion” respectively.

Below is the summary of the comparison between adverse opinion and disclaimer of opinion:

| Adverse opinion vs disclaimer of opinion | |

|---|---|

| Adverse opinion | Disclaimer of opinion |

| Auditors obtained sufficient appropriate audit evidence to conclude that financial statements contain the misstatement that is both material and pervasive. | Auditors usually could not obtain sufficient appropriate audit evidence and its possible effect on financial statements is both material and pervasive. |

| Auditors still give an opinion on the financial statements. | Auditors do not give an opinion on financial statements. |

| Auditors usually state in the report as “In our opinion, because of…, the financial statements do not present fairly…” | Auditors usually state in the report as “we do not express an opinion on financial statements…” |

| Have a basis for adverse opinion paragraph in audit report. | Have a basis for disclaimer of opinion paragraph in audit report. |

Adverse opinion on going concern

The client usually prepares financial statements based on the assumption that the business will continue at least 12 months after the reporting date. In an audit, this assumption is called going concern basis of accounting.

At the same time, the client’s management have responsibilities to assess the company’s going concern status which is its ability to continue operation for at least 12 months after reporting date.

Hence, auditors need to evaluate whether the management’s assessment of the company’s going concern is appropriate and whether adequate disclosures have been made in financial statements.

Likewise, auditors usually express an adverse opinion on going concern matter in any of the two circumstances below:

- Going concern assumption is inappropriate: This is the case where auditors express an adverse opinion when they conclude that the use of going concern basis of accounting by the client is inappropriate.

- Inadequate disclosure: this is the case where the client’s use of going concern assumption is appropriate, but a material uncertainty exists. However, the client has not fully disclosed such uncertainty and auditors conclude that the effect of omission of such information is both material and pervasive (e.g. client might go bankrupt).