Net Open Position

Overview

Net open position is the measurement that is usually used in microfinance or bank to analyze the foreign exchange risk (FX risk) that the company exposes to. It is the difference between total assets and total liabilities in foreign currency.

The company always has the FX risk when it has more than one currency in operation. The bigger of foreign currency exposure, the higher risk that the company faces.

In this case, microfinance or bank (the company) usually tries to maintain the FX risk exposure by limiting the net open position to a certain percentage of the equity or net worth. Additionally, the regulator, e.g. national bank, may set its limit to a certain maximum percentage to the equity or net worth.

In the calculation of the net open position, both individual currency and aggregation of all foreign currencies should be determined. Likewise, the company exposes to FX risk both from individual FX currency as well as aggregations. This is due to the fluctuations of foreign exchange rates of those currencies are usually different from one to another.

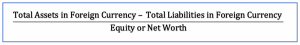

Net Open Position Formula

We can calculate net open position with the formula of using the total assets in foreign currency to minus the total liabilities in foreign currency; then divide the result with the total equity or net worth to get the percentage.

In the calculation, all assets and liabilities that are in foreign currencies need to be converted back to functional currency, usually at the spot rate or the rate of the reporting date.

Net Open Position Example

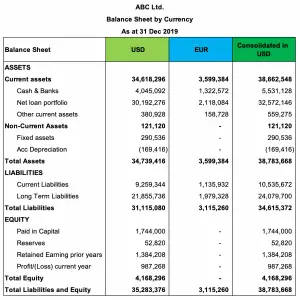

For example, ABC Ltd. which is the microfinance institution uses the USD as the functional currency. As of 31 December 2019, it has the balance sheet by currency as below.

Exchange rate as at 31 December 2019 is 1 USD = 0.89 EUR

Calculate the net open position in the percentage of equity in microfinance ABC Ltd.

Solution

With the net open position formula above, we can calculate as below:

Total assets in foreign currency = EUR 3,599,384

Then total foreign assets converted to USD = 3,599,384/0.89 = USD 4,044,252

Total liabilities in foreign currency = EUR 3,115,260

Then total foreign liabilities converted to USD = 3,115,260/0.89 = USD 3,500,292

Net open position = 4,044,252 – 3,500,292 = USD 543,960

Net open position in percentage of equity = 543,960/4,168,296 = 13.05%

The excel calculation as well as the form and data in the picture of the example above can be found in the link here: Net open position calculation excel

Net Open Position and FX Exposure

Foreign exchange exposure (FX exposure) is the risk that the company undertakes when dealing with financial transactions in foreign currency. The larger exposure of foreign currency, the bigger risk the company will face.

This is due, any fluctuation of foreign currency that the company has in place will impact on the company’s financial statements.

For example, with the calculation above, we have a net open position of USD 543,960 or 13.05% as in percentage. This means that ABC Ltd. has foreign exchange exposure of USD 534,960 or 13.05% compared to the total equity.

In this case, if the exchange rate of USD/EUR changes from 1 USD = 0.89 EUR to 1 USD = 0.92 EUR, the company will make an FX loss of USD 17,738. This can be calculated by using FX exposure of 543,960 to multiply by 0.89 and divide by 0.92 and then minus with 543,960.

(543,960*0.89/0.92 – 543,960 = -17,738)

Hence, there tends to be a limit of the net open position in the company in order to minimize the FX risk. Likewise, this limit is usually set in percentage to equity or net worth, e.g. 20% of net worth. Additionally, this may be done by the company internally, e.g. the risk department, or by the regulator, e.g. the national bank.