Remittance Advice

Remittance Advice is the official document that customer sends to suppliers after making the payment. The customers want to ensure that the seller has acknowledged and received the payment.

The customer may have many oustanding invoices with the seller, so the remittance advice tells the exact invoice number that customer wishes to pay for. The customers are highly likely to pay for the late invoice and extend the new invoice outstanding. It will keep them on good credit and prevent any penalty of late payment. However, the customer may wish to pay for the last invoice in order to enjoy the cash discount. So the best solution is to send the remittance advice to clarify the matching between invoice and payment.

However, sending the remittance advice to the supplier after making payment is not a mandatory process. The company just makes payment and never send anything to the supplier. They may send the proof of payment only when the supplier request, but it just the supporting document which is not the official remittance advice.

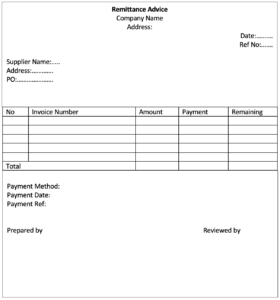

Remittance Advice Elements

- Company Name

- Address

- Contact information

- Reference number

- To Supplier Name

- Address

- Contact Information

- Payment Date

- Send Date

- Invoice date

- Invoice Amount

- Payment Amount

- Remaining amount

- Method of payment:

Remittance Advice Format

Advantage of Remittance Advice

| Advantage | |

|---|---|

| Help supplier to reconcile Accounts receivable | When customer sends the remittance advice, it helps the supplier to match between outstanding invoice and payment received. Some company has many outstanding invoices with a similar amount, so it would save time if the customer can send remittance advice after payment. |

| Help customers to reconcile accounts payables | A copy of remittance advice can be used internally as a supporting document to remove outstanding invoices from the accounts payable listing. It helps the accountant to reconcile the balance and prevent double payment. |

| To clarify the invoice paid | When a customer has many outstanding invoices with the same supplier, they may wish to settle a specific invoice due to some reasons. They may want to pay the oldest invoices to prevent penalties and keep a good rating. Or they may wish to settle the latest invoice to claim a cash discount. |

| Proof of payment | Customers use remittance advice as proof of payment to prevent double payment. |

Disadvantage of Remittance Advice

| Disadvantage | |

|---|---|

| Time-consuming | It is very time-consuming to prepare the official remittance advice after making payment. Accountants simply send the unofficial email or message to the supplier to confirm the payment if they wish. Suppliers’ accountant usually has closed relationship with the customer’s accountant as they are chasing for the cash collection. |

| Not Necessary | It is not necessary to prepare such a document after the payment. The supplier’s accountant will contact us back if they cannot figure out the payment which is a very rare case. |

| Use Online Payment | Online payment such as bank transfer allows us to put the note/remark. So we can mention the invoice number that we want to settle. |